Profile

I am forty years old, a digital event producer and occasional freelance stage manager. I work as a TA and an adjunct. I also work a variety of side hustles and am a full-time student working on a PhD in Drama. Once in a blue moon, I still get to be a stage manager.

Spending & Saving

Though this was an expensive month, I think things are starting to settle a little. It was also a really nice month. July and August are the best two months of the year as a PhD student – everything is much calmer and there is plenty of downtime. I hope that’s true next year too, I suppose time will tell.

The first 12 days of the month were spent in the States, between visiting friends and family in New Jersey and then spending a week up by a lake in Maine with several of my family. Food costs are particularly high due to this – both because there were some expensive meals in Maine (including a stop for snacks at a homemade pie stand where me and one of the other people on the trip totally got hosed – the lady didn’t have prices out and she was so chatty while we checked out both of us were like… I have no idea what I’ve spent. I got a pie, a homemade load of blueberry bread and a jar of honey for $75. W.T.F. Entirely my own fault for not asking the price, but we were both shocked). Also, I absolutely packed both my suitcase and my boyfriend’s with a big grocery shop of foods from home that is rolled into that total.

I got to spend some time with this guy!!

We also did a bit more take-out and exploring the area we’ve just moved to on weekends than I think is the norm. And we were still buying a bunch of essentials for the kitchen in the new place. I’m hopefully the food spending will easily be half that next month.

My rent is now the amount it will be. We did have some issues sorting out the council tax. When I lived alone, my council tax stipend was waived completely. It’s only waived by 25% when living with someone else, which I think it pretty lame. It should be 50%. And we only just got the paperwork through for that, so for this month, I paid the original council tax amount. It will go down next month.

Transport was very high. This is partially because I bought a bike ($260 of that total); however, I also bought train tickets to get to and from the airport for an academic conference I’m attending next month and then one London roundtrip for my academic research centre’s quarterly meeting in September. We also came back from the States trip and went into London one weekend in August.

I have decided I’m definitely getting my British driving license. I’m going to send in the paperwork as soon as I get home from that academic conference in September to start the process.

Utilities were quite high since British Gas left me with a $300 bill of gas I owed since they sort of just guess how much you owe them each month, if you don’t have a smart meter. But apparently, when you try to move, they can suddenly figure it all out. Everything about the London flat was an endless pain in the butt. My security deposit was returned but the landlord made me pay for cleaning because the new tenants asked for the place to be cleaned, even though I cleaned it very thoroughly and he agreed it was clean when I moved out. That seems crazy to me. I left it cleaner than it was handed over to me. But I have no fight left in me for stuff like this, so I got most of the security deposit back.

Entertainment was also a little high since some fun things on vacation were rolled into it. I also paid for 6 weeks of yoga classes near our new place because I need a reason to leave the house sometimes and I bought an old school Wii so I can play some Guitar Hero, as I find it very soothing. In total, that probably came out to around $75 for the eBay Wii and then another eBay Guitar Hero games purchase. I grabbed an old Guitar Hero guitar from home and brought it back with us, though none of us could find the Wii at my dad’s house.

Entertainment was also a little high since some fun things on vacation were rolled into it. I also paid for 6 weeks of yoga classes near our new place because I need a reason to leave the house sometimes and I bought an old school Wii so I can play some Guitar Hero, as I find it very soothing. In total, that probably came out to around $75 for the eBay Wii and then another eBay Guitar Hero games purchase. I grabbed an old Guitar Hero guitar from home and brought it back with us, though none of us could find the Wii at my dad’s house.

Next month should have the very big expense of my final large tuition payment, which will come out of savings and Q3 taxes, as well as a brief trip to Istanbul for an academic conference. The funding was less generous this time and we will have to feed ourselves (a classmate is also going) and we decided to bump our flight back to very late in the evening on the last day, so we can explore Istanbul for most of the day after the conference.

Expenses this month:

- Food – $957.18

- Rent – $820.66

- Transportation – $567.52

- Utilities – $409.33

- Entertainment – $345.46

- Apartment – $288.29

- School – $202.13

- Turkey – $151.99

- Council Tax – $122.11

- Gifts – $99.62

- Credit Card Fees – $95

- Travel – $85.29

- Clothes – $52.81

- Charity – $42.02

- Toiletries – $33.41

- Blog – $32.77

- Hostels – $16.94

Total Spending in August: $4,322.53

Hustling

This month’s income:

- Adjuncting – $1490.51

- Security Deposit – $1097.71

- Blog – $765.48

- TAing – $228.23

- Turkey Reimbursements – $34.80

- BF Reimbursements – $24.59

Income This Month: $3,641.32

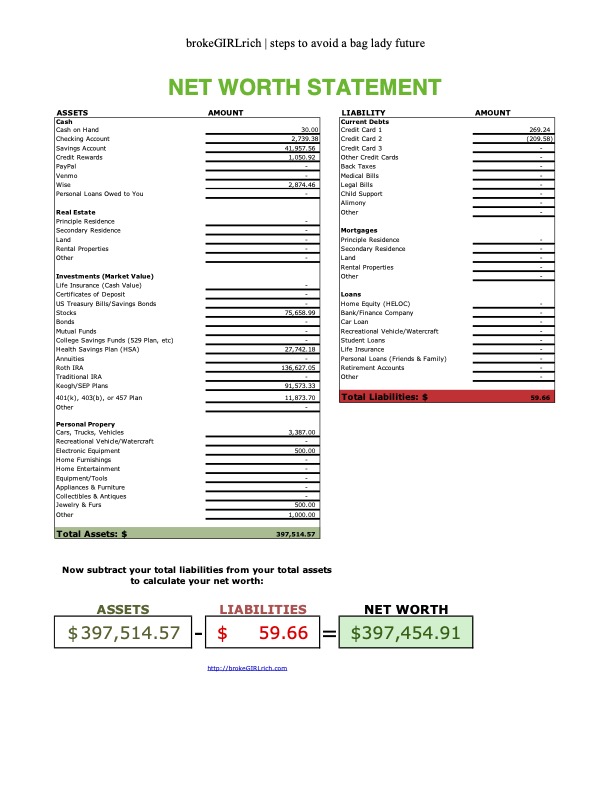

Net Worth: August 2024

Goals

- Save up $5,000 for school– via saving or scholarships. $2626 in scholarships received (£2000), the rest will have to come from savings.

- Max out 2023 Roth IRA. That happened. A while ago actually.

- Max out 2024 Roth IRA ($7000).

- Max out HSA ($4150). $100 contributed, $4050 to go.

- Stage manage a show. Starting strong! I’d like to hopefully stage manage another before the end of 2024.