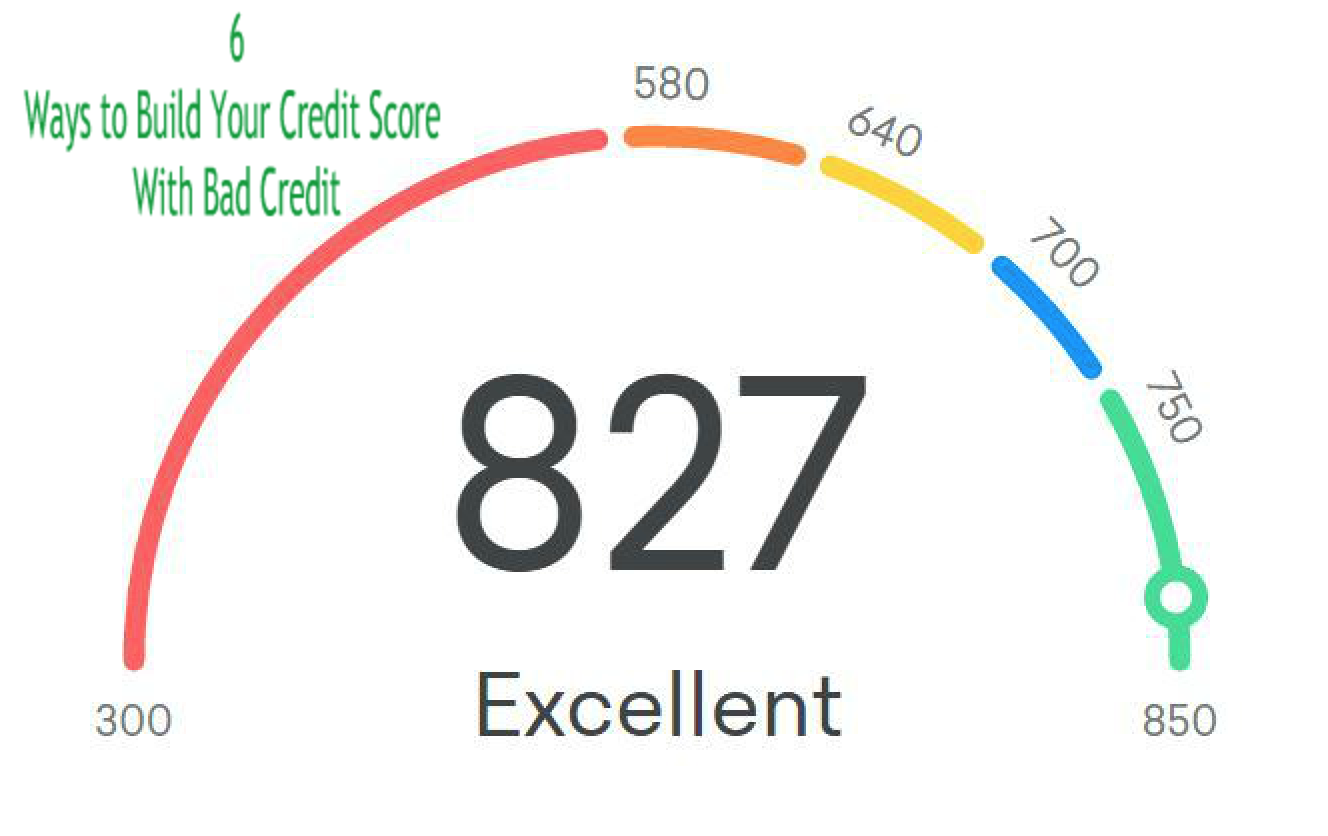

Are you stuck dealing with bad credit? You’re not alone. A 2015 study found that about one third of Americans have a score that’s lower than 601, indicating a fair or bad credit rating. While it’s nice to know that you aren’t the only one facing bad credit woes, this doesn’t solve the wide range of roadblocks that come with having bad credit.

The good news is that there are many ways to build your credit score, even if it’s below the fair threshold. Keep reading to learn six effective ways to repair your credit score so that you can be approved for more favorable borrowing.

1. Improve Your Credit Habits

Poor credit habits are likely what caused the demise of your credit score in the first place. In order to improve bad credit, you’ll need to change your credit habits so that you don’t end up back where you started.

Credit habits that you’ll want to follow include:

- Staying below your credit limit

- Paying off monthly balances in full

- Charging only what you can afford

By improving your credit habits, you greatly reduce the risk of improper charging that only leads to credit and financial issues.

2. Get New Credit Accounts

Has bad credit life you without any credit cards? Being left with bad credit has likely left you with a bad taste in your mouth, especially when it comes to credit cards or borrowing money.But, not having a credit card only makes it harder to rebuild your credit. In order to improve your bad credit, you have to borrow. Using a credit card in the right way allows you to establish a positive payment history and gives your credit score a boost.

However, having bad credit limits the credit cards that you’re likely to get approved for. Thankfully there are lenders that offer credit cards, even to consumers with fair or bad credit scores. Start by reviewing the best credit cards for bad credit.

After reviewing your credit card options, apply for one. If you don’t get approved, you’ll want to wait at least six months before applying again, otherwise your credit score will decrease for too many credit inquiries.

3. Always Pay on Time

Payment history is the most critical factor in terms of repairing your credit. In fact, payment history makes up 35% of your credit score. Falling behind on payments will have a huge impact on your credit score, especially if a lender reports your late payments to the credit bureaus. Late payments not only impact your credit score, they also stay on your credit report for seven years. A few late payments will ruin all of the progress you’ve made.

But when you have multiple payments due to different lenders on different days, it can be hard to keep track, leaving room for error. To eliminate the risk of late payments, sign up for automatic payments. Most lenders offer this service, allowing you to schedule payments that occur automatically each month. This means no remembering or misremembering!

4. Reduce Your Debt

If you do have debt that’s weighing down your credit score, it’s time to start paying it off. You can start by paying off low amounts of debt first or by paying off highest interest rate debt first. The less debt you have, the better your credit score will be.

Having less debt not only improves your financial situation, it also gives you a more favorable debt-to-income ratio. When applying for credit in the future, lenders want to see a low debt-to-income ratio as it shows that you can afford to make payments.

To reduce debt quicker, pay more than the minimum. The more money you can put towards the principal balance, the better.

5. Don’t Close Old Accounts

Closing a credit card or account that you’ve paid off seems like the last final step. But, closing credit accounts can negatively impact your credit score. If you’re worried that having open cards will tempt you to fall back into bad credit habits, shred the cards or give them to a friend or family member that you can trust.

Keeping old credit accounts open boosts your available credit while also lengthening the average age of your accounts. The more credit you have and the older your accounts, the better.

6. Check for Credit Report Errors

Everyone is entitled to a free annual credit report from the three major credit bureaus. Take the time to check your credit report and look for any errors. If you notice any errors, you’ll want to start the dispute process so that you can work to remove them from your credit report. The process can take months, but you want a spotless credit report that is 100% indicative of your credit standing.

Conclusion

Living with bad credit is frustrating and can put you in a financial bind. Using these six tips you can improve your credit score and improve your chances of getting approved for favorable borrowing in the future.

If you have any experience rebuilding your credit score, share a comment with any helpful tips or advice you may have in the section below.