Profile

I am thirty seven years old and I’m a freelance stage manager and digital event producer. I make $55/hour at the digital production company I work with. I also work a variety of small side hustles. I am still at my dad’s house living the very grateful financially but endlessly mentally draining no rent life. Will I ever leave? Who knows? Tune in next month. Sigh.

Spending & Saving

So I’m still in America.

But I am also an active postgraduate student at the University of Greenwich.

It’s been an exciting month. With a lot of painfully early morning online classes and workshops in GMT time. Ugh.

My tuition is paid through August. My dad, who had been a champion on my education from the get-go, despite our otherwise many differences, is amazing and has offered to contribute $5,000 a year towards my tuition, so you’ll see that noted under my income to offset the school amounts under expenses.

I’ve also always thought it’s pretty important to be upfront about any financial help I’ve gotten over the years from my parents because I’m aware it totally changes the balance of the scales. I know I sometimes read blogs and am frustrated about how they are managing things whenever I feel like I’m struggling only to later find out they had access to resources I just don’t – which is understandably how life is sometimes, but I just think it’s handy to know when you’re looking for tips and trying to compare one situation to another to see if any of the advice or tips shared can actually be beneficial.

It’s also why I always try to note when I’m living at home somewhere on my updates too because that is another pretty massive financial advantage, though living at home with your dad in your late 30s is… really something on all other fronts than the financial one.

Anyway, that disclaimer aside, tuition was clearly my biggest expense, even with the help factored in. To apply for my visa, I also had to pay four years of the health surcharge for non-UK residents, which is essentially like paying for 4 years of health insurance at once.

Amazingly though, anything can happen to me once I’m there and I’ll be covered. I cannot tell you how this warps my American mind. I could have a literal heart attack and they will just fix me and I won’t wind up wondering about random massive bills that might show up despite having health insurance. I have actually experienced the wonders of the British healthcare system last time I lived there and it still just feels like a dream. They legit do not understand how good they’ve got it.

Besides those massive expenses, it’s actually been a fairly low expense month. I stage managed a show for about 10 days this month, while going to school, and working at my digital producing job. On the other weekends, I worked as a stage hand. There really just wasn’t much time to spend money anyway.

My stage management expenses are a little high because of train tickets back and forth from NYC for some rehearsals and I bought a ticket to the Event Safety Access Summit because a lot of the workshops seemed useful in general and also a few are specifically applicable to my doctoral research.

I had sort of thought I’d lost my mind when taking the stage management gig because this was clearly a busy month trying to figure out how school is really going to work. While it was a bit chaotic, it was actually an enjoyable little gig in the end. I also really enjoyed calling the show, which I’ve felt like that skill was super rusty. Funnily enough, Hit Me With Your Best Shot was in this show and years ago it was in another show I did and I swear there was something about hearing it that flipped a switch in my head and was like “you do know how to call shows” and the way I had been struggling anticipating cues just stopped and it was a truly glorious moment in my career at this silly little drag show when my brain finally remembered how music works.

Shows are also pretty high because since I’m a bit stuck in America, I decided to try to see as many immersive/participatory things as I can during March, and I also bought a ticket to The Great Gatsby in London for the end of April since I keep seeing it mentioned in so many of the articles I’ve been reading.

Hopefully I don’t wind up regretting not buying it for later in the summer.

I also got a ticket for May to a show I’ve been dying to see in Brooklyn, since I had planned to come home for Memorial Day weekend. Now I just need to find out if I’m allowed, but I’m banking on it being easy to resell if I’m not allowed to come home, since the stupid show has sold out every time they’ve released tickets within hours.

General entertainment-wise it was a very low-key month. I went to a small Super Bowl party that felt a bit surreal as it was one of the last things I did before the pandemic began in 2020 and it was with a lot of the same people. Also pandemic related, a bunch of my cousins and I got together to celebrate Christmas the last weekend in February because it was the first time that everyone was Covid-free since the end of December.

I did my taxes but both my federal and state needed a random form that kept me from being able to e-File. Printing and mailing it all out was easy enough but who knows when my refunds will actually turn up.

I’m hopeful that my refund will be able to be a large chunk of my intended tuition savings for the year to pay my 2022-23 tuition bill in August/September, so whenever it does turn up, it will go into that savings account.

I was able to max out my IRA this month and contribute a little towards my HSA. I’m not fully convinced it was the smartest decision to do, but I guess I am living that pay yourself first life, so I’ll just have to figure out how to make it all work.

And, since I was a bit stressed trying to figure out how balance school, work and life all month, I bought some candles.

Now for your voyeuristic pleasure, my expenses this month:

- School – $12,171.21

- Healthcare – $3001.80

- Food – $499.39

- Stage Management Expenses – $230.43

- Shows – $266.51

- Taxes – $133.90

- Toiletries – $100.17

- Entertainment – $90.67

- Gas – $65.31

- Dog – $57.50

- Gym – $43.78

- Miscellaneous – $41.55

- brokeGIRLrich – $37.00

- Candles – $34.80

- Gifts – $29.25

Total Spending in February: $16,803.27 (or $1,657.26 without school related expenses, which largely came out of my savings)

Hustling

This month’s income comes from digital producing, stage managing and brokeGIRLrich. My dad also offered to contribute $5,000 a year towards my tuition, so that is accounted for here too.

- Dad – $5,000.00

- Digital Event Producing – $2585.00

- brokeGIRLrich – $1,403.59

- Stage Managing – $1,248.49

- Rakuten Cashback – $129.01

Income This Month: $10,366.09

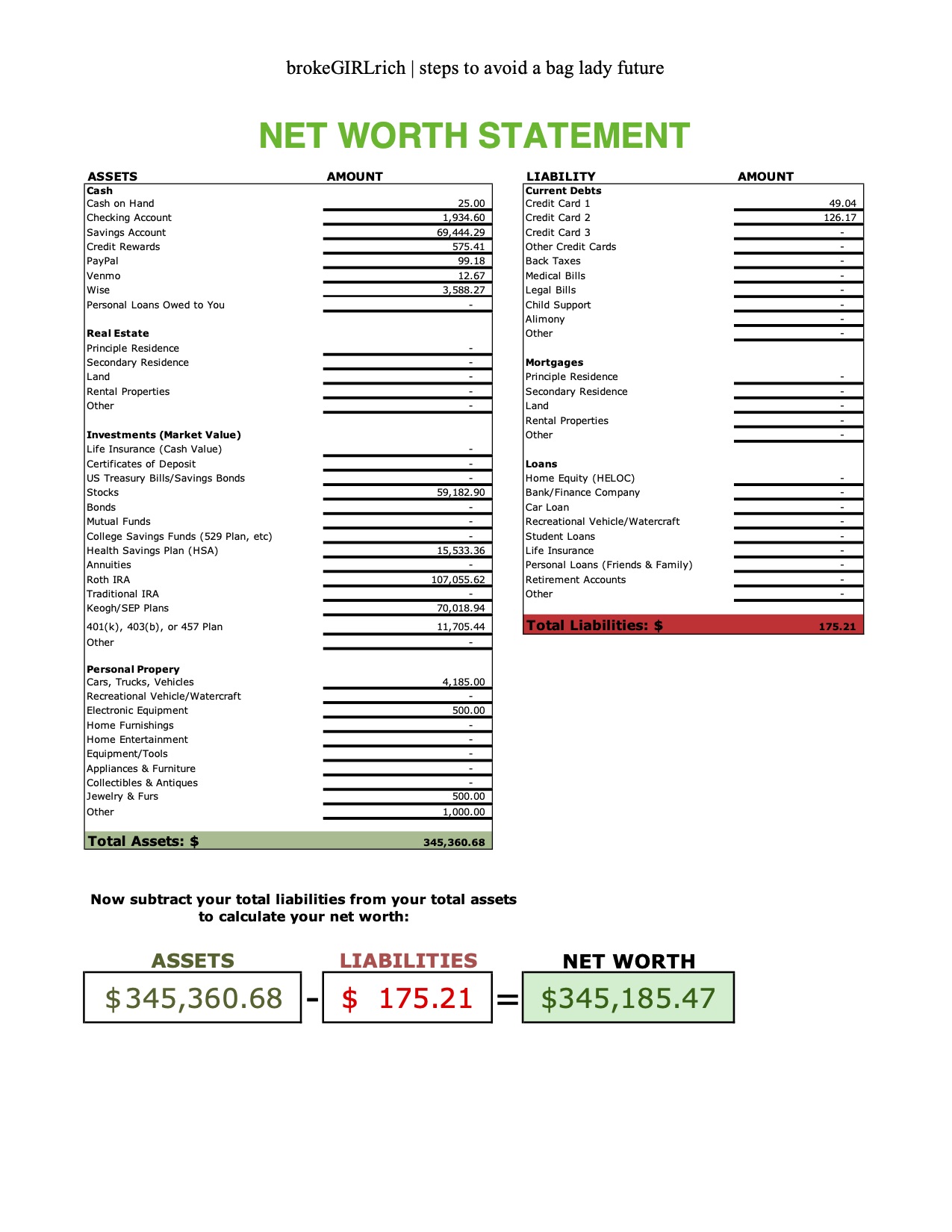

Net Worth: February 2022 | brokeGIRLrich

A tiny nice thing, I suppose, is that even after paying my taxes and now making all the tuition and visa payments and the market being on the struggle bus (for very understandable reasons), I think I can safely say I really did manage to break that $325k in 2021 goal that I set.

Goals

I may need to revisit or add some goals to this because I think this just might be more achievable than I initially though, especially with the additional three months of not paying rent in 2022.

- Max out my Roth IRA.

- Max out my HSA. $1,000 contributed.

- Save up $15,000 to pay my tuition for 2022-23 in August without dipping into the school savings account ($9,000 if I manage the scholarship goal).

- Obtain £5,000 in funding scholarships.

- Save up $2,000 for traveling.

- Balance work and school without losing my mind.