Profile

I am thirty-nine years old, a digital event producer and occasional freelance stage manager. I make $55/hour at the digital production company I work with, though work has been very slow this year. I work a variety of small side hustles and am a full-time student working on a PhD in Drama.

Spending & Saving

February has been a month.

So during the course of my PhD, there are two big assessments – a transfer exam midway where you write a 5,000ish word document to submit that is a report on your progress in your research and then an oral examination of that document and your work and then a final viva at the end to defend your dissertation (or thesis in the UK, I don’t know why the Masters and PhD document terminology is flip flopped here).

So my transfer exam was on February 15th and the first half of the month was a blur of panicky revision and the highest stress academic situation I’ve prepared for yet.

It was highly illuminating regarding how I will probably react to my final viva – which was incredible calm until the date of the exam was set, then I spent the first week after the date was set in a perpetual state of panic (it was almost funny how bad it was) and then that ebbed a bit and I could function better again, but overall it was a stressful month.

I passed the test. It was actually sort of… enjoyable? Once it was underway. Like, enjoyable isn’t completely correct but it was really interesting to actually discuss my research in such depth and to be just fully focused on it with my two examiners. That hasn’t happened in a long time.

But I was fairly hunkered down the first part of the month.

During this time, I also received some notice from my landlord about a not-insignificant (though not quite as bad as I was bracing myself for) rent hike in May. Technically, I could probably still get through my doctorate paying this price plus the 3% more the final year. My location is very convenient. My apartment isn’t great – the utilities are very high and it’s always freezing. So… I may move. This notice came at like the height of panic over my transfer exam so I handled it very gracefully by telling my partner I was moving back to America and screw this country. But after calming down, I did some research on potential commuter towns to London since I don’t have to be here every day of the week and there are months at a time where I maybe need to only come into town once or twice a month.

So my partner and I went out to Peterborough for a weekend at the end of the month to check it out. And I kind of love it. Most of the criticisms about it are that there’s not much to do and it’s kind of boring but… I don’t care. We made a list of the things we actually do in London and it’s pretty much eat Nando’s and Taco Bell, go to the board game café and the movies once in a while, play the pub quiz, and play Gloomhaven with some of our friends. Other than having to come into London on the weekends to play Gloomhaven, everything else is available in Peterborough. So… I’m really thinking of doing it.

Fancy afternoon tea – my favorite part of having visitors.

I need to reach out to some landlords in March and see how my international student status without a full time job may effect my ability to rent there, which may force my hand in staying in London. But I really prefer the pace of the suburbs.

Then the most expensive part of the month – my sister-in-law and cousin came to visit for the last week. I figured it would come in somewhere around $1,000. I think it will be just slightly over when the math is done next month to include the two days they were here in March, but currently my expenses, minus what they have repaid me, which is under income, come out to about $700.

But it was really nice. I don’t think I’ve ever spent that much time with my sister-in-law and my cousin is going to have her third kid in a few months, so she will be in hibernation for about a year. We ate so much food (which I blame on pregnant cousin, but I probably could’ve shown more self-control) and drank so many bougie drinks. But it was really so nice.

It did also do a number of my food bill because I had like ‘be a good host’ panic and realized that like my cupboards and fridge are often very bare, so I stocked them with pregnant lady and vegetarian friendly foods and surprisingly, satisfyingly, most of it got eaten over the week too, so worth it.

I also started doing some training for an adjunct job and will hopefully be assigned a class to teach soon, so I used that to finish off my 2023 IRA contributions and put a tiny dent in my HSA contributions for 2024. Hopefully I will get a tax refund once I do my taxes in March and I can set some aside towards some of the goals below.

I think between the thoughts of moving to a cheaper area, knowing the worst of my tuition payments are over, a tax refund on the horizon, and an actual ok month of income have calmed me a bit on the money anxiety front. It’s still not all how I’d like it to be, but at the moment, it is ok.

Here is the expense breakdown for the month:

- Family Vacation – $1443.52

- Rent – $1297.15

- Food – $621.27

- Utilities – $278.52

- Peterborough Trip – $197.95

- Entertainment – $109.42

- Transportation – $104.26

- Blog – $68.59

- Charity – $40.50

- Apartment – $38.87

- School – $35.62

- Gifts – $34.72

Total Spending in February: $4270.39

Hustling

This month’s income:

- Teaching Assistant – $1547.55

- Digital Producing – $1402.50

- Family Vacation Repayment – $745.75

- Adjuncting – $677.50

- brokeGIRLrich – $480.90

- BF Peterborough Repayment – $30.74

- Pub Quiz – $15.82

Income This Month: $4,900.76

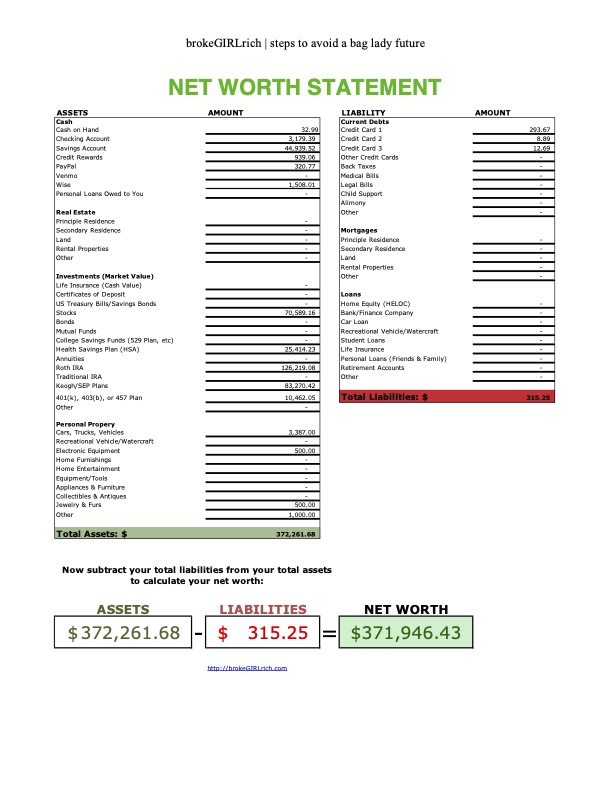

Net Worth: February 2024

Goals

- Save up $5,000 for school – via saving or scholarships.

- Max out 2023 Roth IRA.

- Max out 2024 Roth IRA ($7000).

- Max out HSA ($4150). $100 contributed, $4050 to go.

- Stage manage a show.Starting strong! I’d like to hopefully stage manage another before the end of 2024.