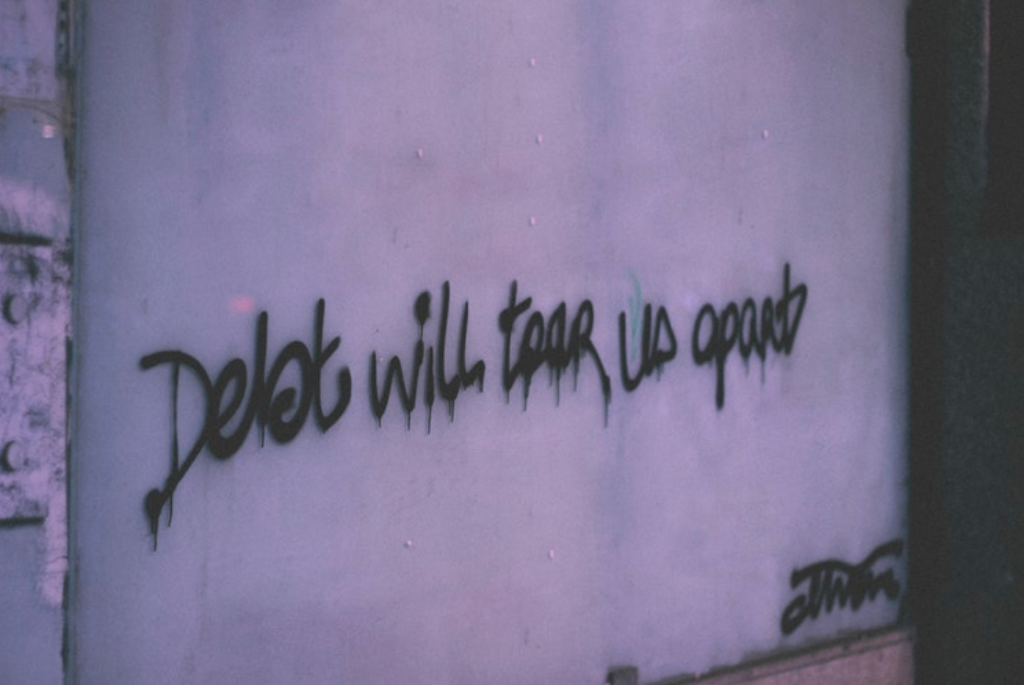

There is only one thing worse than falling into a nightmare where a swarm of spider-sharks chase you through a clown-infested alley and that’s waking up to a reality of debt, debt, and more debt. It’s suffocating. It’s painful. It’s about as bleak as any outlook or future can ever be. Yet, it has become a normal part of life for so many.

It starts with extensive student loans, it dips into consumer debts and then, to top it all of, they then struggle to find a job that pays them anywhere near enough. Still, life goes on, they meet their soulmate, they take out a loan to cover the wedding costs and then move into their first home where the biggest debt of them all – the giant mortgage – rises up and swallows them whole.

The result: young people the western world over are waking up in their early-thirties to a future of crippling debt.

So, without further ado, here are some of the best strategies to help you climb out of the mounds of debt you are faced with now or might be faced with in the future. Don’t despair. No matter how bad your situation may look, you can live a debt-free life if you try.

- Make It More Manageable

One of the hardest parts of escaping the clutches of debt is knowing where to start. You have student loans, mortgages, consumer debts, credit card debts, store credit repayments and possibly more, and that can muddy your mind in the worst way possible. That’s why we recommend you use a payday mentalhealthupdate.com loan relief company to consolidate all your debts into one big debt. Yes, the figure will be overwhelming, but it will make things a million times more manageable than having a dozen different debt plans to adhere to and dates to stick to.

- Make The Biggest Dent You Can

The worst thing about debt is compound interest, which is why you need to do yourself a favor and make the biggest dent you can and you need to do it now. That could mean selling off the clutter in your house, getting rid of your electronics and any other items of value you may have stuffed in the attic. Sell anything you can and then throw that money at your debt. Which one you go for depends on your approach. If you want to start seeing a difference immediately, then focus on the debts with the smallest balance. If you want to save money, focus on the ones with the highest interest rates. Either way, this will feel like a ginormous victory.

- Annihilate Those Cards

Nothing is going to ruin your hopes of a debt-free life more than credit cards. So, chop them up into teeny-tiny pieces and then learn how to live on your income. Not only will this prevent you from racking up more debt, you’ll also get into the habit of carrying nothing but cash and that’s when money starts to feel real again. If you have a spending issue, handing over cash is going to make you think twice, especially compared to a contactless purchase.