Profile

I am thirty five years old and I work as the General Stage Manager for a touring circus; however, we didn’t have any shows this month, so no stage managing income for me. I also didn’t get put on any calls at any of the theaters I work at as a stagehand. It has been a very slow month.

Saving & Spending

On the plus side, after several go arounds with the new company sorting out banking info, I finally got paid at the beginning of the month for last month’s work.

A few big spends happened this month.

I went to Montreal with my two best friends for a long weekend. Spending a couple days exploring a new place with them always makes my soul happy. I wouldn’t call it our most exciting trip, but we had a good time together.

Montreal highlights: Kayaking, food, sightseeing and a Harry Potter-esque bar!

I made a kind of last minute decision and decided to head to FinCon ’19. I picked up a discount ticket on the exchange on the last day it was available. I’m crashing at my circus BFF’s apartment in D.C. and taking the metro in to the hotel everyday. I’m stoked about the savings and the time to catch up with her, but a little sad cause some of my favorite FinCon ’14 memories were insane middle of the night hotel hangouts.

I paid for the family rafting trip we’re going on in West Virginia in September. Two people have paid me back so far. Four more family members still owe me a nice chunk of change.

And I had to buy contacts. Boo.

Overall though, I can’t complain. One of the best friend’s I went to Montreal with and I were on standby for a European cruise with the line I used to work for. The cruise would’ve been pretty cheap ($700 for 11 days) but the last minute plane ticket to Rome was going to be real pricey. Since we got denied the cruise at the last minute, I figure I probably didn’t spend around $3,000 I was thinking I was going to spend over those two weeks.

I spent a lot of time with this goober too.

As for savings, I finally sorted out my Health Savings Account and made sure I was enrolled in the investment option and that my money was going into it properly.

I started the ball rolling on the Solo 401(k). Since I have an EIN already for brokeGIRLrich, when I tried to open a second one easily online for banking, it rejected it. So I mailed in the application. It says to wait 4-5 weeks for a response, so hopefully I have the Solo 401(k) sorted by the end of September/October at the latest.

I got reacquainted with our local library and found the personal finance section! Besides just reading Joe Hill books, I also read a book about how Warren Buffet picks his stocks by his daughter in law and I finally read Your Money or Your Life. At times it seemed a little quaint and I was already familiar with most things in it, but I do love the idea of breaking down expenses into hours of your life.

I was also struck by the fact that 3 hour work days used to be the norm and natives used to hunt and gather for a day and then live off that for two or three days before doing more work. We have got things all wrong nowadays, people!

Sigh.

Anyway. I did manage to tackle a task that I keep telling myself I want to do but I avoid.

I made macarons again.

And they were kind of delicious. They still look a little funky (and weirdly gray in this picture when in reality they were light purple).

Slowly and steadily improving…

My buttercream recipe needs a lot of work still and I slightly undercooked the macarons, but progress is happening.

I also signed up with QuickBooks since for the first time I’m making enough as a contractor to have to pay quarterly taxes.

Here’s the August spending breakdown:

- Food – $527.26

- Car – $83.11

- Healthcare – $140.63

- Music Lessons – $122.00

- Fun – $175.18

- Gifts – $75.00

- Gym – $45.83

- Pool – $148.96

- Toiletries – $16.06

- Clothes – $106.23

- Rafting – $567.00

- Dog – $26.60

- Contacts – $719.92

- QuickBooks – $12.00

- FinCon – $331.80

- Montreal – $259.58

Total Spending in August: $3,357.16

Hustling

Yay for paychecks from work in July. I made money from stage managing last month and brokeGIRLrich

- brokeGIRLrich – $556.61

- Stage Managing – $9,916.25

Income This Month: $10,472.86

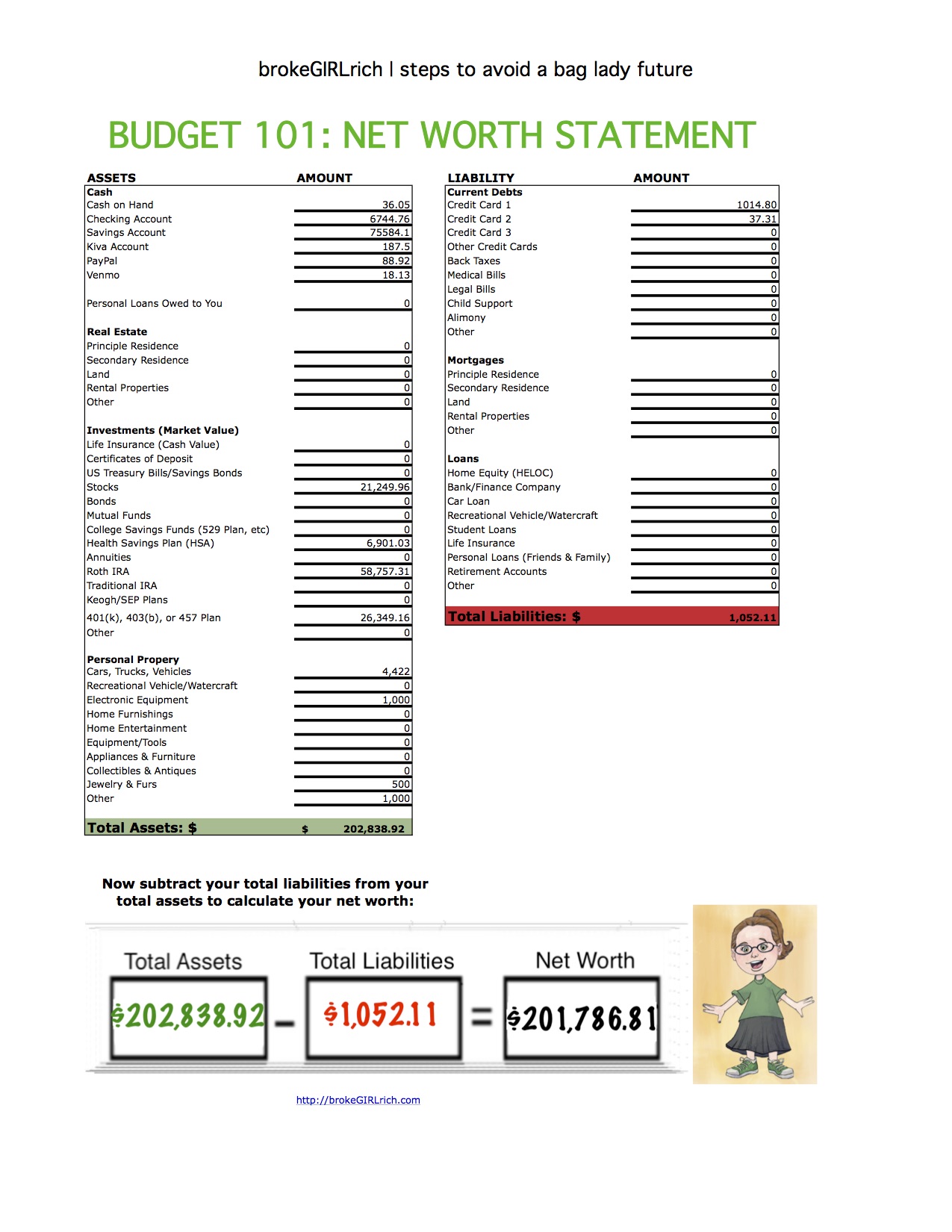

Net Worth: August 2019

Most Popular Post of the Month: Doin’It By the Decade: The Wealthy Barber Review

My Favorite Post to Write This Month: My Savings and Investing Priorities Pyramid

Goals

- Start eating better. Sometimes.

- Work out more. Nailed it! I have been to the gym an average of four times a week this month AND I started hiking semi-regularly.

- Better stress management. This is going ok.

- Keep taking accounting classes. Nailing it.

- Do two things to build up my stage management skills. I went to an APA sponsored pyrotechnics course, so one skill project done and recertified on First Aid & CPR

- Take music lessons while I’m home for a few months. I started them at the end of the month!

- Spend more time with family and friends. Success!

- Be more supportive of family and friends when I can’t be there in person. Sure?

- Go out on a date.

- Make an effort to not withhold kind words and encouragement. Always a work in progress.

- Max out my Roth IRA.

- Max out my HSA.

- Set aside $20,000 for my house down payment account.

- Set aside $5,000 for my new car account.

- Invest $3,000.

- Read more. I finished Big Little Lies and Meddling Kids. I also read Horns and Your Money or Your Life.

- Learn to make macaroons. Progress! Much improved actually, but still not perfect.

- Visit (way more than) two roadside attractions.