Profile

I am thirty eight years old and I’m a digital event producer and very occasional freelance stage manager. I make $55/hour at the digital production company I work with. I work a variety of small side hustles and am also a full time student working on a PhD in Drama.

Spending & Saving

So I was pretty pleased when I ran my spending for this month because at first I was a bit horrified that the three highest numbers are food, entertainment and a weekend trip to Luxembourg/Germany but really, that’s not so surprising. Overall though, things are continuing a creep towards more settled in.

Utilities are a bit high because my intro rate for the internet ended. I also had to add extra data to my phone this month for the first time and I still think my ridiculous electric box is out to get me and just haphazardly draining my money somehow – especially as I wasn’t even home for like a week this month.

I finally cut off all my pandemic hair. It looks… terrible now. But it will regrow. First big haircut since May/June 2019, other than those insane mid-pandemic bangs.

My flat spending is starting to chill a bit. I bought another bookshelf and was so excited the price was so reasonable but that turned out to be because it was delivered in 8000 pieces and took me three days to assemble. I also found a cool map picture that I still need to hang up and… another plant. I killed the very fancy plant I bought in June – apparently String of Pearls is still too advanced for me. Though Seymour, the Venus fly trap, continues to thrive. This is not so surprising as there are often plenty of flies to eat here thanks to keeping the windows open to survive the delightful British heat waves. I also managed to shatter the coffee pot from my old maker and then couldn’t find a replacement coffee pot that would fit, so I have a new coffee maker.

My BFF was still here visiting the first week of August so I was essentially staycationing – which is some of the Entertainment and definitely some of the food expense. I also spent 4 days in Edinburgh. My school sent me there as one of the staff for the undergraduate students to contact in an emergency.

There was a lot of fun this month.

It was rough gig (j/k). They paid for my train ticket and lodging and I had to work 2 whole hours a day, watching the student’s show, and keep the emergency phone with me. So there was a boost to food and entertainment expenses from that too. I spent about $100 to buy tickets for like nine other shows. It was kind of incredible. I really liked Fringe.

My favorite show was The Gods, The Gods, The Gods. But I really enjoyed experiencing the Darkfield shows – they do cool things with binaural audio. I also follow this comedian on Instagram, Ali Woods, and I’m pretty sure I’m going to get to say I saw him at Fringe when he has a Netflix special someday because he is pretty funny. The Mr. Thing Show is also highly recommended – lots of laughs. angel-monster was an absolutely brilliant modern dance piece but it covered a really heavy topic. They were possibly the most precise and skilled dancers I’ve ever seen though. Totally amazing.

Returning from Edinburgh, I picked up some kind of cold, resulting in some health care expenses as I stocked up on cold medicine. I also figured the rest of the month would be pretty chill but a friend from the FAME tour is working in town and we met up one night for a fairly ridiculously expensive night of tapas and drinking and then we decided to meet up again on her next day off and go on an afternoon tea bus tour – which I am so excited to do because I am lowkey obsessed with tea time and had no idea where on earth I was going to find someone to ride that silly bus with me.

My boyfriend and I are definitely a little out of whack with who pays for what too this month since I often just paid for our tickets to stuff when my BFF was in town and then to go to a pretty pricey immersive show with some of my classmates – however, this means that will probably balance in my favor next month.

It’s also kind of hard to feel bad about any of the spending considering how the last few years have gone and the weird realization I had recently that I am the happiest I’ve been in years. And while I don’t need to do super expensive things or pop off to foreign countries every month – the ability to do these things when I want really does make a pretty big happiness difference.

I was also able to save a little more for 2023-34 school tuition. Next month the 2022-23 tuition is due, which will be a crazy expense. I opened two new credit cards to benefit from some rewards from this project.- a Chase Sapphire and Hilton AmEx. I’ve never had a hotel rewards card before. My current plan is to use the Sapphire rewards to reduce the cost of the plane ticket to my brother’s wedding in June. I hope to use the Hilton rewards to go to Venice some long weekend later in the fall or in the spring.

Next month I also have to buy a plane ticket home in October for my cousin’s wedding and probably book a hotel room for the evening of the wedding. I mean, I don’t have to – but I think I want to. I have about $200 in rewards on one credit card that I’ll use to knock down the cost of the flight and $60 on another card that I’ll use to knock down the hotel room cost.

I also suspect that my school is going to make going to the conference in New Orleans as difficult as possible and while I do believe I may actually get approved for the funding, I suspect I’m going to have to buy the things and then get reimbursed.

All of this to say I expect to spend somewhere in the realm of $20,000 next month.

Ugh. UGH. I am prepared but it never stops sucking.

My short term goal over the next few months is to focus on finishing contributing to my HSA and start saving a bit to make an initial contribution to my IRA in January. I’m not sure my funding goal will pan out this year, though a significant number of funding opportunities open in the fall for the following year that I couldn’t access last year, so hopefully at least some of those will help reduce the 2023-24 tuition bill.

On the plus side, when I figured out my financial plans going into this, I figured I would have trouble finding part time work in England and instead I hit my 20 hours most weeks, unless I don’t want to. This should add about £8,000 more in income than I expected each year.

Next month’s income should be a little better than this month, though the digital workshops were still light this month. They’re already picking up for September though, which is certainly promising.

Here is the expense breakdown for the month:

- Food – $753.13

- Entertainment – $608.91

- Luxembourg – $447.24

- Utilities – $185.43

- Flat – $177.41

- Travel – $152.23

- Clothes – $104.86

- Fees – $95.00

- Hair – $61.16

- Medical – $60.20

- Charity – $57.56

- School – $50.00

- brokeGIRLrich – $37.00

- Toiletries – $10.44

Total Spending in August: $2,800.57

Hustling

As usual, most of my income comes from digital event producing. The other income is two of my jobs in London – ushering and relationship management, brokeGIRLrich, and a tiny bit of backpay from the murder mysteries.

- Digital Event Producing – $2062.50

- brokeGIRLrich – $1370.54

- Relationship Managing – $484.46

- Ushering – $112.42

- Murder Mysteries – $87.20

Income This Month: $4,117.12

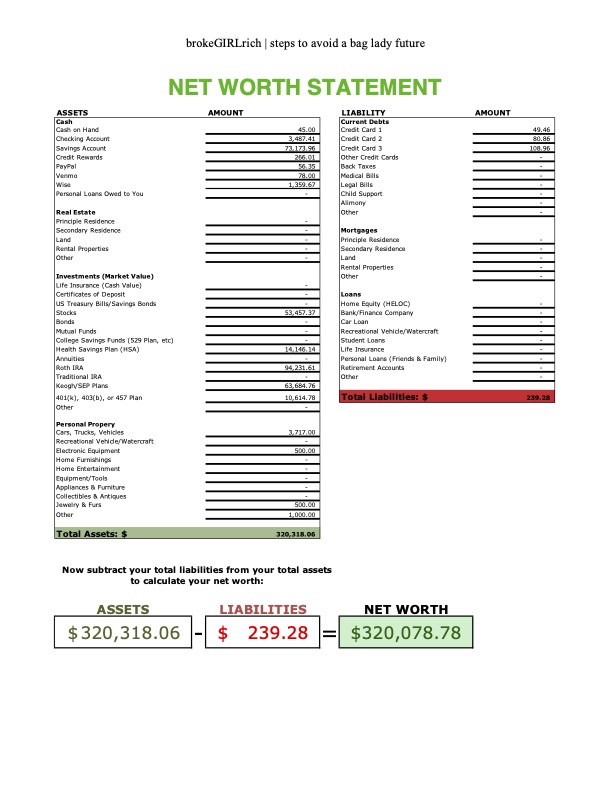

Net Worth: August 2022

Goals

I think this is a pretty good assessment of what I might be able to achieve this year. If I luck out and the blog has a really good year or something, I will aim to make a contribution to my SEP 401k too.

- Max out my Roth IRA.

- Max out my HSA. $1,000 contributed.

- Save up $15,000 to pay my tuition for 2022-23 in August without dipping into the school savings account ($9,000 if I manage the scholarship goal).I accidentally saved an extra $800.

- Obtain £5,000 in funding scholarships.

- Save up $2,000 for traveling.Done

- Balance work and school without losing my mind. I haven’t lost my mind but there was very little work to balance this month anyway. My life to school balance hasn’t been great this month either though it was skewed towards life – hopefully the rebalancing of this next month is not too painful.

Pingback: Accountability: August 2022 – brokeGIRLrich – Indiatips.in