Profile

I am thirty four years old and I am pretty much unemployed. Or I’m freelancing – that sounds much better. I’ve been a freelance stage manager and blogger this month. I mean, I am freelancing, it was just a purposely slow month. I’m calling it my hunker-down-under-the-trauma-of-my-mom’s-death-and-general-burnout-regarding-my-career month.

Saving & Spending

I may have slightly over-YOLOed. Is that a thing? How long can I blame grief?

I do think one month of erratic spending in the wake of death is actually probably pretty ok.

Some financially questionable choices I made (though some make me mostly happy anyway):

- I decided to go on a spontaneous trip to Prague, Vienna and Budapest with my cousin Sam in March.

- I signed up for Ipsy for a year. The ads finally won. To be honest… I’ve been tempted for ages. But, this is really amazing because I barely wear any makeup.

- I went into the city way more than normal just to meet up with friends. I took an Uber twice in one night to get to a friend’s birthday party in Queens.

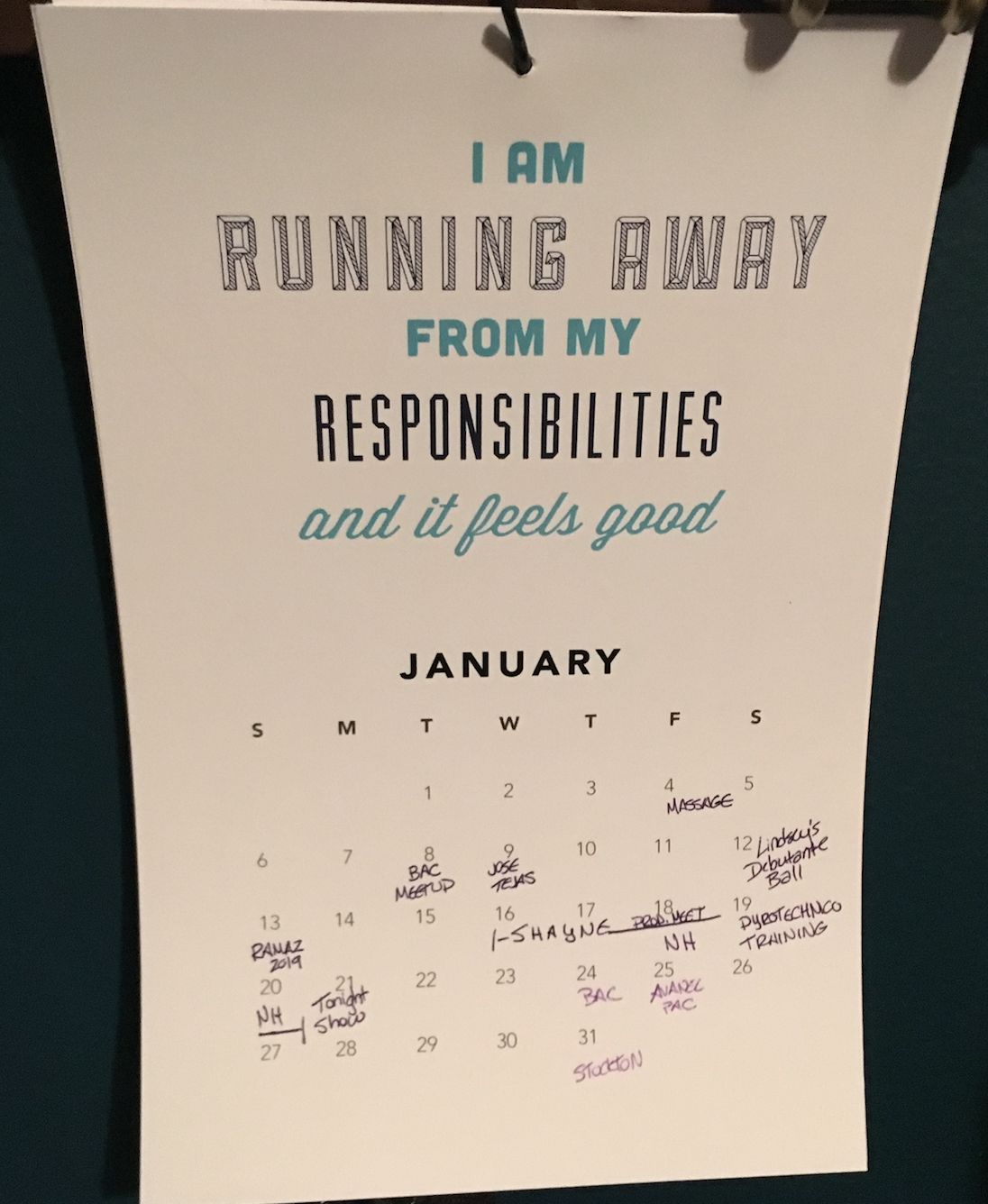

- I spent the weekend in New Hampshire attending a questionable pyrotechnics training that turned out to be pretty cool.

- I bought a bunch of books (but I also returned several, so it was a wash – Elevation, Grit, Lean In, and Nice Girls Don’t Get the Corner Office, in case you were wondering).

- I impulse bought a game because I liked the sequins on the cover of the box.

- I totally forgot Dropbox was gonna renew this month. Good-bye, $100.

- I got angry at how slow my computer was running one night and shelled out the money for the software to clean it in a fit on impulsive rage.

- I also managed to spend $85 on I don’t even know what through several trips to CVS this month.

Here are a few things I did right this month:

- Even though I was freaked out about my checking account balance, I still forced myself to transfer over 1/12 of the amount to max out my Roth IRA and my HSA this month.

- I made sure my new health insurance was setup properly and functional.

- I bought an AirBnB gift card off Raise before booking one of our places in Europe and started out $20 ahead.

- I did something productive every day except for two when I just cuddled with the dog and stared at the TV. And most days I did more than the bare minimum of productivity. I know that doesn’t sound like much, but apparently I grieve by being distracted and tired. I could sleep like all the time and that would be ok – except in the middle of the night, apparently sleeping at night is out these days.

- I hung out with friends pretty often, which was a 2019 goal, and, honestly, probably a big part of staying sane this month. Even if friendship does seem to cost money most of the time.

Also, I did not buy any candles.

And the best thing I did was spend a little money supporting That Frugal Pharmacist. She writes a great personal finance blog, but that aside, life recently kicked her family in the teeth and her adorable, small child has cancer that came out of nowhere and to get the kid decent treatment, they have to commute pretty far from home and everything seems wildly miserable for them right now. I also felt pretty strongly my mom would be all about helping this kid – so it made donating some cash to them an easy choice. If you have a few free dollars, you can send it their way via this site.

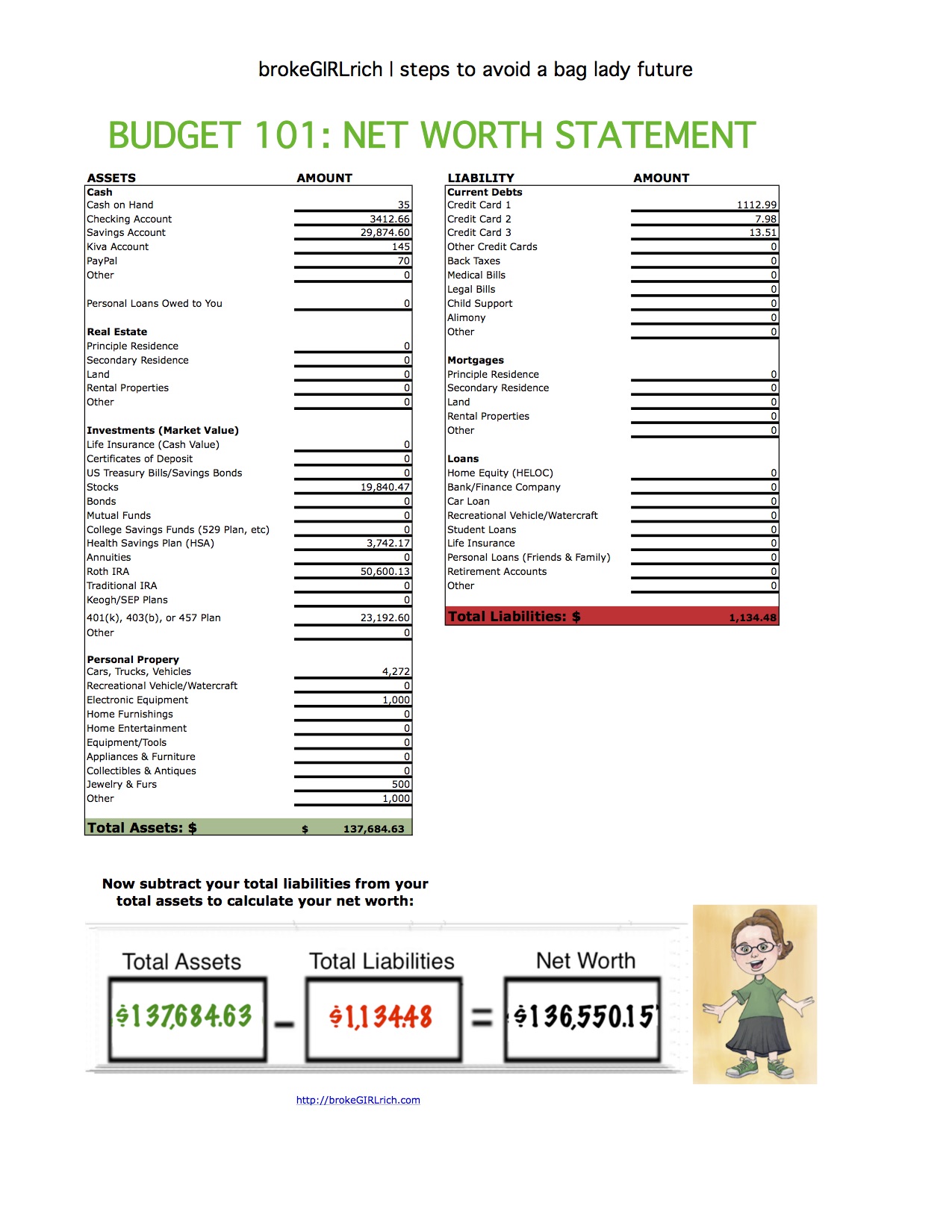

Now – back to our regularly scheduled programming. I was totally expecting to see a pretty big drop in my net worth and I was mostly ok with it, but you know what’s exciting about having most of your money in investments? As it so happens, the market was waydown last month when I did my net worth, so despite my ridiculous spending this month, I am actually up $6K. WTF. I thought I calculated it wrong.

Invest, people. For real.

My expenses this month:

- Food – $537.97

- Travel (Gas, NJ Transit, MTA) – $212.92

- Health Insurance– $140.63

- brokeGIRLrich – $2.99

- Mom Stuff – $16.63

- Books – -$9.17

- Games – $21.31

- Fun – $130.43

- Gifts – $30.20

- School – $95.96

- Makeup – $137.99

- Clothes – $32.07

- Software – $39.95

- Car – $110.30

- Stage Management – $306.27

- Postage – $11.88

- Charity – $120.00

- Union Dues – $32.39

- Prague, Vienna & Budapest Trip – $1393.37

- Miscellaneous – $84.59

Total Spending in January: $3,448.68

Hustling

This has been a fairly weird money month. I ASMed an event with a friend of mine.

The vast majority was outstanding things that turned up. It includes a return of my RV deposit from Big Apple, payment from The Tonight Show filming where I was paid an extra fee (which is also why there’s a Union Dues line on my expenses this month), an insurance claim for my mom’s The Lion King ticket, my dad paid me back for his part of the tickets, car insurance dividend check and, of course, brokeGIRLrich.

- Stage Managing – $150.00

- brokeGIRLrich – $762.04

- Big Apple RV Deposit – $500.00

- The Tonight Show Filming – $569.22

- Dividends – $28.80

- Dad Ticket Reimbursement – $250.00

- Insurance Claim – $171.80

Income This Month: $2,431.86

Most Popular Post of the Month: Doin’It By the Decade: The Wealthy Barber Review

My Favorite Post to Write This Month: Useful Things to Do During Your Downtime as a Stage Manager

Goals

- Start eating better. Is this quantitative? How do I measure this? Doesn’t matter this month. I failed anyway.

- Work out more. See above.

- Better stress management. I did go get a massage, so, yes? January win? I kind of hated it though.

- Keep taking accounting classes. Nailing it.

- Do two things to build up my stage management skills. I went to an APA sponsored pyrotechnics course, so one skill project done.

- Take music lessons while I’m home for a few months. Month one of being home, fail.

- Spend more time with family and friends. I’m going to call this month a success on that front.

- Be more supportive of family and friends when I can’t be there in person. Still trying.

- Go out on a date. Fail.

- Make an effort to not withhold kind words and encouragement. I actually think I did ok with this.

- Max out my Roth IRA. On track.

- Max out my HSA. On track.

- Set aside $5,000 for my house downpayment account. No progress here.

- Set aside $2,000 for my new car account. No progress here.

- Invest $2,000. No progress here.

- Read more. I did read a book this month! Andrew Jackson and the Battle of New Orleans. I’m currently working on To Capture What We Cannot Keep.

- Learn to make macaroons. Guys, this has been on the list for years. I did attempt it once this month though – there’s still a lot of work to go.

- Visit two roadside attractions. One down – Wild Bill’s Prop Shop in Connecticut. I also went to The Cushing Center which probably doesn’t quite count, but it’s the museum at Yale full of brains.

Aww, you sound really beat down. You’re allowed to just be, you know. You don’t have to be achieving all the time. Give yourself a break and just be for a bit. This to shall pass. It always does.

I lost my mother in June and I had been her caretaker for 3 years. IT was hard, although it was a blessing. I too went on a spending spree. But I am resolving now. Give yourself time. You get to grieve and you need to grieve. I am so sorry for your loss.

Thanks, Kim. I’m so sorry for your loss too.

Losing your mom is hard. I lost my mom a few years ago and tried to bury myself in work, but that was probably made things worse in the long run. Take the time you need to mourn and care for yourself.