Profile

I am thirty six years old and I’m a freelance digital event producer. I make $50/hour and generally work about 16-20 hours a week. I also work part time for a theatre company doing a digital murder mystery/escape room for £15 a show a few evenings a week.

Spending & Saving

I’m starting to feel a little frustrated that I make the same in a month that I used to make in a week or two, but I am still trying to be grateful that I’m working at all.

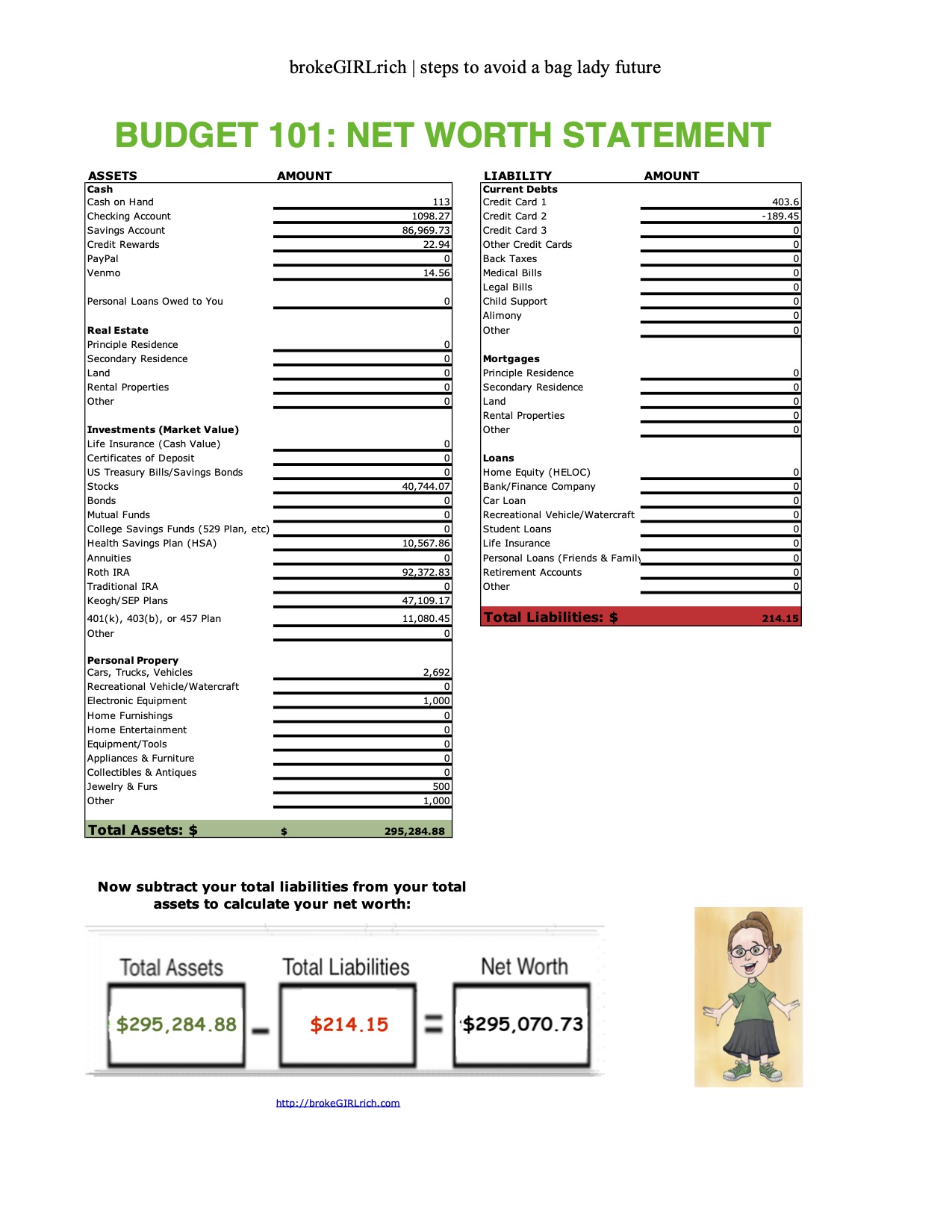

The thing that is just insane to me is how much the stock market and compounding interest can affect my net worth. It’s been just ridiculous to watch all year as I feel broke but realize I have definitely slid much further towards the rich part of brokeGIRLrich in the last few years. Not so much in like “buy a yacht” way, but in “the world is on fire but I am totally financially stable.” It is a crazy jump from my first net worth update when 1/3 of my net worth was the Blue Book value on my car.

It has even occurred to me in the last few months that my panic response to move in with my dad was unnecessary, but how could I know that at the time?

And also moves like that are how I got here in the first place and not paying rent a lot of the time has been the #1 reason I’m where I am financially – which is clearly not an option for most people. Further proof that an awful lot of financial success is luck – lucky investments, lucky place of birth, lucky first job, etc.

I also wouldn’t be able to reach my saving and investing goals for this year if I were trying to pay rent too at my current income level. So my knee-jerk panic move has been helpful.

I did have a pretty low cost month. I had one big splurge in that I paid a professional editor to look at my book. My goal is to start querying agents by the end of the month. Spend money to make money? I hope?

Who wouldn’t miss this goober?

I’ve been hiding out in the Outerbanks all month. They are kind of bleak in February. I was hopeful that I could come up with some kind of plan for the future, but so far that hasn’t really panned out. It has been nice to have my own space again.

It has also made me appreciate having my own space but still being near enough to family and friends to see them sometimes. I’m looking forward to seeing my dad in a few more weeks and I miss the dog.

Even though my income was low, my expenses were pretty low too and I was able to put $1000 into my IRA instead of just $500.

I have spent a lot of this week very seriously considering going back to school for an MFA or a doctorate. I would prefer the latter, but I have applied in the past and not gotten in, so I don’t see why the odds of success on that front would have changed much. This is so I can teach again in the future and not be trapped in a horrible pay bracket for those without terminal degrees.

I also took another COVID compliance class because a small part of me is hopeful about summer/fall jobs and I want to be as qualified as possible. I don’t think the SM should have to be the person in charge on the COVID front but I also am aware that as non-equity that are all sorts of things I don’t think I should have to do that I wind up doing as trade-off for not being in the union (for me, worth it).

Overall it has been a very low key month of a lot of Netflix and reading in between so many hours of staring at Zoom for work. So. Much. Zoom. Ugh.

My expenses this month:

- Food – $474.43

- Book Editor – $420.00

- Beach – $274.50

- Entertainment – $159.59

- Health Insurance – $150.66

- Gas – $99.18

- Clothes – $93.78

- Gifts – $51.05

- Stage Management – $50.00

- Toiletries – $19.48

- Fees – $2.30

Total Spending in February: $1794.97

Hustling

My income was mostly from digital workshop producing. I submitted my first murder mystery invoice at the end of the month too but haven’t been paid yet (I only submit once a month to minimize all the lovely wire transfer/currency conversion fees). I also made a little bit from a few days as a stagehand, UserTesting, this blog, and Rakuten’s cashback app.

- Digital Event Producing – $2290.00

- Stagehand Work – $180.51

- UserTesting – $120.00

- brokeGIRLrich – $114.42

- Rakuten – $29.07

Income This Month: $2734.00

Net Worth: February 2021

Most Popular Post of the Month: Doin’It By the Decade: The Wealthy Barber Review

My Favorite Post to Write This Month: How Much Do Delivery Apps Add? (because I had no idea)

Goals

- Max out my Roth IRA. $2,372 down, $3,628 to go.

- Max out my HSA. This is on track. I’ve learned to just go a month at a time here, since sometimes my insurance changes over the course of the year due to different jobs.

- Invest $2,000. Halfway there.

- Save up $3,000 for post-pandemic traveling.

- Add $1,000 to the emergency savings account.

- Add $2,000 to the new car savings account.

- Break $300,000 net worth.

- Do two things to build up my stage management skills. One down – COVID compliance officer certificate.