Profile

I am thirty seven years old and I’m a freelance stage manager and digital event producer. I make $55/hour at the digital production company I work with. I worked as a stagehand a lot this month. I also do an assortment of other little side hustles. I have been living at my dad’s house rent free since July 2020 (thanks, ‘Rona), which definitely has given me a major head start on investing and saving goals.

Spending & Saving

I went from 110 mph from the 3rd to the 23rd without a day off. Then the 24th-26th was lost to a lot of holiday stuff (which was lovely, just very busy) and then my brother told us he had Covid (very mild, he’s ok), so the world kind of grind to a halt while we waited long enough in quarantine to see if we would test positive too.

(So far, so good, no Covid).

I’ve seen those memes about not knowing what day it is between Christmas and New Years and I don’t think I ever really related because an awful lot of the time, I’m working. But this last week I genuinely didn’t have a clue. I read a bunch of books and watched the whole Hunger Games series one day.

On top of the crazy work schedule earlier in the month, I did get into school and spent a fairly frustrating week trying to sort out getting transcripts to them before the holidays, so I could get my CAS letter and submit my visa.

This did not happen in time.

Which isn’t really tragic, though it does feel par for the course considering I thought the whole flipping thing would be sorted out by August and here I am less than one month from my course start date with my tuition not yet paid, no housing plans, and still unsure of exactly when I’m headed to England.

I have a remote start date for February 1st and in person by March 1st, so hopefully by January’s update I will know when and where I’m moving. Or I’ll just put a series of gifs of people laughing maniacally and rocking in a corner and ya’ll will know it is still not going smoothly.

I also opened a Wise credit card account which should let me open essentially a US and UK bank account and, in theory, should work as my bank account for the next few years. After I have a chance to actually use it for a bit, I’ll definitely write up a review about whether or not it was a good idea.

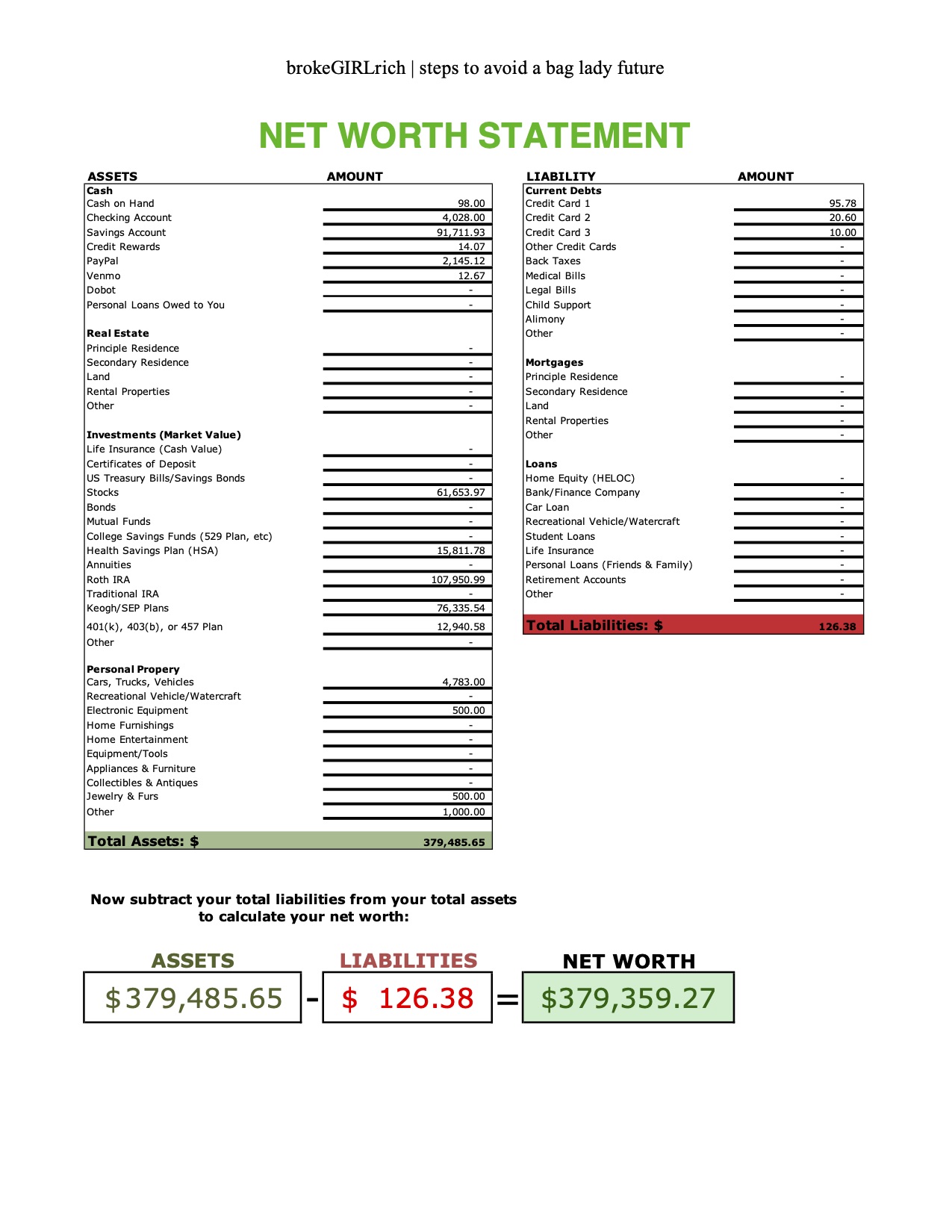

As far as this relates to money though, I did manage to finish 2021 with my goal of breaking $325k net worth. Even if I had to pay the full year’s tuition and after I submit my Q4 estimated taxes, I will still have achieved this goal, so that’s pretty cool. My net worth actually went up just under $94k this year, which is kind of totally nut considering how abysmal I really thought this year was going to be financially.

The absolute craziest thing to me about 2021 is that it began as a total dumpster fire regarding my career. My industry didn’t really exist. I had totally lucked out pivoting into producing corporate events the last few months of 2020, which is like 90% stage management skillset and 10% IT customer service, but even that began slow and I expected my income to be around $2000-3000 a month for the whole year, if I was lucky.

Instead 2021 was the highest income year I’ve ever had through a combination of the corporate job exploding and there being so many workshops to produce, finding the part time murder mystery job that was an absolute delight for nine months, the unexpected circus contract, the totally unexpected film festival contract, my blog income finally picking back up midyear, and a variety of random little side hustles.

I’m going to try to remember that while I never know what’s coming in this weird freelance life, sometimes it is a pandemic but other times it’s work like 2021. So anything can happen and once in a while those anythings are actually good.

Food was astronomical this month. Like I was legit a bit surprised when I added it all up, but I guess I shouldn’t have been. I did Hello Fresh for three weeks, since they had a discount to entice me back. It is also kind of crazy as I reviewed those numbers to realize that like two UberEats meals were like nearly $40 each. I remember sitting there ordering one thinking this is kind of wasteful, but I barely do it, and I guess I still agree but man, those fees are crazy.

I also thought a lot of the damage came from nickel and diming the week and a half where I was doing stagehand work and just grabbing a sandwich and coffee on my way into work each day, but honestly, not really. It would’ve been easiest to knock the total food cost down by skipping the meal kits and UberEats.

I really only note this because it was the main area that I’m thinking I need to get under better control.

My next highest category this month was gifts, which wasn’t surprising being Christmas and all. A friend also had a baby this month but they live kind of far away, so I sent over a meal, which is surprisingly expensive to do. A friend of a friend also had some medical issues and I figured that was a good category to put that donation into as well. Anyway, my gift spending usually makes me pretty happy too, so this fine.

I’m planning a long weekend trip to Vegas in January to see my best friend out there. I was able to use a bunch of my credit card rewards, so the ticket only felt like it cost about $50.00, which included some additional fees to make it very cancellable if necessary.

Stage management/stage hand spending was a little high because I finally replaced a bunch of black clothes with new ones that actually fit.

Health is also high because I tried to get a Covid test several times this month and failed because the lines were so long that you either had to wait all day like we live in Communist Russia or something or you would get on the list to be called later and just never get called. Not the end of the world for someone who sits at home digital producing a lot, but sometimes I do leave the house, so I bought a few kits from Amazon.

Overall, I’m still happy enough with my spending, but need to get the food a little more under control. Especially since it’s been kind of high for several months now.

I definitely felt the pinch of the 30 days delayed invoice for November from the digital producing job, but it’s not the end of the world since I knew I would and I made a plan. The blog had a surprisingly good month and I actually picked up more digital producing sessions than I thought I was going to, so while next month will probably be a lot like this month in income, that is higher than I initially thought it was going to be.

On the plus side, this was $20 super well spent this month.

One thing I waffled over for the last month and then decided to go for was buying a new laptop. Mine has slowed down quite a bit, which is tolerable, but the slightly alarming thing is that it’s physically coming apart on one side and I think I sort of need to gaff tape it together.

I started thinking about how this eventuality was on the horizon probably two or three months ago. Facebook actually sent an on this day memory this month from 6 years ago noting that my first Macbook bit the dust also after 6 years, so perhaps that’s an average run? It is a run I’m satisfied with.

I had figured I might just let it roll and hope for the best and just go out and buy a new one if this one dies when I went to check prices to start budgeting for it on the Apple website and found everything is backordered about a month.

I then considered that like 80% of my income comes from my computer working and if the pandemic flares back up, like 100% of my life is online. I also thought I would absolutely rather buy a new Macbook in the US than the UK, so I ordered it. I am now also stressed at the idea of my current computer biting the dust before the new one arrives, which isn’t estimated until the end of January. Then my plan is to keep plugging along with this one for a few months before actually opening that one.

Strangely enough, my card hasn’t been charged yet, so maybe they don’t charge till they ship? But this will be a substantial expense next month. I had also kind of hoped to dump that amount into my IRA on January 1st, but I think in the immediate run, this was the more cautious choice.

I do still have a little set aside to get a jumpstart on my IRA, but it’s definitely not my earlier goals of maxing it out on day 1. That’ll have to wait for a different year. I’m hopeful that a substantial part of my tax refund can go to that, because I’m fairly sure I over-padded my estimated payments this year to make sure I got it completely right for a change. I also don’t account for business deductions or retirement savings in those estimated taxes, which in reality knocked my net income down almost by half this year.

Anyway, my expenses this month:

- Food – $767.81

- Gifts – $319.93

- Vegas Trip – $257.13

- Gas – $155.78

- Health – $131.44

- Stage Managing/Stage Hand – $125.77

- Entertainment – $120.88

- Clothes – $99.29

- School – $92.90

- Miscellaneous – $74.19

- Toiletries – $68.05

- Gym – $28.78

- Dog – $27.00

Total Spending in December: $2,268.87

Hustling

This month’s income comes from brokeGIRLrich, digital producing, stagehand work, a health insurance refund and a dividends check.

- brokeGIRLrich – $2447.04

- Stage Hand – $1332.60

- Digital Event Producing – $1225.00

- Brother Loan – $126.66

- Health Insurance Refund – $39.15

- Dividends – $36.80

Income This Month: $5,207.25

Net Worth: December 2021

Goals

- Max out my Roth IRA. New goal is to have $1000 saved to deposit on January 1st. Did it.

- Max out my HSA. Done

- Invest $2,000.Done

- Save up $3,000 for post-pandemic traveling.Done

- Add $1,000 to the emergency savings account. Done

- Add $2,000 to the new car savings account.Done

- Break $300,000 net worth.Updated to break $325,000. Done

- Do two things to build up my stage management skills. COVID compliance officer certificate and immersive theatre design class.

I am excited for your new adventure in the UK and for such a robust net worth!

I’ve enjoyed reading your accountability reports for years.

Thanks for reading for so long! I’m excited too. It still doesn’t seem totally real – I think because I don’t have a date I’m moving yet. But it should be a good adventure.

Mel @ brokeGIRLrich recently posted…Accountability: December 2021

Super impressive that your net worth grew by (almost) 100k in a year! 🍌 Your determination has served you well!

Budget Life List recently posted…Showing More Courage than Skill at a Silent Meditation Retreat

Thank you! It’s definitely been a wild time. I can’t even claim that much credit, it’s just the craziness that is the US stock market.