Profile

I am thirty five years old and I am a Visiting Instructor of Theatre Arts/Production Management at a state university, where I make $26,418.51 for the semester.

Tech at the first production with the school.

Saving & Spending

Things seem a little less like a runaway train here, but my spending is still far from on point.

I’m feeling a little less hard on myself though because to go from total tour life to total home life probably takes some period of adjustment anyway. And just when I get it together, who knows what the next thing in life will be?

But anyway.

I’m currently in meltdown mode over my taxes. I have that old rage that fired me up to study accounting in the first place but stupidly you have to take every other kind of accounting class before getting to taxes, so I still haven’t taken a class that will help me at all.

When I put things into TurboTax this year, it had a meltdown, and then I had a meltdown, and now here we are. I’m looking for an actual accountant to fix some of the messes I dug myself into during my first year of trying to pay quarterly taxes and sort my own retirement savings.

I have two friends who owe me a decent chunk of money, which is not a big deal and will likely be largely sorted by the end of March.

And then of course, the stock market is pulling the b.s. it’s pulling, so that tanked my net worth nicely.

C’est la vie.

Zoey Desha-who?!?

In far more important matters, I’ve been thinking about getting bangs, so $8 was just spent on a fake pair that I’m currently wearing while I type this article. The color is totally wrong, but they’re growing on me.

I’m also drinking some wine while I type this post, so we will reevaluate the bangs a little more soberly before actually hitting the hairdresser.

As far as spending, I’m going to visit my work BFF in Brazil next month, so that flight was a large expense.

I saw a really interesting immersive show in NYC with my future sister-in-law as her Christmas gift called Unmaking Toulouse-Lautrec and I got tickets to go see Harry Potter and the Cursed Child with one of the high school BFFs in May.

So I may have actually mastered the YOLOing during the Great Grief Tour last year… I guess it’ll take a little while to get better at cutting back on it now.

I find it hard to regret the YOLO events with friends though. Or even things that build skills. I bought a keyboard. I’ve spent the last month trying to teach myself how to play A Groovy Kind of Love (the sheet music was free). I can almost sing along while I play.

It’s more like when I sort through my expenses and see how expensive Chinese delivery was or the Pizza Hut pizza that I am in denial makes me sick these days were – those are the spending regrets.

On the plus side, all savings goals were hit for the month, so we’re doing ok over here.

My expenses this month:

- Food – $578.80

- Travel (Gas) – $109.46

- Uber/NJ Transit/MTA – $81.24

- Health (including optometrist) – $44.46

- Fun – $565.10

- Brazil Trip – $878.85

- Teaching Supplies – $55.77

- Gifts – $256.36

- Rent – $1265

- Utilites – $106.41

- Wire Transfer Fees – $15.00

- Gym – $10.66

- Quickbooks – $25

- Apartment – $80.24

- Postage– $44.80

- Tuition – $-916.00

- Dog – $44.78

- Toiletries – $38.71

- Clothes – $117.28

- Checks – $24.42

- Loans – $1502.35

Total Spending in February: $4,928.69

Hustling

My income this month was an unexpected overtime check from the circus, brokeGIRLrich, some eBay sales, and teaching.

- Stage Managing – $1321.32

- brokeGIRLrich – $309.72

- eBay – $28.36

- Teaching – $2239.98

Income This Month: $3,899.38

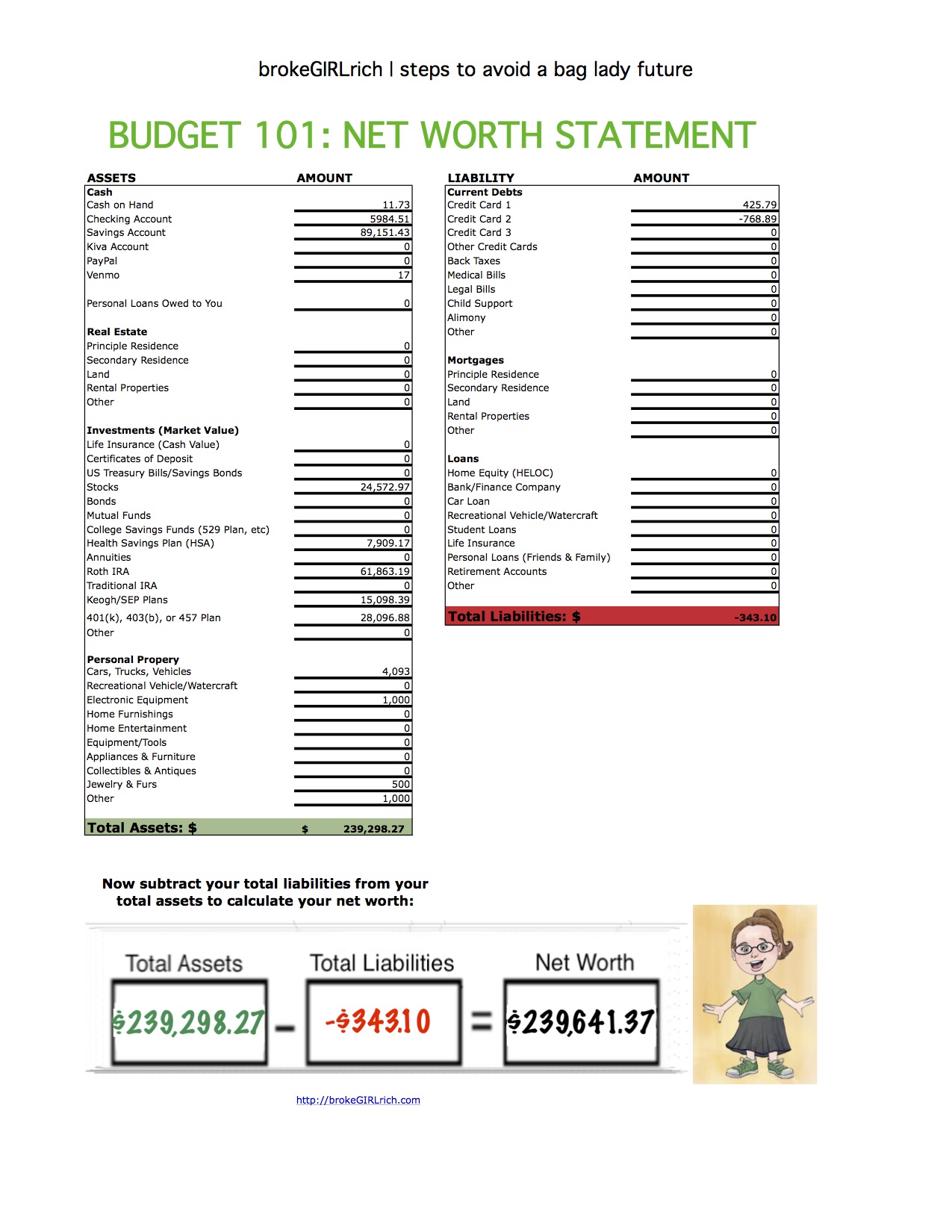

Net Worth: February 2020

Most Popular Post of the Month: Doin’It By the Decade: The Wealthy Barber Review

My Favorite Post to Write This Month: Financial Benefits to Touring

Goals

- Do two things to build up my stage management skills. One in progress. Any suggestions for the other this year?

- Spend more time with family and friends.

- Max out my Roth IRA. On track.

- Max out my HSA. On track.

- Set aside $1,000 for my new car account.

- Invest $2,000.

- Read more – not counting textbooks I have to read.

- Learn to make macaroons. Will this be the year?

You like so cute with bangs, get ’em! I really love these accountability posts, they motivate my financial goals. You go girl!!

LOL, thanks!