20.) I will not panic when the stock market and housing values and any of my investments fluctuate over time, because they’re going to do that. And I’m just going to ride it out. | brokeGIRLrich

Welcome to point 20 on my Money Manifesto! I very confidently declared these things when I was 29 and over the last year I’ve been checking in to do an update on each point to see how the last decade has gone.

This is certainly easier said than done.

I will say that I do think I have enough accountability updates now, especially in the last few years once my retirement accounts crested $100K, where I might have a terrible income month and be a little stressed about how I’m paying the day to day bills only to find when I calculate my net worth at the end of the month – future retirement Mel has dragged my net worth up again despite the daily struggles.

So banking the max in my IRA and since my mid-20s and then adding in my HSA in my early 30s is certainly making a difference.

I also have an eTrade brokerage account that is like 75% a general index fund of the total stock market and the S&P 500 (it’s two different index funds) and then 25% individual stocks which I check out with great interest each month because those totally are all over the place sometimes.

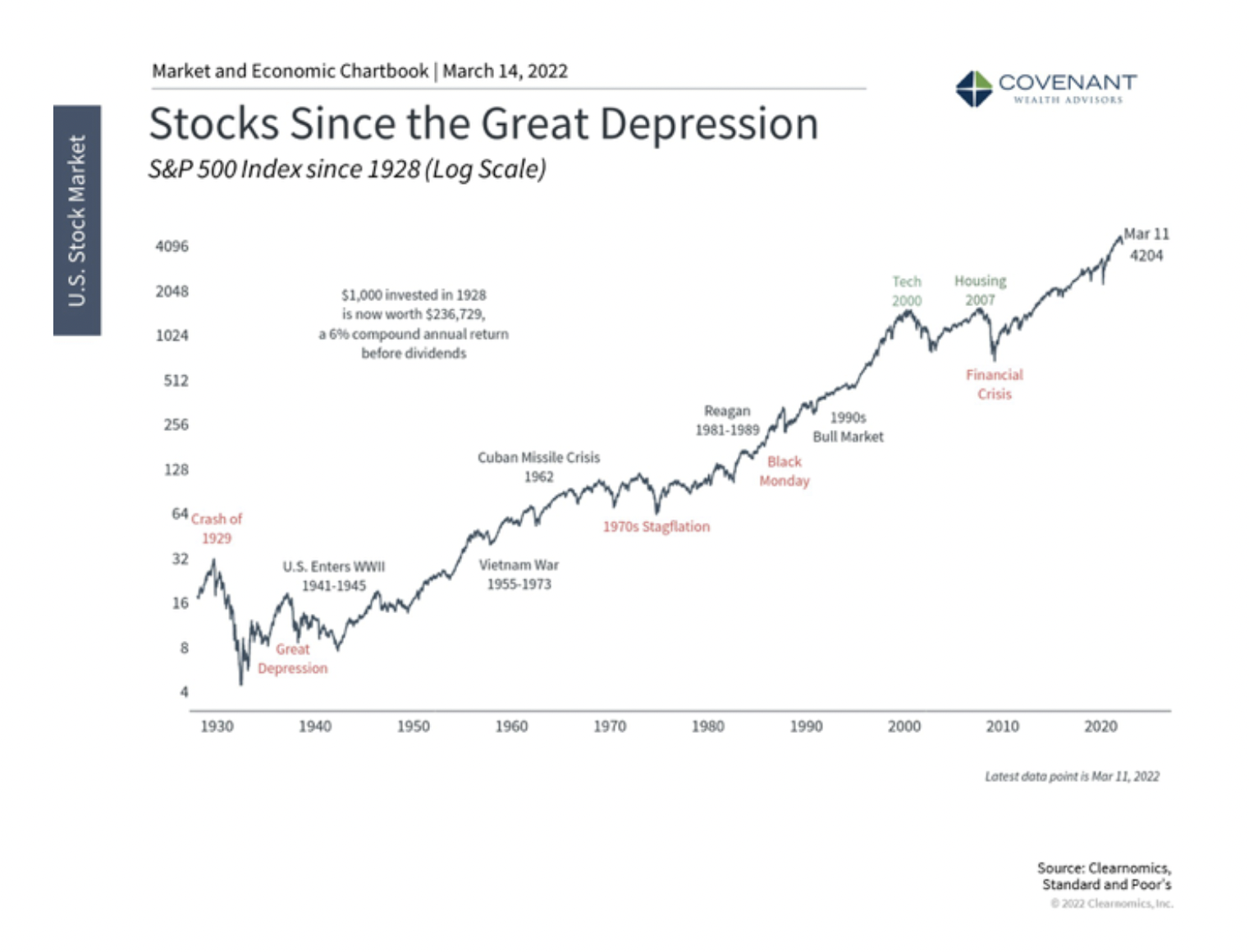

I do place an awful lot of faith in this graphic and the accompanying info that over enough time, the stock market pretty much always goes up and it beats inflation.

You can also read more about that history here.

Perhaps also living through the pandemic where money made very little sense anymore and it became pretty evident that things actually don’t have to be way

One thing that I don’t panic over but do feel a wild despondence is housing costs. I genuinely cannot fathom making enough money to comfortably buy a home at this point. I just don’t think it’s doable if I actually want to live anywhere near my family or friends.

My boyfriend’s roommate also owns the flat they live in and she is talking about selling the flat and moving in with her boyfriend, so there are all sorts of estate agent papers around his place right now. She has owned their flat for several years and evidently had a fixed rate mortgage and since she and my partner are good friends, they just split the mortgage. His rent is £500 plus utilities for a two bedroom, two bathroom flat that’s a 5 minute walk to two overground stations and 10 minutes to a DLR. He is only a 10 minute ride to London Bridge. I was flabbergasted when I learned that. Their flat is really nice!

I live in a dilapidated hovel with a boiler that never really works for £1026 a month. I figured he was paying about the same and if we moved in together, we’d both be saving a ton of money but he would actually be paying an additional £13 a month for a serious quality and space downgrade.

However, I was looking at the papers from the estate agent and it was clear that they could be renting out the space for about £1900 a month (which had been my guess) and to buy a comparable place these days is now between £500-650k. For a two bedroom flat in London.

This didn’t surprise me though because I daydream about living in the flats that are right above the Elizabeth line in Woolwich and they run about the same amount – to be 30 minutes further outside the city center than where my partner currently lives.

So yeah, not panic but a general sad acceptance that I will probably never in a place with a functioning boiler and no mice unless I hit the lottery or something. An also increasing acceptance that I really can’t stay in the UK after I graduate because their wages are really terrible. If you’re not working in like law or finance and you’re not an entrepreneur, I don’t see how you’re making enough money to not just constantly struggle over here. I mean, my one bedroom gas utility bill was £113/month to essentially freeze all winter. I barely ran the dang thing. The gas bill has finally just dropped but it’s so arbitrary, I don’t think there’s anything stopping it from just skyrocketing again.

But overall, in the spirit of the money manifesto goal, I have ridden out both the bear and the bull markets calmly, just putting away the usual amounts of savings, adding a little extra whenever possible, and not panicking when the market plummets. Fingers crossed I can stick with that.

If you’d like to check out how the other declarations on my Money Manifesto are going roughly a decade in, you can find those posts here:

- ) I will pay off all my debt.

- ) I will tithe 10%

- ) I will save at least 15%

- ) I will build up a $10,000 emergency fund.

- ) I will max out my IRA every year.

- ) I will put effort into learning how the stock market works better.

- ) Then I’ll invest in it.

- ) I’ll put effort into learning how REITS work.

- ) And then I’ll invest in it.

- ) I will own a home and it will not be a McMansion.

- ) I will pay for cars up front, in cash.

- ) I will write a book. About a little man named Jorge who lives in a jar in an antique shop. He has a mustache.

- ) I will keep on learning thrifty and frugal ways to live and then actually use them.

- ) I will make good decisions about how to spend my money, but I also won’t sacrifice all of the now for later.

- ) I will travel. A lot. All 7 continents someday.

- ) I will learn to side hustle. Especially to pay for #15.

- ) I will start a roller derby team.

- ) So I will always have good health insurance. And any other reasonable insurance to keep from bankrupting myself because of an accident or act of god or a drunken lunatic driving a car into the living room of my house.

- ) I will be careful about who I date and open with my finances with them when it gets serious – so that we can come up with good money plans for our future together.