A Financial Order of Operations | brokeGIRLrich

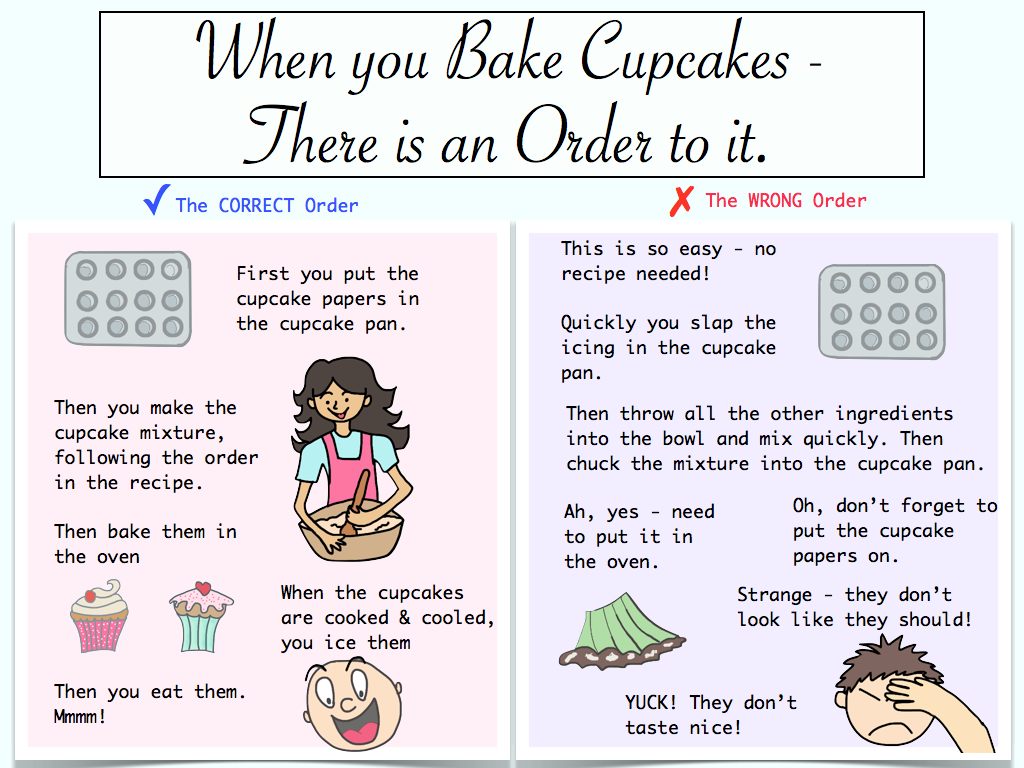

When I hear Order of Operations, I feel like I’m sitting in Mrs. Shipley’s seventh grade math class. She taught us to Please Excuse My Dear Aunt Sally – parenthesis, exponents, multiplication, division, addition, subtraction.

That’s the order you attack a complicated math problem.

Now, I’m terrible at math, but more than 20 years later, I can still remember the order of operations and that the order you do stuff in can have a huge effect on the outcome.

I can’t say I’ve worked on any algebra problems lately, but when I look at how I work on my financial goals now, I’ve got my own order of operations.

I also really like mnemonics. Please excuse my dear Aunt Sally definitely helped on those order of operations tests. I can’t tell you the order of the plants without thinking My Very Educated Mother Just Served Us Pizza (well… maybe Pizza. Some years it’s Pizza).

However, I’m fairly terrible at making them. In college, I took music theory and memorized the circle of fifths with the insane mnemonic Cows Go Down And Elephants Brown Fear Crowns.

Is that the worst mnemonic ever? Maybe. But more than 10 years later I still remember it.

I offer you what might now be the worst mnemonic ever:

Do Everything Or Risk Short Infant Military Lice

- Debt

- Emergency Savings

- One Month

- Retirement

- Short Term Savings

- Investments

- Mid Term Savings

- Long Term Savings

Debt

The first order of operation is to get out of debt. For me, all debt is like a prison sentence. It’s being owned by someone or something else. When you have debt, you have to make sure the life you’re living makes you enough money to pay that debt each month. When you’re debt free, you have a lot more freedom.

But sometimes debt can feel like it’s too much and there is no sign of relief in sight. In these instances, a chapter 13 bankruptcy lawyer might help put things back on the right path financially. They can assist you in creating a repayment plan tailored to your current financial circumstances and get you out of debt within several years. Also, they offer legal advice and guidance regarding improving your credit scores and financial habits for future success. Once out of debt, make sure to take steps that ensure you stay debt-free in the long term.

You could choose to live somewhere really cheap and make almost nothing and be ok. You could move into the woods like a hermit with an internet connection and blog your days away. You could take a crazy career risk and wind up making tons of money, living in a crazy expensive city just fine.

Emergency Savings or One Month

Just like multiply or divide and add or subtract, you can attack these two steps in either order – generally doing whichever is cheaper first.

One Month is getting one month ahead on all your bills. If you’re renting and you can get ahead so that you’re paying your rent on the first possible day instead of the last, it’s a win. If you’ve got a mortgage, get a payment ahead.

Open a special account just for your bills and get your electric, Internet, cable, phone, any monthly bill saved up in advance. Of course, this isn’t a perfect system, some monthly bills fluctuate, but you should have a good estimate of what you need to save up. When in doubt, oversave.

If you live somewhere expensive, it might be easier to get started on your Emergency Savings first. I think it’s best to start with some goals in mind. Emergency savings are different for everyone, but these were my goals:

- $100 – stress

- $500 – stress

- $1,000 – a little relief

- $5,000 – a lot of relief

- $10,000 – we’re going to call this totally done

As you can see, the first few goals on emergency saving, I still had a lot of stress, especially because at the $100-$1,000 level, a lot of things can go wrong and wipe out most of my progress (and did) – doctor copays, car tires, dental visits, a last minute airfare for an emergency. And unless you’re going to have probate coming through for you soon, your emergency savings need to just about cover these things, with the goal of one day comfortably covering them.

Now, having that money was way better than not having it and going into debt, but it definitely sucks at the beginning when emergencies crop up and you’re just able to weather it (somehow the universe always knows when you just hit that emergency savings goal).

Around $1,000, emergencies would pop up and be an inconvenience and I’d have to hustle a little to get my balance back up to $1,000. From $5,000 on, I’ve felt set for just about anything. I was able to weather three months of unemployment and another month of underemployment this year.

You have to decide what numbers would work for you in your emergency fund. Most conventional wisdom seems to say that your final goal amount should be six months in expenses. I think six months in expenses plus any insurance deductibles is a better goal.

I also hit this goal hard until I got to $1,000 and then scaled it back and started working on the next order of operations.

Retirement

Here’s the obnoxious thing about retirement savings when your finances are a mess – compound interest is magic and you can never get the time back.

That’s not to say just give up if you’re starting late. It’s just to add some extra pressure to all the broke 20-somethings out there. Seriously, even if you can only put away $50 a month, the compound interest on that is going to help you out a lot.

If you can possibly contribute to a 401(k) at work, you really should be. That’s just free money from your company if you can contribute up to the match.

Because of the compound interest, retirement savings is where I send the first of my extra money. Some of this comes directly out of my paycheck now and into my 401(k). The rest is up to me to transfer to my Roth IRA.

Since I was 25, I’ve prioritized maxing out my IRA each year. It hasn’t always been easy, but it has been getting a little easier as I’ve gotten older and the compound interest is currently around $15,000 in magic money I did nothing to earn.

Short Term Savings

Short term savings are annual expenses that I save up for each year. I pay my car insurance in a lump sum. I have a good guess at how much contacts are going to cost for the year. I have several really good friends and for some reason, they’ve all decided they need to get married.

Bridesmaid savings accounts work, ya’ll. Most of the time. Unless your cousin drags you to Vegas for the bachelorette party – that’s kind of a budget killer. But a lot of fun.

These are the things that get priority savings because I know I will need to pay for them soon.

Investments

The stock market has done pretty well historically. Each year I set a goal amount that I would like to invest and after everything else is set on this list, I try to hit it. When my income was in the $30,000 range, I’d try to invest $1,000-$2,000 a year. Now that it’s more than doubled, I’m aiming for $5,000.

Mutual and index funds seem to be a fairly safe bet. However, I also invest in a few individual stocks – partly because of this blog and my own crazy experiments to see if carefully picked individual stocks can beat out mutual funds.

I also started doing that after I had a little extra money to do it and because it interests me – so if picking individual stocks seems overwhelming to you, don’t. Mutual and index funds are a great and easy choice. My portfolio is heavy on DIA (SPDR Dow Jones Industrial Average) and ITOT (S&P 1500 Index Fund).

Though the big winner in my portfolio is an individual stock – HI (Hillenbrand Inc Com).

Midterm Savings

I have two big midterm savings goals right now – a down payment on a house and a new car. I want to be able to put about $20,000 down on a house, if I ever decide I want one. I also want to be able to buy a brand new car around that price range when my current one dies.

The down payment goal I don’t see myself using for the next 5 years or so.

The car goal depends a little on how much longer Mona the Matrix lasts. She just crossed the 10 year threshold and it still holding up pretty well. I’d love it if she made it another 10 years, which isn’t impossible from what I’ve heard about Toyotas, but I’m hoping for at least 5 more there.

Long Term Savings

I don’t actually have any of these goals, but if I did ever have kids, I assume college would fall in this category. Can you guys think of any other long term savings goals?

So while Do Everything Or Risk Short Infant Military Lice might not be exactly poetic, it’s the line I live my financial life by and it’s been working pretty well for me.

Mnemonics are so useful. From my own childhood, I remember Every Good Boy Does Fine for the musical notes. Do Everything Or Risk Short Infant Military Lice might not roll off the tongue, but the concept is very clever. There’s definitely an order to doing certain things, and taking care of your finances is one of them. Great post!

Gary @ Super Saving Tips recently posted…Free Money Update – How I “Earned” $5,000 in 36 months!

Love this! I can’t believe I’ve never seen anyone else reference order of operations. Super smart!

Femmefrugality recently posted…Defining Success: Thoughts On God and Finances

great job on the savings, especially with your low/irratic income

RAnn recently posted…What Are Options and Should I Invest In Them?

This is AMAZING and I need to print this out and put it somewhere. SO helpful – it feels like I have to do ALL THE MONEY THINGS but that just makes me paralyzed!! This is a great recipe for success! What do you recommend for investing though? What happens if you don’t have a lot to invest upfront?

Before I left my FT job to FT freelance, my work handled investing (I just told them how much I wanted deducted from my paycheck). I can’t contribute there now that I’ve left working for them so… I haven’t contributed anywhere. I KNOW, that’s bad. But where do you recommend? I don’t have a ton saved up for investing and am discouraged by “you must have $1k to invest with us right now” places.

I invest with Sharebuilder, which I think still is currently owned by CapitalOne, but in the process of being bought out by E*Trade.

It costs about $7 per stock purchase, so I usually do buy in $1,000 increments, but there is no minimum to get started and no reason you can’t buy smaller amounts.

They have index funds, ETFs and individual stocks, and I’ve been investing there for like 8 years with no issues, so I’ve been pretty happy with it.