Profile

I am thirty-nine years old, a digital event producer and occasional freelance stage manager. I make $55/hour at the digital production company I work with, though work has been very slow this year. I work a variety of small side hustles and am a full-time student working on a PhD in Drama.

Spending & Saving

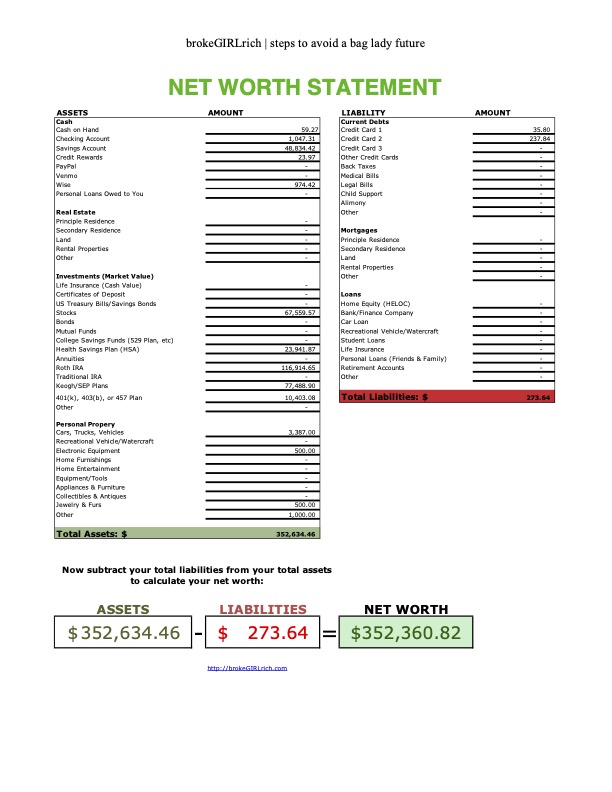

I decided to go for it and move some money from savings to investments, which I hope I don’t regret, but I feel like the stock market was rewarding me for that choice at the moment.

I moved some money out of my car savings account to max out my HSA and moved $2,000 out of my emergency savings to add to my IRA. I may still manage that last bit of 2023 investing before I do my taxes or I may not, but it doesn’t feel so drastic now. And having moved the money around, I think I will still be ok to finish my degree.

Which, terrifyingly, is halfway done. February 2nd is the two year mark and the degree is supposed to take 3-4 years. I used to be insistent that it was 3 years or bust to my supervisors but I now laugh at that sweet summer child. I’m hopeful I’ll get it done in the 4.

It was a terrible income month. Next month will be better but the digital producing is still very slow. Fingers crossed things improve in 2024. It was like an immediate and drastic drop off into 2023, so maybe the reverse will be true for this year.

Food jumped back up a bit this month between the fact that supplies to bake cookies are wildly expensive when you don’t really have anything stocked in your cupboards and getting takeaway a few times.

Extra takeaway occurred because I fell down some steps, sprained my ankle and slammed my knee into concrete so I could not walk well for like two weeks. London is a real unpleasant place to live – on the fourth floor of a walk up too – when you cannot walk well. Travel also ballooned because I usually save a few dollars on every trip by walking down the big hill to the main tube stop/DLR but that didn’t happen this month because of the injuries and I was working for my supervisor again on Friday-Sunday so I had to travel around London more than I usually do. It’s also higher because I did a fair bit of driving in New Jersey, which will probably be reflected in the January accountability too, and gas is expensive.

I thought I was done gift shopping last month but evidently not. And I had a trip to the dentist. Overall though, not really a crazy month. Entertainment was easy to keep low considering I could barely walk.

As far as income, I spent last month and this month helping my supervisor with one of his theatre company’s installations for a festival done by one of the school’s research centres. I was paid for some event staff working I did last month. I came home to a few refund checks. My health insurance company never seems to meet some kind of requirement by the state and always has to send us some check at the end of the year. My car insurance company is fabulous and when they make a lot of money, we all get sort of a refund/dividend check from them. I also received a regular dividend check.

We also finished creating Tavern of Conquests, which has been a strange trip over the last year and a half and a wild moment holding the actual book in my hands. It’s for sale now on Amazon though it’s incredibly hard to find without a direct link. Even if you type in the book title and author it doesn’t come up and I can’t figure out why. But it is there. Which is pretty cool.

Here is the expense breakdown for the month:

- Rent – $1295.66

- Food – $484.80

- Travel – $214.93

- Utilities – $190.61

- Gifts – $176.65

- Health/Dentist – $139.68

- Charity – $90.46

- Apartment – $71.87

- Blog – $71.04

- Entertainment – $62.75

- Toiletries – $6.40

Total Spending in December: $2,804.85

Hustling

This month’s income:

- Digital Producing – $550.00

- Work for Supervisor – $271.61

- Event Staff – $237.05

- brokeGIRLrich – $162.33

- Health Insurance Refund – $151.64

- NJM Refund – $52.95

- Dividends – $40.00

Income This Month: $1465.58

Net Worth: December 2023

Goals

- Save up $10,000 for school.

- Save up £5100 for school. Thishas been a resounding failure, so all of this year’s tuition payment is coming out of savings. I will try again for next year.

- Max out Roth IRA ($6500). $4000 contributed.

- Max out HSA ($3850). Done

- Buy the pretty lamp. Absolutely not.

- Save $2000 for vacation with BFF over the summer.This just completely and totally failed.Not my best money moments but some really great life moments? Sigh. I hate grad school for every financial reason imaginable,

- Stage manage a show.Hey! I did this twice!