Profile

I am thirty two years old and I started out this month as the Production Stage Manager of Tenderly: The Rosemary Clooney Musical.

I am now the Assistant Stage Manager/Props Master for Susannah with Opera Roanoke, a regional opera company in Roanoke, Virginia. At the end of this show, I’ll receive a $1,000 stipend for Assistant Stage Managing and a $500 stipend for doing props. I’ll also receive a small reimbursement for props expenses and a travel stipend for driving from New Jersey to Roanoke.

Saving & Spending

This month has been a little stressful mostly because I was stupid and forgot that stipend work doesn’t pay until the end of the contract. That means I got my last paycheck the first week of April (for the last week of work on my last show) and haven’t been paid for stage managing since.

My biggest expense this month was food, since I was out of town every day except one.

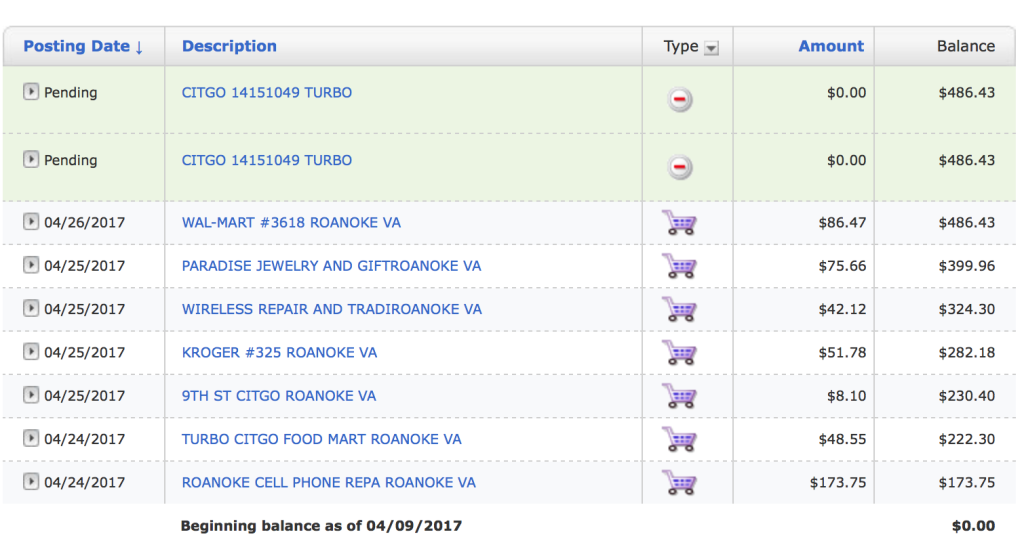

My biggest aggravation was losing my wallet at Walmart (or having it pick pocketed, which I kind of think is what happened) and having to sort out what to do when all your money, credit cards and ID disappear while you’re out of state. It’s awesome. I realized I forgot one of the credit cards that was apparently in my wallet (I don’t usually carry it with me), so I didn’t cancel it and the thief racked up nearly $500 in charges on it. I was also excited to learn that CapitalOne Venture sends replacement cards to you for free in 3-4 days. Every other card had a $15 charge to receive it in less than a week, so I’m running with just one card now and will pick up the others at home when I get to NJ.

I am mostly stressed out about the fact that they have my driver’s license and social security card. So that’s kind of a nightmare. I signed up for Lifelock for the next few months to hopefully make sure they don’t do any horrible damage to my credit or successfully open any accounts.

I am also a little stressed about driving home to NJ next week without a driver’s license, but NJ doesn’t allow you to remotely obtain a driver’s license (turns out some states do). So it is what it is. I’ll try to drive slowly… or May’s update will have a crazy rant about how my most expensive item is a speeding ticket with no driver’s license. Ugh.

It was weird and sort of scary being stuck so far from home without any access to money for 4 days. Fortunately I had some groceries and half a tank of gas to get to and from work, but just the stress of not having money was intense. I have no idea how some people function under that strain all the time.

My next highest expense was medical related because something happened to my shoulder. I came home from a work event and it felt like someone was trying to shove a broom handle through my left shoulder. It hurt a lot and my chest sort of ached too, so I went to sleep and decided whatever was happening would either kill me in my sleep, resolve itself or if it still hurt that much, I’d go get it checked. When I woke up, my chest hurt worse, so after Googling (turns out those aren’t good symptoms), I decided maybe the emergency room was actually the smartest place to go.

The doctor told me it was probably a muscle strain, and gave me muscle relaxers, which have done nothing, but he said my heart sounded fine, so the peace of mind I guess was worth the $135 co-pay. Unfortunately, since my healthcare sharing ministry deal is that I pay up to $3,500 for everything each year, I’m sure a second bill with the rest of that balance will turn up soon, since I’m nowhere near that limit. I also don’t actually feel any better, so I think medical might be a higher amount than normal next month too, since this seems like something I should look into actually getting fixed.

For the record, I think our healthcare system is a mess. I never notice it more than when I’m putting off any preventative care because it is so freaking expensive. My like my $400 strep throat last spring. It’s cheaper just to die. < / rant >

Anyway, before all the health weirdness, I drove over to Natural Bridge on a day off, which I haven’t been to in a decade, and hiked around there a little bit. It was a nice way to spend the day off.

Natural Bridge. Apparently George Washington scaled part of that thing as a teenager and carved in his initials.

On a happier note, I have two weeks of nothing coming up at home other than a quick weekend trip to Rhode Island to see one of Ringling Brother’s red units last shows.

I also tapped into my cousin’s bridesmaid savings this month to pay for the flight to Las Vegas for her bachelorette party. I’m also flying in a day early to spend some time with my best friend who lives out there.

Finally, I cancelled my gym membership last month. I realized that paying less to go to a gym without a pool doesn’t really make sense for me, because I won’t go.

digit also sent out that notice that it’s starting to charge, which broke my heart a little (maybe that’s why it hurts :P). I’ve switched over to dobot, which is free and almost exactly the same as digit. It seems to be pilfering slightly higher amounts than digit used to, but I still don’t really notice and I like it so far. If you’re interested in checking out dobot, here’s a referral link that’ll give you $5.00 to get started.

- Food – $513.77

- Healthcare – $329.99

- Stage Management – $55.82

- Car Expenses – $159.76

- Entertainment – $8.00

- Blog – $89.45

- Cousin’s Wedding – $256.50

- Gas – $51.43

- Gifts – $10.70

- Lifelock – $9.99

- Miscellaneous – $18.40

Total Spending in April: $1,503.81

Hustling

My income this month was mostly from stage managing and brokeGIRLrich. I also made a little bit from selling two old, broken iPhones to a cell phone recycling place.

- Stage Managing – $914.29

- brokeGIRLrich – $1,499.80

- Stagehand Work – $128.95

- BuyBackWorld (Cell Phones) – $31.25

Income This Month: $2,574.29

Most Popular Post of the Month: 114 Side Hustles: Ways to Make More Money

My Favorite Post to Write This Month: What Are Some Other Ways to Save Besides digit?

Elsewhere On the Web: Facebook is Tracking Your Every Click So You’ll Spend More – Here’s How to Stop It at Money Under 30

Saving Money with a Paleo Diet: How to “Whole 30” for $10 a Day at Money Under 30

Book Now, Pay Later: Explanations of When Each Hotel Charges at First Quarter Finance

Entirely Unrelated to Personal Finance

I’ve been binge watching ER from the beginning and have made it through Season 3. My parents were pretty strict and I had a 10 PM bedtime until I was like 16 or 17; however, I somehow convinced them to let me stay up until 11 PM on Thursday nights to watch ER from around 13 on. I had a crazy crush on Noah Wylie. I am now horrified by how young he is on it. It’s still a great show though.

Goals

- Max out my IRA. – $3,169 to go.

- Buy $1,000 in stock.

- Contribute $2,000 to my New Car Fund – $1,332 to go. Currently on track.

- Contribute $5,000 to my Down Payment Fund – $3,332 to go. Currently on track.

- Contribute $1,000 to my cousin’s wedding fund. – Her account is sitting at $860.31 and that might be as good as it gets.

- Develop 2 new resume skills – One to go.

- Do something really fun with my brother.

- Write a journal or magazine article.

- Hike something.

- Master making macaroons.

Broke Girl Rich is really getting richer for you; great work.

RAnn recently posted…First Quarter Investment Results

Thanks. I guess and slow and steady does eventually start to pay off a little with blogging.

Wow, it sounds like a stressful month between your wallet and your shoulder! Our healthcare system is definitely a mess. It’s ridiculous that among everything else with healthcare in this country, you have no idea how much it’s going to cost until after you receive care. Could you imagine buying anything else and the salesman says that they’ll tell you the price after you agree to buy it? Anyway, I hope your information stays safe and that you get your shoulder figured out. Glad to see that your goals are on track…keep up the good work.

Gary @ Super Saving Tips recently posted…Huge Financial Fears and How to Cope, Part 2

Thanks, Gary! And I couldn’t agree more. It feels like financial roulette every time I walk into a doctors office or hospital.

Yikes, good luck on the ID front. It would scare me too,

Do you have some kind of police report for the lost wallet because of the credit card fraud? If so, keep a copy in the glove box of your car in case you get pulled. It shows a reasonable excuse for not having the license.

Also, when you get your replacement social security card, do you need to carry it in your wallet? I generally leave mine locked up at home, but then I don’t travel to jobs in different cities where I might need to fill out I-9s pretty often, either.

Emily @ JohnJaneDoe recently posted…401(k) Mistakes That Wreck A Comfortable Retirement

That’s a good idea about the police report! Thanks!!

I always carried it in my wallet because I’m on the move so much and am constantly filling out tax papers. However, this has made me rethink the whole thing and I’m thinking it might just be safer to keep a scanned copy on Dropbox. I want to look a little more into Dropbox’s security measures first though.

Oh my goodness, I would love to know how you made that much from your blog. I’m really just starting to look at some strategies to make more from my website, and I am perplexed. Is it advertising? Affiliate marketing? Sponsored posts? All of the above? It’s overwhelming. I mean, I suspect it’s also very gratifying, but getting started feels…big.

Amanda recently posted…How I Made Mighty Progress on My Dream in 2.5 Years

Honestly, the big bump came from one client, who pays a large extra sum to do Facebook boosts on their sponsored posts. I have to put some of that towards the Facebook boost (so I had higher brokeGIRLrich expenditures too this month), but it was worth it. If you want to shoot me an email at brokegirlrich(at)gmail(dot)com, I can fill you in on some of the more specific details.

Your blog income is going really well! Congrats!

Sorry to hear about your wallet situation. I’d be freaked out by all of that info being out there, too. Hopefully it’s someone who just took the money and tossed the rest.

Jamie @ Medium Sized Family recently posted…5 Ways We’ve Saved Money This Week 74

I’m kind of hoping that too -esepcially since they finally got declined at a Citgo, so I’m guessing they just tried the local zip code and it didn’t work. If they were smart and still in possession of it, my driver’s license would’ve given them the right zip code to use.

Ugh, what a stressful month. I hope your shoulder situation is resolved quickly. It’s bad enough that you are in pain but now have to deal with the mess of healthcare.

I can’t imagine how stressful having your wallet stolen away from home is. I am always worried about that when I am flying. Emily gave great advice about the police report-I am going to file that away in case I ever need it.

Here’s to a calmer May!

Jax recently posted…Weekly Accountability: The Happiness (and Money) Edition

Thanks!

Sorry to hear about your wallet being taken and the charges on your card. How frustrating to deal with that. What a challenging month too, then, with health issues. We have a pretty lousy health care policy. $134 to see a doctor – for all of 10 minutes at the most. It has to be pretty serious for us to waste that kind of money. Hope your shoulder starts feeling better soon.

Ann recently posted…Saving Money and Being Frugal – Week in Review – April 22-28, 2017

Yikes. definitely a stressful month. Glad the chest pain was nothing serious. Gary @ Super Saving Tips really did describe our healthcare system right on. It’s unfortunate and definitely one of the reasons its scary about the possibility of getting sick. I really hope May is a flip of April.

The One In Debt recently posted…A Predicament to my Budget