Profile

I am thirty five years old and I am a Visiting Instructor of Theatre Arts/Production Management at a state university, where I make $26,418.51 for the semester.

Spending & Saving

Life is still weird. Yet here we are.

My spending focused a lot on random things to stay busy – some books, some sheet music, a calligraphy kit. I also donated a lot to charity. It is fairly selfish because it actually just makes me feel better to do it.

I learned my contract Is not getting renewed where I work because there are major budget cuts to my university. I was going to teach several of my classes as an adjunct, and was actually pretty ok with that plan, but several of them were cut too and now I will probably adjunct one class.

So that’s cool. I suspect that will probably get cut too before all is said and done.

Clearly, all the progress I made on getting a mortgage has stopped. Turns out they don’t like to give money to people with looming unemployment. My hunt isn’t totally done yet. I’m seeing if I can do anything with the AFCU.

I have bought odd things. More candles. I thought I was doing better with the candles. A video projects that looks sketchy AF to maybe project onto the ceiling over my bed – if it ever arrives from China or whatever country it’s coming from.

I prioritized trying to support some alternative theater. I seem to be drawn to mindfulness-based experimental art. Some was good. Some wasn’t so good. All of it was a nice break in the weird monotony of my days.

I have spent a lot on food, though less than I usually do when I can easily stop and grab takeout. And some of that is actually kitchenware purchases from the grocery store because I was wildly unprepared to cook at home.

I took an introductory workshop course on intimacy direction, which was pretty cool.

I have been filling my time taking pretty much any free course I can find. I did the Red Cross Mental Health First Aid course, ETC Troubleshooting Techniques, and FEMA’s Animals in Distress training. I have a slowly growing list of others to take over the summer too. I foresee a very long, slow summer. I have also been working The Science of Well-Being course for the last month, which is about rewiring your brain for a happier mindset. It has been interesting.

I tried to cook catfish. I did not result in an impressive outcome.

I have spent more hours on Zoom with friends than I ever could’ve imagined. It has only been the last few days that I didn’t chat with a friend in the evening, even some old friends I haven’t had a chance to catch up with in some time. It because a little overwhelming. I’m naturally very introverted, so I think I’ve actually been more extroverted than I have ever been due to all these meetings, but I am also glad to have had a chance to catch up with so many friends. Silver lining.

My expenses this month:

- Rent – $1298

- Charity – $773.00

- Food – $467.95

- Entertainment – $181.00

- Utilities – $120.66

- Theater Tickets – $81.77

- Clothes – $76.97

- Gifts – $69.99

- Stage Managing – $68.41

- Gas – $61.50

- Candles – $50.55

- Medical – $14.99

- Miscellaneous – $9.61

Total Spending in April: $3,274.40

Hustling

My income this month was from teaching, brokeGIRLrich, stimulus stipend, tax refunds, stagehand work, health insurance refund from when I switched insurances, cancelled credit card reward balance, and a dividend check.

- Teaching – $3550.76

- Stipend – $1200.00

- brokeGIRLrich – $817.24

- Health Insurance Refund – $54.50

- Dividends – $38.85

- Stagehand – $36.59

- Tax Refunds – $25.00

- Reward Card Cashout – $21.71

Income This Month: $5,744.65

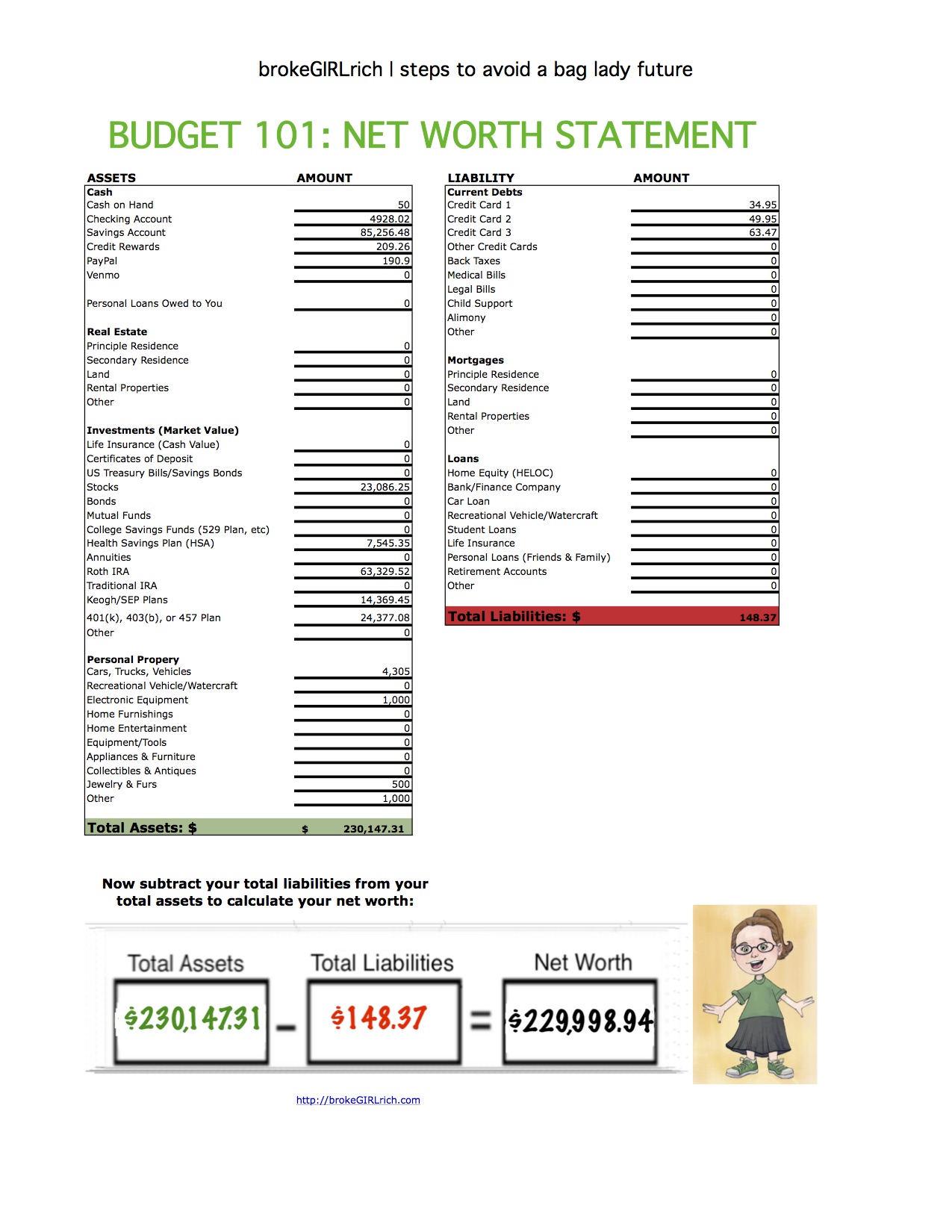

Net Worth: April 2020

Most Popular Post of the Month: Doin’It By the Decade: The Wealthy Barber Review

My Favorite Post to Write This Month: Is Global Entry Worth It? (because it reminds me of a more normal time)

Goals

- Do two things to build up my stage management skills. Killed it. Obliterated this goal this year.

- Spend more time with family and friends. I am doing excellent at this, in it’s own virtual way.

- Max out my Roth IRA. Done.

- Max out my HSA. Probably as done as it can be, since I can’t contribute to it while I’m on the university healthcare.

- Set aside $1,000 for my new car account.Done.

- Invest $2,000. Done.

- Read more – not counting textbooks I have to read. Still currently rereading The Stand, but I also finished Stage Management Theory as a Guide to Practice, How to Buy Your Perfect First Home. I am also working on The Soulful Art of Persuasion.

- Learn to make macaroons. May will be the month. Quarantine is the time. I believe in me.

Pingback: The 10 Year Challenge - brokeGIRLrich