Profile

I am thirty eight years old and I’m a digital event producer and very occasional freelance stage manager. I make $55/hour at the digital production company I work with. I work a variety of small side hustles and am a full time student working on a PhD in Drama.

Spending & Saving

The highlight of my month was going home for a few weeks for the holidays and seeing that goober dog. He refuses to FaceTime with me or acknowledge I exist over the phone. I also had a lovely time with the rest of my family and catching up with several friends.

The end of the month was a bit lackluster regarding work. This was followed by some really lousy news at our quarterly producer meeting that was can expect a drop in the number of sessions we produce for a while. January currently only has one session booked for me and it’s a whopping hour and a half session.

To be fair, people are off during the holidays and not much session booking is happening but fingers crossed I hit at least 5-6 full day sessions for January because my income for January and February is currently looking pretty grim.

It’s also the end of the year and I got to review my goals and consider my goals for next year. A fairly major source frustration for me regarding grad school is that I would prefer to be making a normal amount of money – however, I really like my life here and I get to be here because of school, so on we go with this degree. My dad contributes $5,000 a year to my tuition which overall, depending on the dollar to pound conversion when I’m paying bills – is anywhere between $17,000 and $20,000 annually. That leaves me to scrounge up $12-15k. Which was not a big deal with my 2021 or 2022 income from digital producing but I have a little anxiety about at the moment.

But it will all be fine.

My brother is getting married in Mexico in June, so my boyfriend and I paid for the days we’ll be staying at the all-inclusive resort. We’re going to spend 3 other days at a cheaper hotel by the airport and I’m hoping to use some of my credit card rewards to knock down the cost of some of that. I’m also hopeful to pay for most of my flight with points from another card. If I’m very lucky, I can use the points from my last credit card to cashback the cost of the one tour we’d like to do to go see the ruins. The boyfriend also paid my back for half of that cost (noted in income because sometimes tracking expenses and income just gets sort of weird), so hopefully most of my Mexico spending is done.

Food was a little higher than expected but when I was home over the holidays I went out to each with some friends several times. As I noted in November, I went a little overboard on gifts this year, though there were birthday and Christening gifts in that number for this month too.

Transit was very high but I lumped my usual Transit for London costs together with a train ticket to NYC and gas to get around while I was in New Jersey. And surprise, the dog needed things from the vet yet again, so I got hit with some dog expenses on my last day at home.

Utilities are creeping up a little and I am excited that I believe I will be spending some time on the phone with British Gas since they charged me a little over £1200 for my two weeks of minimal gas usage. Though they only did the usual monthly draw from my account.

The rest of my expenses were in an expected range though travel really made me regret not getting the United Mileage card before maxing out the number of open accounts I can have. I keep getting walloped with checked bag fees.

Overall this year felt a little tight but in reality I still traveled, did and ate what I wanted, managed to pay cash flow my tuition needs, rented an apartment by myself in London, stayed on track with my studying, and stage managed a show. I’ve been very, very fortunate and I’m very grateful.

Here is the expense breakdown for the month:

- Mexico – $2303.50

- Food – $537.33

- Gifts – $346.54

- Transit – $229.30

- Dog – $215.00

- Utilities – $211.87

- Clothes – $162.69

- Travel – $165.35

- Entertainment – $104.27

- Charity – $83.72

- Health – $70.22

- Clothes – $64.55

- Blog – $56.56

- Nails – $42.00

- Toiletries – $10.79

- Apartment – $4.82

Total Spending in December: $4,608.51

Hustling

This month my dad gave me $5,000 for the next year’s tuition payment, which was my largest income and, of course, totally not my hustling at all. But we’re all about money transparency over here. It will sit in one of my savings accounts now until my next tuition payment is due. Also my boyfriend paid me back for half of our Mexico trip expenses. Other than that, my income was mostly digital event managing and ushering. However, there were a lot of weird little checks I was finally able to deposit when I went home for the holidays including dividends, cashback rewards and some kind of overpayment fee from my health insurance company.

- Dad – $5000.00

- Digital Event Producing – $3093.75

- Boyfriend – $1151.75

- brokeGIRLrich – $596.00

- Ushering – $586.45

- Murder Mysteries – $156.55

- Dividends – $90.35

- Credit Card Rewards – $75.94

- Health Insurance Fee – $73.00

- User Testing – $10.00

Income This Month: $10,833.79

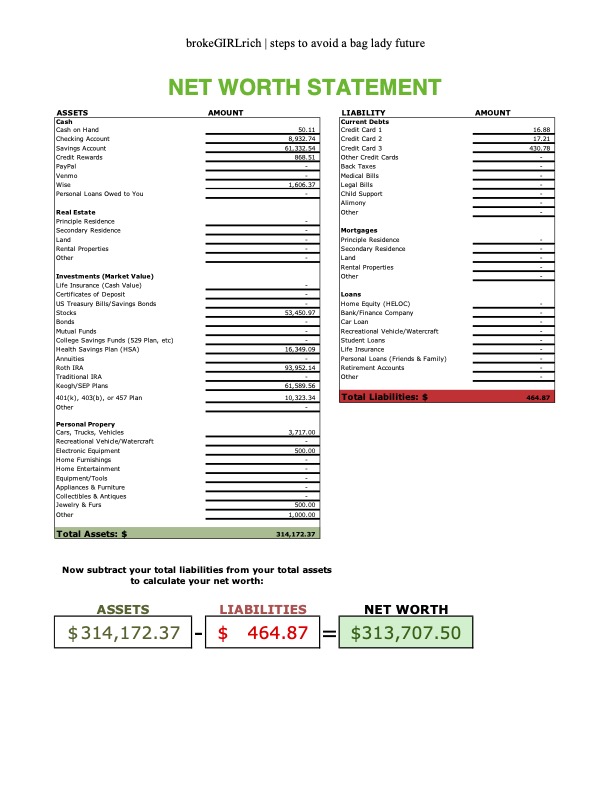

Net Worth: December 2022

Goals

Things didn’t go 100% as planned financially but they were overall ok.

- Max out my Roth IRA.

- Max out my HSA.

- Save up $15,000 to pay my tuition for 2022-23 in August without dipping into the school savings account ($9,000 if I manage the scholarship goal).

- Obtain £5,000 in funding scholarships. I only managed £500 in funding and it was applied to the 2023-24 tuition bill.

- Save up $2,000 for traveling.

- Balance work and school without losing my mind. I didn’t literally go crazy but this is genuinely the most difficult part of grad school.