Profile

I am thirty six years old and I’m a freelance digital event producer. I make $40/hour and generally work about 16-20 hours a week. I’m still living at my dad’s house. I am so not sad to say good-bye to this year.

Spending & Saving

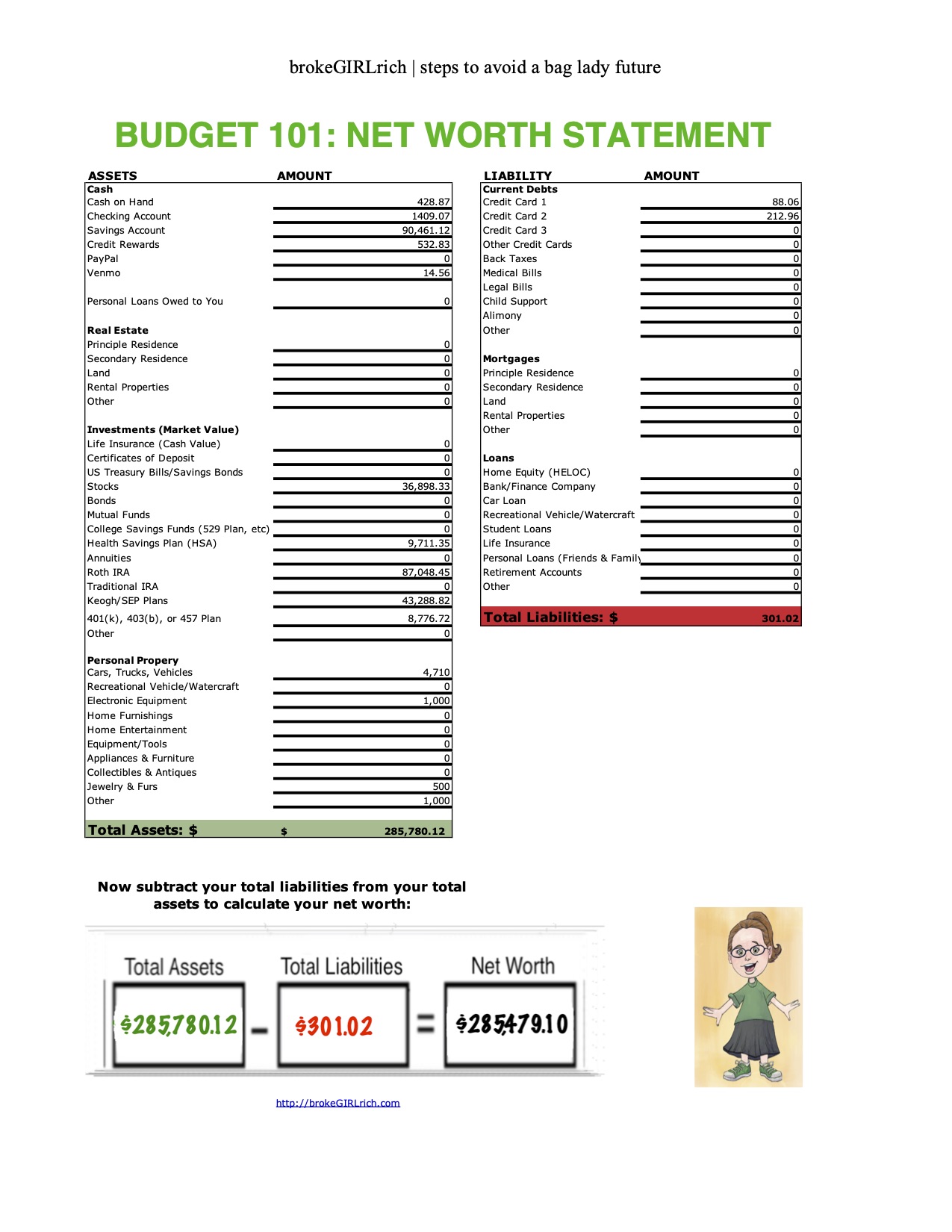

This has been another weird month where my net worth continues to climb thanks to my retirement and brokerage accounts and yet my checking account makes me slightly nauseous. Though nothing like last month. Geez.

So overall my financial life is still a win, but ugh, am I ready for theatre to restart and start making stage management money again.

How ridiculous is it that after all those years of being warned against the instability of a career in the arts, I find things most unstable when I’m not working in that field?

Anyway.

Food was my usual largest expense. Health insurance was an unsurprising second, but I switch health insurance providers next month and should start saving $100 a month and I’ll be eligible to contribute to my HSA again.

I had to get new tires during the first week of the month for my car after my dad and my brother, both on the same day, told me they thought I was going to die driving around on those things. But since my dad didn’t really know what to get me for Christmas, he gave a gift of $220 to “pay for the tires” on Christmas. I was not sad about it. Excellent gift.

The main damage on entertainment is a lift ticket to go skiing with my dad and my brother in January. I hope this isn’t a nightmare, but the ski resort had limited ticket numbers, spaced out for certain times, and everyone is already bundled up and breathing into scarves, etc. without even taking their masks into account so… fingers crossed this wasn’t a terrible idea. My dad and my brother are very much team don’t give a damn about the pandemic, so I can never really trust their assessments on things.

But considering the ticket was like $30 more expensive than normal, I guess the resort is genuinely cutting down entrances? I flipping hope so.

Gifts were kind of high, but it was actually a sympathy gift and a wedding gift that pushed it so high. My Christmas shopping was largely done at the beginning of the month.

I personal finance failed twice this month with two different bank fees. One to cancel a check because the NJ department of unemployment has had an outstanding $1450 check just sitting around for 2 months and it was making me so anxious considering how tight my checking account keeps running right now. That was from when they issued me the wrong unemployment amount in September.

One of the options was to have the amount taken out of my tax refund. I had wanted to sort it out faster, but apparently that was naïve on my part. I’m also not sure why it was stressing me out so bad, but it was. So I just transferred that amount into my Tax Bill savings account and will sort it when I pay my taxes.

The other was a maintenance fee, because I just forgot an annual automated bill was going to deduct money from that account, causing it to drop below the amount I have to keep to not get a maintenance fee.

Nailing it this month.

One fun spending line this month though is what I called book. So, I wrote a book. It’s a middle grade (age 8-12) book about Jorge, the little man who lives in a jar, and when he gets loose, he and the three children who set him loose travel through history. Jorge steals Benjamin Franklin’s kite and the children have to rescue him from some pirates.

It’s probably garbage, but three of my friend’s with children in that age range agreed to read it and give me some feedback, so that line accounts for all the postage, binding the copies, and I bought each of the kids some fun pens to write on their copy with.

I’ve had this idea bouncing around my head for 20 years though, so it’s kind of exciting to have actually done it, even if nothing further ever happens. It’s also kind of crazy to me right now that there are kids out there reading my story. It might be my 2020 highlight.

My expenses this month:

- Food – $397.82

- Health Insurance – $263.45

- Gifts – $252.26

- Tires – $220.30

- Entertainment – $141.19

- Gas – $86.30

- Book – $56.98

- Toiletries – $33.28

- Fees – $29.00

- Masks – $24.99

- School – $14.95

- Miscellaneous – $4.27

- Clothes – -$33.00

Total Spending in December: $1,491.79

Hustling

My income was mostly from digital workshop producing. Since I get paid 30 days after invoicing, I was missing the week of Thanksgiving when there was no work. It will be worse next month since it will include two weeks of missing work. I got a tiny insurance refund and did some UserTesting. I also included the Christmas money.

- Digital Event Producing – $2210.00

- Christmas Gifts – $220.00

- User Testing – $25.00

- brokeGIRLrich – $19.12

- NJM Refund – $3.35

Income This Month: $2,477.47

Net Worth: December 2020

Most Popular Post of the Month: Doin’It By the Decade: The Wealthy Barber Review

My Favorite Post to Write This Month: If I Were a Class of ’20 Theatre Grad

Goals

- Do two things to build up my stage management skills.

- Max out my Roth IRA.

- Max out my HSA. I did as much as I was allowed.

- Set aside $1,000 for my new car account.

- Invest $2,000.

- Read more.

- Learn to make macaroons.

You’re going on a skiing trip, in the USA, in the middle of the worst expected months of a global pandemic? How many people do you think you might be sharing air with on the way there, during, apres and on the way back? All of whom are probably also not that smart about their personal safety because, you know, they’re going skiing in a frickin pandemic in the months when the US death toll is expected to reach 5000 A DAY. Brilliant idea.

Over the years that I’ve been reading your blog, I’ve read some occasional silly stuff from you. I’ve written it off as a bit of naivete from a determinedly middle class person. This, I think, is the last post I’ll bother reading. All the best, and I hope you have decent medical insurance.

Enjoy your ski trip and ignore busybodies like Beth. Stay safe, enjoy the sunshine and the slopes!

Thanks, Mike.

I actually agree with many of her points, but as I live near the slopes, I won’t really be doing much traveling to get near them. It was actually really well run, the smallest groups I’ve ever seen there, and actually something that I would consider no more dangerous than going to the park or outdoor eating was all summer.