I’ve got lifestyle inflation on the brain.

A few weeks ago, I was working on a post that had me digging through my old net worth updates to track the financial growth of this blog. Out of the corner of my eye, I half noticed that the amount I spend each month appeared to be creeping up over time.

So I decided to go back again and make a spreadsheet.

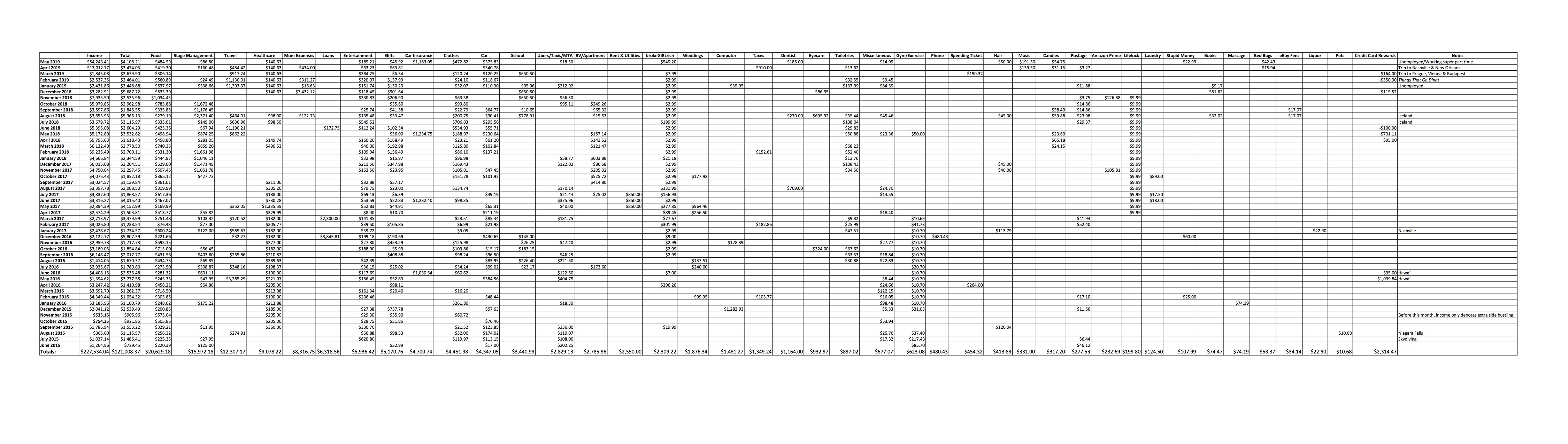

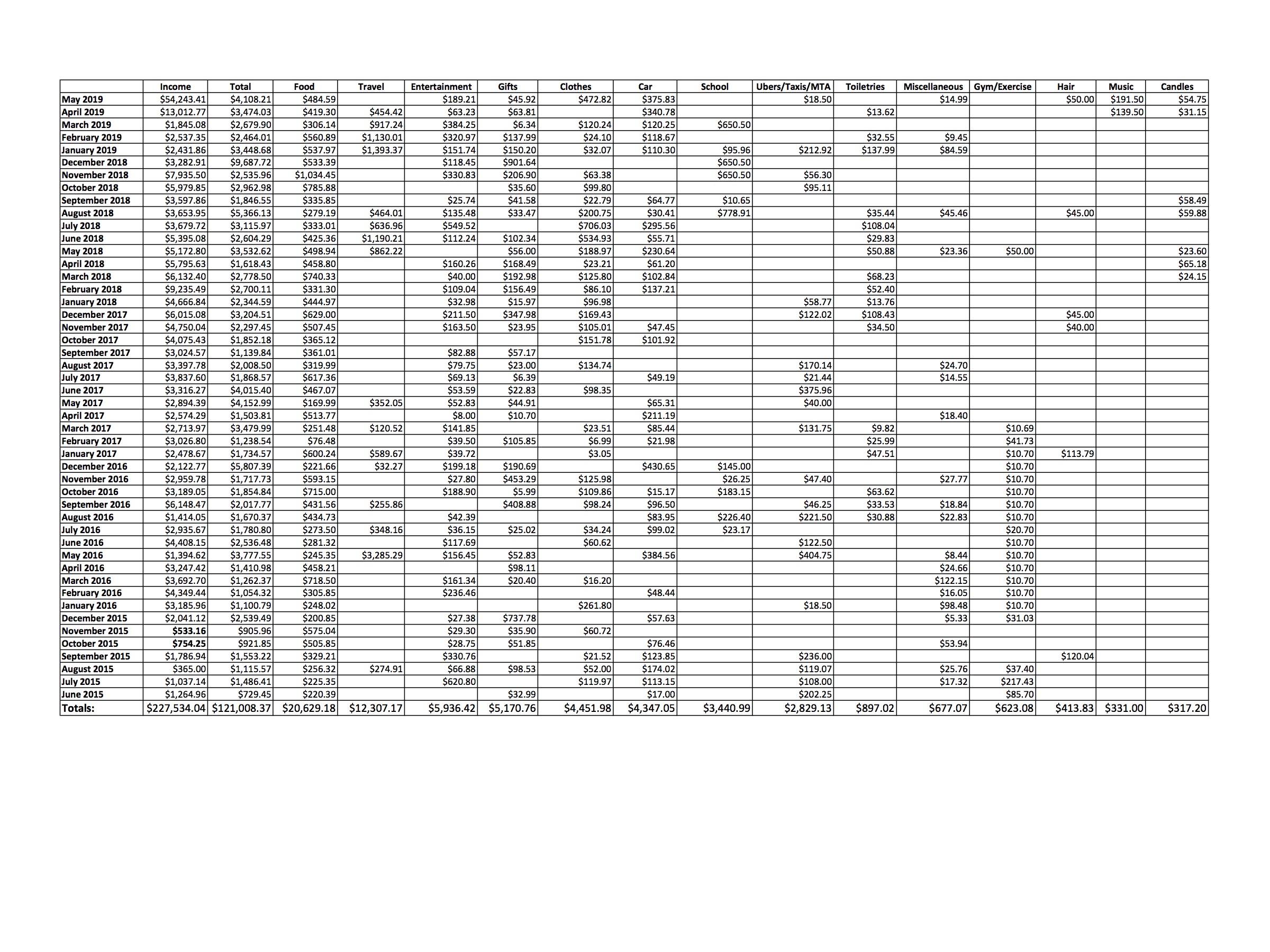

Spending Breakdown: June 2015-May 2019

Yeah, I don’t blame you if you don’t want to sort through that chart, but it’s a list of how much I’ve spent every month since I started tracking my spending in my monthly updates. I haven’t been doing that as long as net worth updates, but my first breakdown was in June 2015, so I did have nearly 4 years of tracking on that front.

I learned some cool things with this little project.

In 4 years, $227,534.04 have gone through my grubby little fingers. That’s the post tax, post any work deduction amounts that have wound up in my bank account from work, side hustling and windfalls.

And I’ve spent $121,008.37 of that.

That also doesn’t include any 401(k) contributions from work, since those come out of my paychecks before they hit my bank account. They also don’t include healthcare deductions while I was at Big Apple Circus.

My highest spending category by far has been food, which came in at a whopping $20,629.18 and has most definitely been subject to some lifestyle inflation.

Food clocked in at $220.39 in June 2015 and held fairly steady, with the occasional outlier month, for a little over a year, before it started doubling in January 2017 and from then through now, again with the occasional outlier month, it comes in just over or under $500.

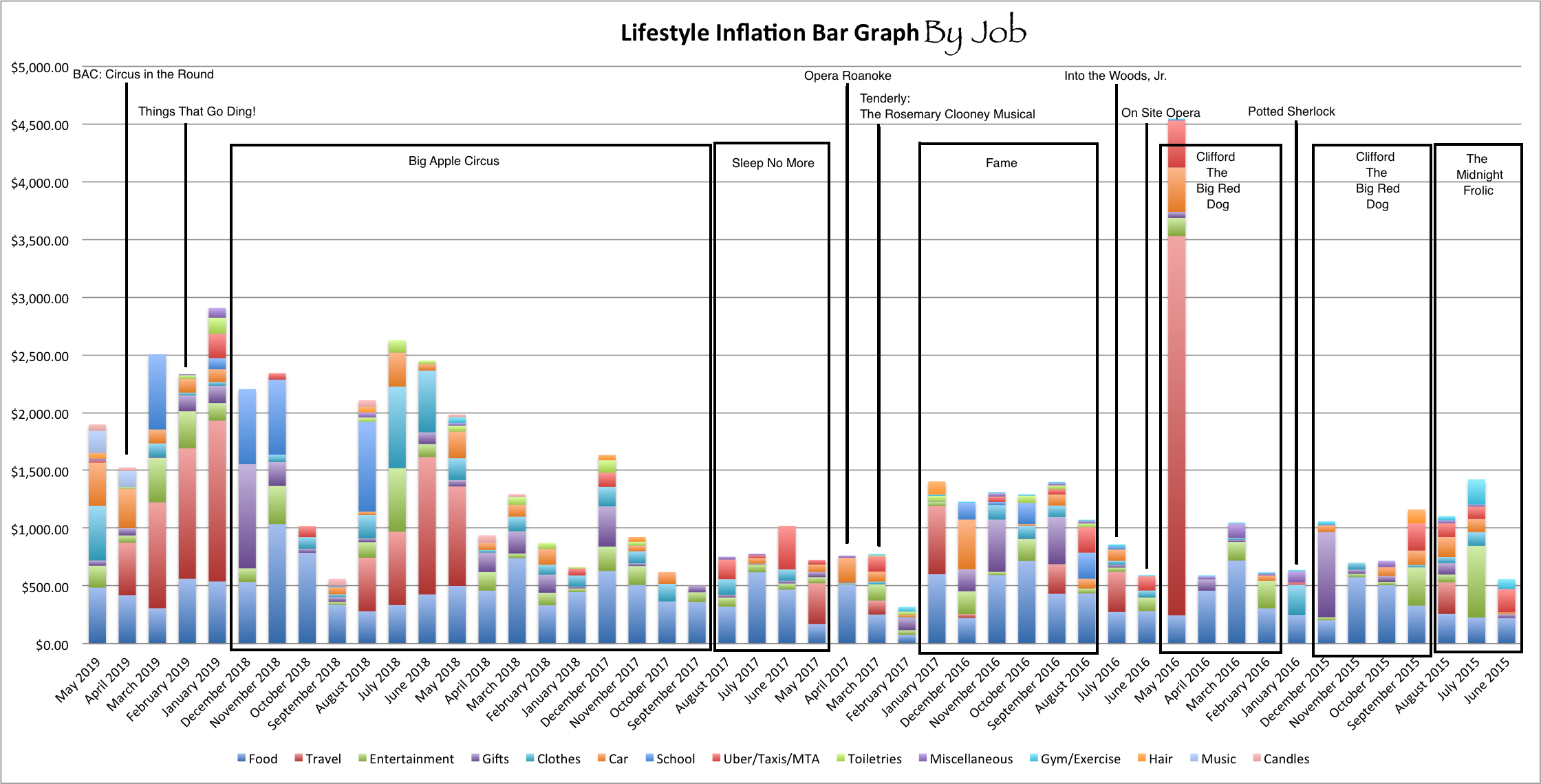

A breakdown of how my spending broke down during different jobs.

My second highest budget line was Stage Management Stuff, which came in at a fairly insane $15,972.18. The trick to this line though is that when I worked at Big Apple Circus, we had crazy credit problems in the beginning and so I would often buy what we needed and get reimbursed a month or two (or at one point four months) later.

Big Apple Circus specific expenses were $13,110.86, which then brings actual out of pocket Stage Management Stuff to a way more reasonable $2,861.32. Still a little expensive, but considering that covers 4 years of my “always try to build at least two skills” goals, I feel it was money well spent.

This could also raise the question of how can you ever be expected to succeed in a career path like this if you aren’t financially stable enough to front your company thousands of dollars sometimes? And why is that ever ok? But that’s a post for another day.

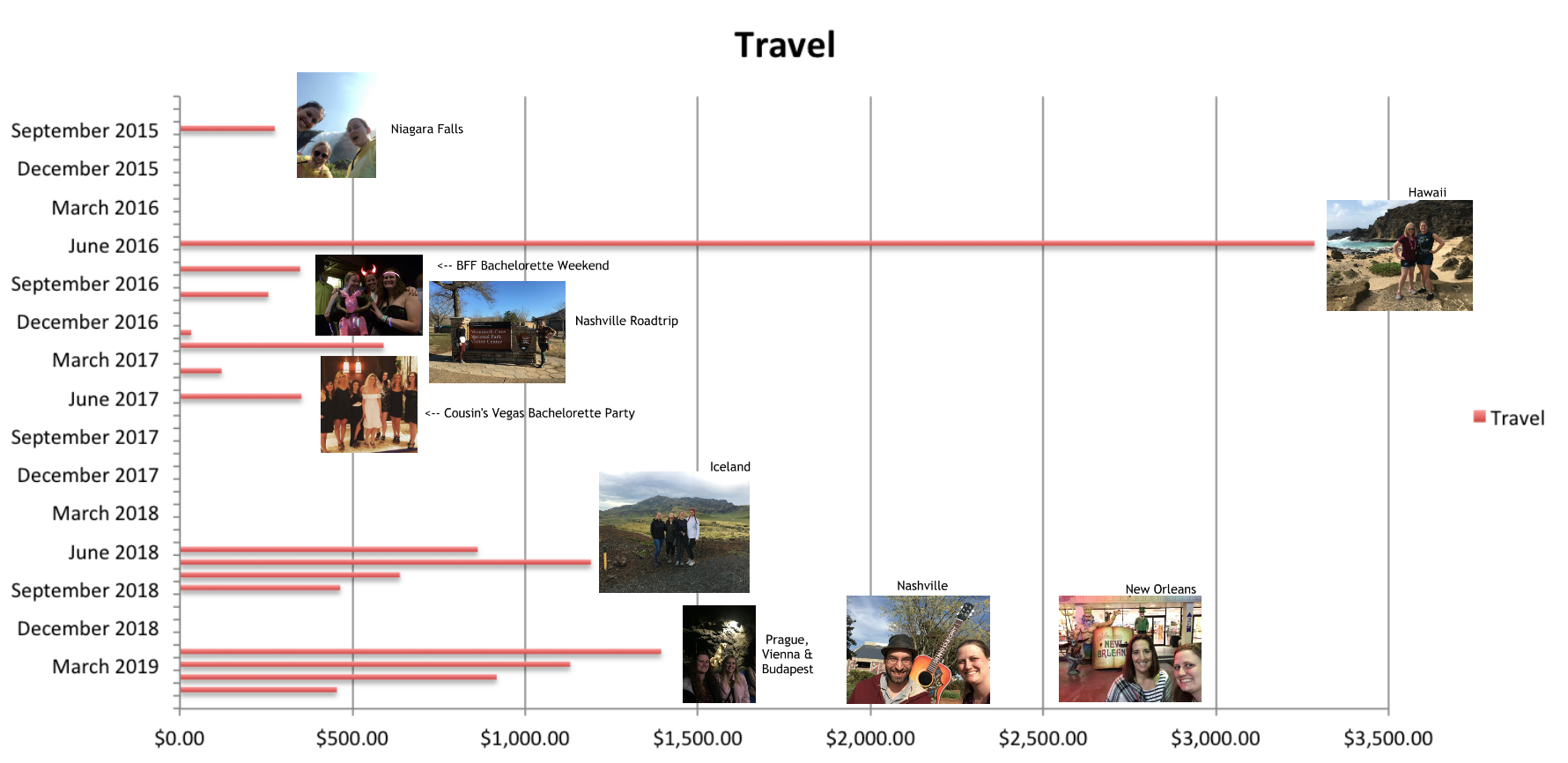

Holy cow, Hawaii is expensive, though notably, so is Iceland, I just spread out costs across 4 different months.

Another number that surprised me was $12,307.17 spent on travel over the last 4 years – though it shouldn’t have. It’s always been a major priority for me.

I don’t think lifestyle inflation is necessarily evident in my spending there. Even in the lower income, earlier years, I was still dropping thousands of dollars to travel once in a while.

I will see I notice more weekend and budget, friendly roadtrip adventures in the earlier years than the later ones.

Additionally, balancing out some of that expense, over 4 years I racked up $2,314.47 in credit card rewards with minimal effort and my biggest churns were in my brokest years. To be honest though, I’m fairly sure advance notice had a lot to do with that too. I noticed trips that were planned with several months notice had a lot more churning around them than last minute travels.

Unsurprisingly, cause… ‘merica, my next biggest expense, as a healthy 31-34 year old, has been healthcare, clocking in at $9,078.22, which includes 4 months of not having any coverage (and nothing happening), and surprisingly high costs a few times for some routine screenings over the years when I did have coverage. Sigh.

Perhaps the only evidence of lifestyle inflation there is that I actually got health insurance.

A few line items over the 4 year budget don’t necessarily apply to the lifestyle inflation expedition such as Mom Expenses (related to her burial and estate, all of which I was paid back for), loans to others, car insurance, rent and utilities, weddings, computer, taxes, dentist, eyecare, speeding tickets, stupid money, etc.

A more accurate look of stuff that actually “inflates.”

I think a few spots where I notice lifestyle inflation the most are just a smidge in entertainment and gifts – though, not gonna lie, I’m pretty proud of that fact that I seem to spend almost as much on gifts and charity for others as on entertaining myself. They clocked in at just under an $800 difference over the 4 years.

Until I made this chart, I didn’t realize how bad I was doing at spending money on clothes, like… I couldn’t even tell you what most of those expenditures even are. In 4 years I’ve spent $4,451.98 on clothes.

On the plus side(?), that hasn’t inflated over time, I’ve just always spent too much in that category.

I would actually say the lifestyle inflation creep is in the addition of some new categories but they bring me some real joy.

School has ballooned because I’ve been using some of that extra income to work on an accounting degree.

Music is a new category that’s a little pricey for trumpet lessons (and accordion buying).

The only borderline shameful lifestyle inflation is the Candle budget line, because, yes, it turns out I’ve spent $317.20 on candles in the last four years, but March 2018 was the first time Candles had their own line in a budget.

I’m also a little proud that over 4 years, my Miscellaneous category is only $677.07 – I’d definitely like to get it lower, but that’s only $677.07 that I can’t account for exactly how I spent it.

It’s actually been astonishing to me that my lifestyle didn’t really inflate, I just started paying for things that shouldn’t really have to be considered “luxuries” like health insurance, going to the doctor and dentist, etc.

I really rolled the dice on those categories for years and was incredibly lucky nothing terrible happened, although I am 99% sure I broke one of my wrists once when I didn’t have health insurance and I just let it be and that sucker hurts like a mother when the weather is funky.

But, what can I do about it now? Nothing. So we’ll just add that to the file of stories I never told my mom because she would have killed me and move on.

I read somewhere about a rule of thumb where when you get a raise, only let your lifestyle increase by 10% of the raise and bank the rest, so I’m pretty excited that looking over my spending, even though it’s a far cry from perfect (and for pete’s sake, I need to stop buying clothes), I seem to have managed that pretty well.