Profile

I am twenty-nine years old. I work as an assistant production manager and my yearly salary is $52,000. I am about to acquire a ton of bills for the first time in my life when I move into my own apartment in January, so I suppose I better brush up on my budgeting skills.

Saving & Spending

Money-wise, this has been a super weird month.

I just got a new job working for a theater in NYC (the goal for years). It’s not 100% what I want to be doing, but as far as a step in the right direction, it’s probably the best step I’ve taken since I was 23. I’m working in an off-Broadway theater as part of the production management team and I get to meet tons of people who are doing exactly what I want to be doing (Broadway stage manager – if I’m going to dream, why not dream big?). Production management is definitely a step in a different direction, but a lot of the skills I’m learning here will make me more employable in the long run, and, like I said, the connections I’m making are pretty awesome. The $14,000 raise didn’t hurt either. Or the flexible schedule with a boss who encourages us to find outside projects during the slower periods of work. I’ve been working here about two weeks and already found a side gig making props for another theater, so I’m pretty excited about that.

That being said, while the $14,000 raise was really exciting, it’s really just going to pay rent – and after taxes, it won’t even cover that fully for the year. I applied this past week for an apartment in Inwood and am waiting to see if I get approved. So hopefully, by New Years, I’ll actually have my own home for the first time since I was in school.

So this month my main bills were one last overland with the circus that was a whopping 2 hours (score) and then driving from Indiana to New Jersey to stay with my parents while I sorted out my living situation. NJ Transit and Metrocards have been my other big ticket items this month.

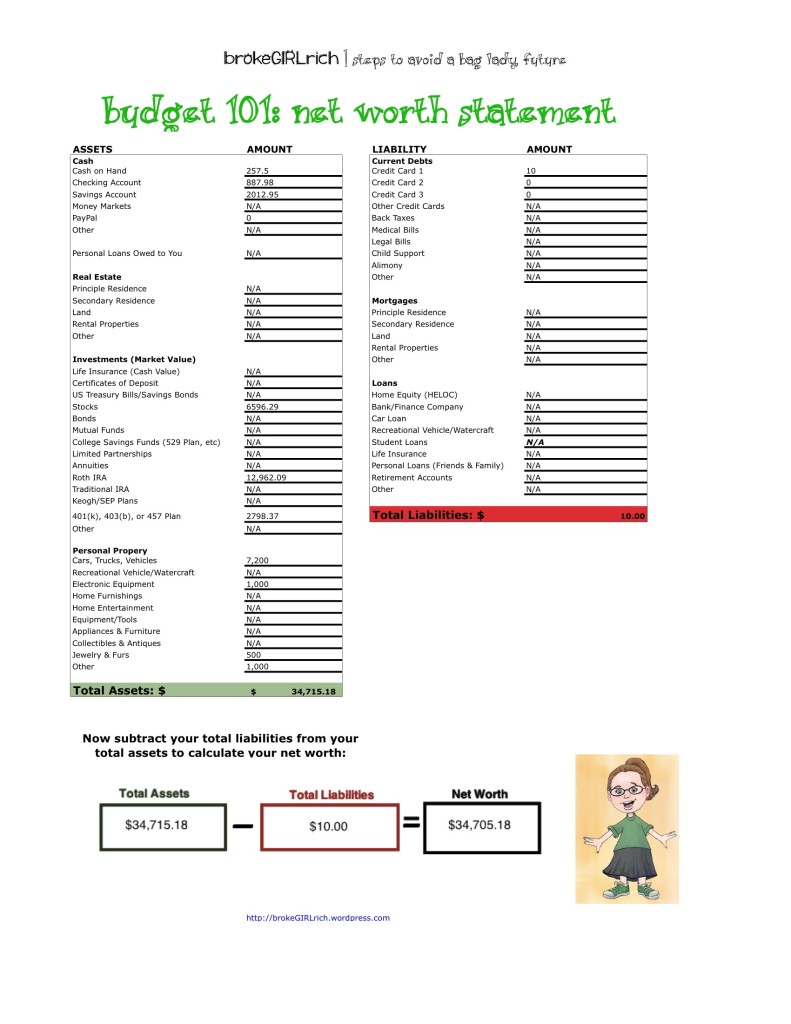

Also, to be able to move into an apartment, I had to tap my emergency fund. So my $5,000 goal by the end of 2013 is definitely NOT happening. Maybe 2014 will be the year.

But you know, none of that matters because I made $64.30 side hustling this month.

All in all, I’d consider it a successful month for my career but a little less successful for my bank account.

So this year I had a crazy job working for the circus and living on a train. I got to see my oldest best friend get married. I started a blog. I finally celebrated Christmas with my family for the first time in years. Fingers crossed, I found an apartment (which is a post or 20 in and of itself – I haven’t done anything so frustrating in a long time). And I met my goal to max out my IRA and paid off all my student loan debt (which was another reason I was able to take on paying rent for an apartment).

Hopefully 2014 turns out even better.

Living in NYC can be very expensive. Best of luck Mel in 2014!

Brian recently posted…Week End Round Up #13

Way to go on the new job and that impressive salary increase! NYC housing is absurdly expensive. When I was in grad school I was up in Harlem, it was pretty affordable (university owned) but wasn’t always the safest (the neighborhood-I felt safe for the most part in my actual building).

KK @ Student Debt Survivor recently posted…6 Tips for Dealing with Disappointment

I looked at a few apartments in Harlem. I actually did like one, but didn’t apply quick enough. I just signed the lease for one in Inwood though that I feel good about, so I’m pretty excited to move in tomorrow.

I was actually just there a month ago with the circus! It was freaking cold. But the Field Museum was cool. And I loved the tiki bar in Rosemont by where we were parked.