Guys, if you haven’t seen it yet, go over to Personal Finance Junkie and check out their post 15 Financial Goals to Achieve By 40.

Here are a few things I love about this list:

- I like goals I need to achieve by 40. Since it’s too late for all those goals I’m supposed to have achieved by 30, 25 or 20. And I feel like a lot of personal finance stuff constantly makes me feel like I’m behind the curve.

- It’s an awesome, actionable list.

- You’ve probably got at least one or two of these under your belt, if you’re hanging out, reading blogs in personal finance land. Which made me feel a little accomplished.

- You probably also got some things you need to get better at on the list too.

Here’s how I’m doing with this list.

1. Build a starter emergency fund of $1,000.

Nailed it! Though I will level with you, it was one of the toughest steps to take when I went from never having any money to having $1,000 saved up for an emergency. Since then though, my emergency fund has bailed me out of several bad situations and given me more wiggle room to take some big career risks than I would have without it.

2. Organize your important financial information in a binder or eFile.

Fail. A few years ago, right after my grandmother passed away, I learned how important it is to have all your papers filed in a logical manner. Mostly because she did not. But it also occurred to me that I don’t really have anyone and spend most of my life doing my own thing – so if something does happen to me, my family won’t have a clue where to look for my financial information.

3. Develop a monthly budget habit.

Fail. For a lot of years I did! But as my monthly bills have shrunk to nearly nothing and my income keeps growing, there’s not really any point in tracking it so obsessively. Nowadays, it helps me to track my net worth every month. It motivates me to keep saving and investing and with those two goals in the forefront of my mind, I don’t have to worry about ever getting too off balance with my spending.

4. Pay off all your debts.

Nailed it! I landed nearly $30,000 in debt by the middle of my twenties thanks to a grad school habit. Fortunately, I got it all paid off before I turned 30. I would not have been able to do most of the things I’ve done career-wise in the last few years with that debt still hanging around.

5. Build a mid-level emergency fund of $10,000.

Semi-nailed it! I had it at $10,000 and then came the spring of unemployment coupled with several large medical bills and so now it is not at $10,000. However, the spring of unemployment was followed by the fall of very good employment and my last financial goal of the year is to get that emergency fund back up to $10,000. I’m $700 short right now with about 5 weeks left in 2017. I think I can do it.

6. Cut your expenses.

Nailed it! I think… I feel like there are always more places that could be cut, but I’m in a good place for how much I make and my expenses are really, really low. If I had to, I could probably get by on $200-300 a month. I also always keep trying to learn new tricks. I’ve loved Hints from Heloise since I was a kid and my dad recently gave me a battered copy of The Tightwad Gazette that I’ve really been enjoying.

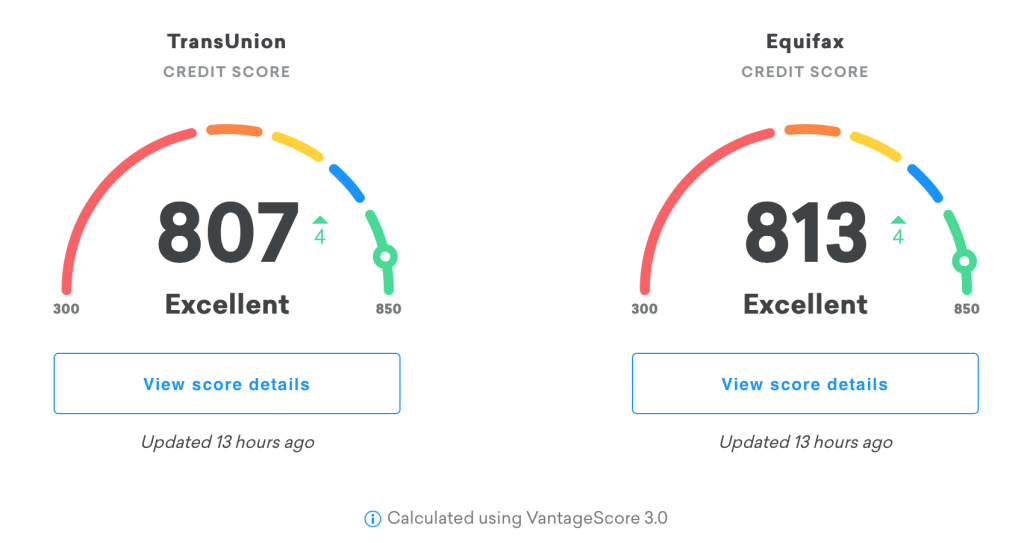

7. Be aware of your credit score.

Nailed it! I use Credit Karma all the time. It’s super easy and FREE. There’s no reason not to be aware of your credit score. If you’re currently failing number 7, you can fix that by spending the next five minutes over at Credit Karma.

8. Earn extra income.

Nailed it! You guys are looking at my main way to earn extra income right now. brokeGIRLrich averages about $500 a month in income. To get that through investments, you need approximately $240,000 (approximate being the key word because there are a lot of variables). I also make a small amount from dividends, that is slowly but surely growing too.

9. Read the top personal finance books.

Nailed it? Personal Finance Junkie points to these lists of top personal finance books. Personally, my finance journey started with Money Girl’s Smart Moves to Grow Rich when I was 25. I didn’t just head first into personal finance, but it definitely piqued my interest. From there I also read Rich Dad, Poor Dad and The Wealthy Barber. I spend a lot more time reading blogs, but I still try to keep educating myself regularly. I’m really interested in learning about the mindsets and habits of successful people.

10. Automate your savings.

Fail? I don’t actually have a lot going into savings anymore. I’m starting to reach those magical bank account numbers where I have savings for all of my next goals and most of my money is going into investments now.

11. Automate your bills.

Fail! Just like I wrote above, I prefer to have control of when the money leaves my account. But if you regularly forget to pay your bills, this isn’t a bad idea.

12. Automate investing.

Mostly fail! I kind of freak out when money just disappears from my checking account – I suspect this is from all the years of variable income. I definitely prefer to be in control of when the money goes and how much. That being said, I did just set up my 401k at the new company to try to max it out for the year automatically from my paycheck. I also usually go right in on the day my paycheck hits and siphon out the money I intend for my savings or investments, so it doesn’t sit in my checking account for long.

13. Write a 5 year financial plan.

Total fail. I’ve never done this. I am the queen of financial winging it.

14. Start maxing out your retirement accounts every year.

Nailed it! At least since 2013, I’ve nailed it every year.

15. Complete your emergency fund so that you have at least 6 months expenses saved.

Nailed it! Currently it would probably take about $3,000 to stay afloat easily for 6 months. There are definitely times in life that number is higher though, so I feel better with the $10,000 goal.