Profile

I am thirty eight years old and I’m a digital event producer and very occasional freelance stage manager. I make $55/hour at the digital production company I work with. I work a variety of small side hustles and am a full time student working on a PhD in Drama.

Spending & Saving

Guys. I feel wildly successful that my income was higher than my expenses this month because ugh. What a lousy month.

And next month is not looking any better. Ugh. Ugh. Ugh.

The last two months have genuinely felt like I’m between some sort of contracts and am living like I expect to go back to work like usual and that’s not really what’s going on, is it? Sigh.

The digital producing work, which has been the backbone of the whole go back to school plan, has been a hot mess. I’m not sure if my ratings have dropped or what, although I did ask. My boss mentioned that bookings were down 50% from this time last year but I’ve personally looking at like a 75% drop in scheduled work for some reason. I do kind of suspect my stupid school obligations are part of the reason I’m getting less bookings because when we were flush with work, they just worked around them and now I suspect work is going to people providing the most availability.

So I’ve been reconsidering my options a bit. I applied for another freelance digital producing job and heard back from that company that they had just hired a set of producers but would be in touch in April, so hopefully that will pan out. I’ve been prowling LinkedIn a little more looking for additional freelance work in this realm, though the odds that it will pay as well is probably slim.

And of course, like it has been for the last nearly 10 years, when my regular income drops, somehow the internet gods know and brokeGIRLrich income drops too.

I’m currently grateful that my rent is paid until mid-May so I feel like I have some wiggle room to get back on my feet regarding income without that large monthly expense. I do also technically have enough saved to pay rent for another year and my next tuition payment but I will be in a little bit of a panic about tuition for the final year and also I will finish up this ridiculous school excursion with like no money saved for a house down payment anymore.

Also my tax refund, which I will hopefully have by next month, was significantly higher than I expected mostly because despite spending four years getting an accounting degree, I still barely understand what I’m doing – thank heavens for tax bracket calculators and other free online tools – and often over save for my quarterly tax payments.and often over save for my quarterly tax payments.

That money will go into some kind of split between savings account for tuition and my Roth IRA goals. Hopefully work will pick up a little more next month too and I will be less stressed about all that.

Now that I’ve complained about all the money I’m not making these days… let’s look at my expenses this month. I had a friend visit for two days down from Scotland (and if you like travel and cruise ship blogs, check out hers – Life of Iris). She is generally a cheap date, our only real splurge was a cheese and champagne place in Greenwich, which was certainly bougie but only like $35.00.

You can see from the breakdown that my largest expense was a visit from my cousin, which was a lot of fun but we very much live in two different income brackets these days and I spent four days pretending I was still a gainfully employed human and not a grad student. She is very into fancy food and we went to an immersive show and the opera and also to a spa one evening so… a very expensive four days. Some of these things I paid for last month. And she repaid me for several things too, which is accounted for in income.

It was really nice. It did nothing for my feelings of “omg, why am I doing this stupid degree and losing so much money to do it” that I have been marinating in lately.

And then, because I was panicking a little about making no money and spending so much money – I bought a last minute ticket to see Kurios because apparently I just gave up on the idea of spending less money.

I bought my bridesmaid’s dress for my brother’s wedding. The last two expenses related to that trip are plane tickets and a tour of the Mexican ruins one day with my boyfriend. I plan to use my rewards points on my credit card for the plane ticket and we’ll probably get those next month.

Here is the expense breakdown for the month:

- Food – $584.29

- Cousin Visit – $566.48

- Utilities – $295.17

- Entertainment – $161.79

- Transit – $152.07

- Taxes – $122.00

- Bridesmaid Costs – $118.61

- Flat – $55.51

- Gym – $45.98

- Blog – $44.76

- Charity – $33.88

- Health – $22.58

- Work – $19.65

- Gifts – $16.12

Total Spending in February: $2,238.82

Hustling

This month’s income was largely depressing. But here we are.

- Digital Event Producing – $1237.50

- Repayment from Cousin – $397.05

- Ushering – $375.62

- brokeGIRLrich – $317.42

- Pub Quiz – $12.10

Income This Month: $2,339.69

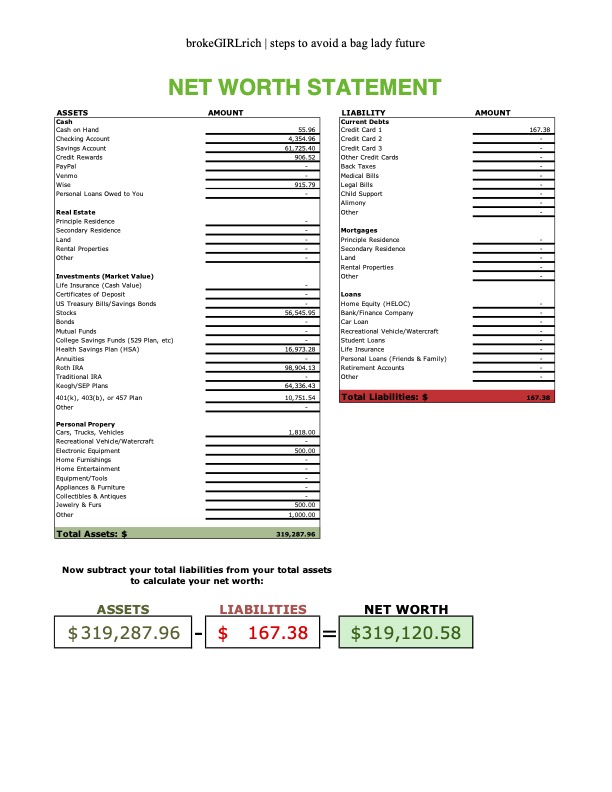

Net Worth: February 2023

Goals

I’m bracing for a significantly smaller income year. I think I’d rather be pleasantly surprised and trust myself to make some good choices for my future if I find myself in a position to do so rather than feel like a total failure who can’t meet her goals. So here are the new ones for 2023.

- Save up $10,000 for school.

- Save up £5100 for school. Down a little to £1297.

- Max out Roth IRA ($6500).$1000 contributed so far.

- Max out HAS ($3850).

- Buy the pretty lamp.

- Save $2000 for vacation with BFF over the summer.

- Stage manage a show.

I think you are doing very well to have kept your spending less than income, when your income has dropped. Even with a splurge ticket.

My income is mostly steady, but I see significant variability over the year with my spending (insurance, vacation, taxes). To be honest, some months I spend more than my paycheck–that’s why I save in the good months.

I suspect you will do fine, but wish you a speedy increase in well-paying work.

IM-PCP recently posted…Lessons From My Dad’s Life