I haven’t actually forgotten about this blog, the reason I haven’t posted actually goes back to the premise under which I started this blog. It’s that I have no idea what I’m doing and would love, love, love to not spend my retirement under a bridge, in a cardboard box, eating hobo beans. I tried to figure out the next step from learning how to read a stock page to actually doing something and realized, I’m not really there yet. And maybe you’re not either. So let’s go back to the basics.

I think Step #1 to understanding your money and what your goals are is start with a realistic, accurate assessment of where you are in life (ok, so Kiplinger’s thinks this too… an article called What’s Your Retirement Number? in their June 2013 issue kept talking about benchmarks and planning and how people who do this generally have their sh*t more together than others – yes, those exact words from Kiplinger’s). Several excellent books I’ve read about finance also suggest creating a Personal Financial Statement (dun, dun, dun) and I actually did create one a year ago.

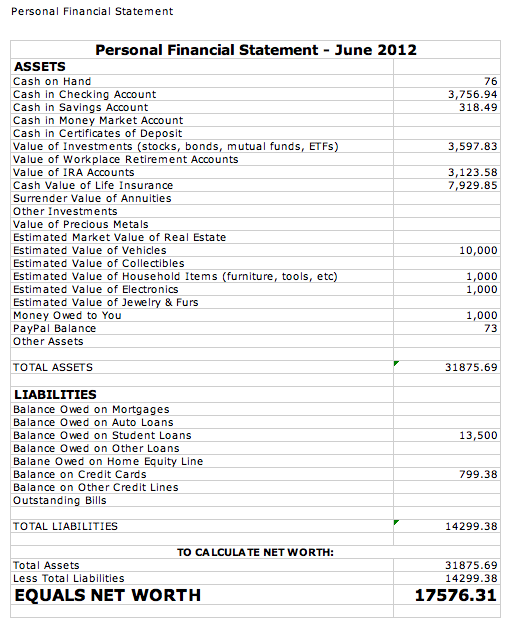

So here, in the land of way too much personal information of the personalist kind (my flipping salary and savings), I present you with my June 2012 Personal Financial Statement (things have actually changed for me a little since then, but to give you an idea of what goes on there…):

This was not too painful to fill out, actually. As of June 2012, I’d just finished one year back at work after grad school and was starting to look for a new job. I actually found out what a Personal Financial Statement was because I was trying to read up on how to save enough money to try to live in New York City for a year. So, if you’re a little flakey like me, find that immediate goal that will make you sit your butt down and pour over all these numbers. I also liked, in the particular finance book I was reading at the time, that this was a concrete goal that I understood. I could make this chart. It didn’t seem too big, foggy and weird as that vague term that is investing. And let me tell you, I was shocked at what my Net Worth was. Pleasantly. This may not turn out the same for you.

So if you’d like to calculate your Personal Financial Statement (PFS), here is the information you need to gather.

#1 – Cash on hand. Empty out your wallet. Scrounge in the couch cushions. Take that change jar to the Coinstar. This one is easy to understand. This is the actual moolah in your possession.

#2 – Cash in checking account. Hopefully, you’re set up with online banking, which makes this an easy column to fill out. If not, check out your checkbook. Oh, you don’t actually balance it? Perhaps now is the time to start doing that. (Coincidentally, I don’t actually keep that much cash in my checking account like ever [cause it’s not making much money for me there] – but I used to work for a cruise line and you’d get paid once a month. I’m assuming I made this thing right after payday.)

#3 – Cash in savings account. If you have one. You should have one. We will talk about an Emergency Savings Account next time. Ideally, you can also look up this number online. As you can see in the picture above, in June 2012, my savings account was a sad little thing. But at least it was still a thing.

#4 – Cash in a money market account. I do not have one of these. It is my vague, and hopefully soon to be improved, understanding that this is similar but different to a savings account. I believe it also makes some interest on the money you deposit in it and you still have pretty good access to that money. So I take back my earlier savings account judgement if you don’t have one of those but you do have one of these.

#5 – Cash in certificates of deposit. I cashed in every CD I had when I was 19 to buy my first car. I’m still feel that was a totally ok use of that cash. But if you’ve been hoofing it forever or you have these stashed away wherever, this is the spot to add them in.

#6 – Value of investments (stocks, bonds, mutual funds, ETFs). As you can see, I have several thousand dollars listed there. If you are like me and you are lucky enough to come from a home that has solidly middle class parents or affluent grandparents and you have any vague memories, you may want to just check in with the parents and see if you have some of these you don’t know about. I was 27 when I made this list. I was aware that as a kid, my grandparents liked to buy me and my brother stock in Exxon for our birthdays (my grandfather worked there for like 40 years). I remembered this because I always thought it was such a crappy birthday gift when I just wanted a Barbie. Sorry Nanny and Poppop, I was an idiot. Thank you, thank you, thank you. I asked my mom if she had any idea about this financial stuff and I actually wound up learning a ton about a hidden little world of finances available to me. Sort of. I don’t touch them because I don’t understand them, but I learned I do have a few grand in stock, from Nanny and Poppop’s way-better-than-a-Barbie birthday gifts (and that like $2.98 from my failed ShareBuilder investment – see my first post).

#7 – Value of workplace retirement accounts. You may not have one. In June 2012, I didn’t. By June 2013, I did. I’m totally not judging. I work in entertainment, you may or may not have any idea how rare a 401(k) is in this industry. And I don’t expect to have one for long either. But while I do, you can bet your bottom dollar I’m contributing to it at least up to the point that my employer will match me.

#8 – Value of IRA accounts. The one investing thing I feel I’ve done right is open an IRA. And I’m not gonna lie, it was a little bit of a pain, since I opened the kind that made me start with a $2,500 investment. However, I’ve had it like 3 years and it’s already made like $1,500 on it’s own. I know that’s not going to get me much further than just a bigger box under an overpass, but I did literally nothing for that money and now my account is making interest on that as well (yay, compound interest). I highly recommend one. There are also plenty that you can open with less money that I did. Also, they even let idiots like me (and maybe you) just pick a retirement goal year, the level of risk your comfortable with and then it picks what you’re going to invest in. Pretty awesome.

#9 – Cash value of life insurance. During that conversation with my parents about my stocks, it also came up that, for some weird reason, they had invested in life insurance for me as a child. So, turns out, I have life insurance. Now, everything I have every read says it’s very stupid for me to have any life insurance as I have no dependents. I don’t have plans for dependents anytime soon, if ever. So a few weeks ago, I put the wheels in motion to cash that sucker in. If you have children, you should totally, absolutely, have life insurance so they’re not just totally screwed if something happens to you. However, the payout on this life insurance was like $50,000, so even if I do have kids, if I’m actually the breadwinner, this isn’t going to help them much. I feel ok about my decision to cash it in. I’m going to pay off the rest of a student loan and then reinvest the last few grand. I felt very ok about it until I went to actually do it and the life insurance agent tried to talk me out of it, but I think, in the end, it’s still the right choice. Oh, also, FYI, if you do cash it in, the government will be taking a large chunk in taxes.

#10 – Surrender value of annuities. Not a clue. I have no annuities. I only understand they are an investment of some kind. I bet if you have them though, you know what they’re worth if you had to sell (???) them today.

#11 – Other investments. Anything else you are invested in.

#12 – Value of precious metals. Hahahahahha, I wish. I do like shiny things as much as the next raccoon girl.

#13 – Estimated market value of real estate. If you own a home, unlike myself, you should be able to look online to get a ballpark figure of what your home is worth.

#14 – Estimated value of vehicles. I do actually have a car. A 2008 Toyota Matrix. In June 2012, she was still in excellent condition (probably cause I went to go live on a cruise ship for most of the year 6 months after I got her). She is a little more beat up now. I estimated her worth based on the Blue Book value, which you can look up for free online… sadly, she’s worth a few grand less these days.

#15 – Estimated value of collectibles. This is totally up to you how in depth you want to go. If you collect coins, stamps, antique agriculture equipment, Beanie Babies… whatever your vice is, spend a little time and try to assess what that collection would actually be worth if an angry bookie were threatening your life and you needed money NOW. I collect ceramic pigs, shot glasses and pens. Turns out these are worth nothing.

#16 – Estimated value of household items (furniture, tools, etc). Figure out how much you could get for the stuff you own. I’m a bit of an e-bay junkie, so I was able to pretty accurately assess my junk and figure out I’d probably bring in about $1000 if I sold off all of my stuff. When in doubt, underestimate your stuff. Although you can also just start putting things into e-bay and seeing what price most people are selling them.

#17 – Estimated value of electronics. Figure out how much your laptop is worth. Got a smart phone? It may have a $100 to $200 resell value. Gamer? You can get cash for your consoles and games. Add up these numbers and you’ve got your number for this spot.

#18 – Estimated value of jewelry and furs. Hahahaha. See notes for #12. raccoon.

#19 – Money owed to you. In June 2012, my dad owed me $1000. Right into the spreadsheet, dad. I’ve got my eyes on you, sir.

#20 – PayPal Balance. Don’t forget this bank account of yours. My e-bay addiction often leads to me having a little cash over in PayPal world.

#21 – Other assets. Anything else you have that is worth cold hard cash.

Now you add up #1-21 and that number is your total assets. Save this. Savor it. It’s a happy number. Now on to the sad number. Let’s look at your liabilities.

#1 – Balance owed on mortgages. Self-explanatory. Rejoice now if you are not a home owner.

#2 – Balance owed on auto loans. Thank mom and dad for that car again. Or look affectionately out the window at your clunker and think, at least, in this, you were the right choice, cheap car.

#3 – Balance owed on student loans. Bugger. Got me. Nearly 14,000 last year (almost down to 5,000 this year – woo – go me).

#4 – Balance owed on other loans. Also, if you want to call gambling debt by another name, possibly here’s the spot to put it.

#5 – Balance owed on home equity loan. Self- explanatory. Renters, rejoice again.

#6 – Balance owed on credit cards. This can probably be found online. This may be an enormous number. Be honest. You totally have to be honest on this thing or you’re not going to get anywhere. Besides, sane people, not like me, lock this away and no one ever sees it.

#7 – Balance on other credit lines.

#8 – Outstanding bills. Note anything here like medical bills, car repairs, insurance bills, etc.

Add numbers 1-8 and you have your total liabilities. To get your net worth:

TOTAL ASSETS – TOTAL LIABILITIES = NET WORTH

And now at least you have an accurate picture of your financial state.

Pingback: Doin’ it by the Decade: The Roaring 20′s | brokeGIRLrich

Pingback: Budget 101: Introduction | brokeGIRLrich

Pingback: Budget 101: Net Worth | brokeGIRLrich