11.) I will pay for cars upfront, in cash. | brokeGIRLrich

In this series, we’re looking at Mel’s Money Manifesto, which I wrote in 2014 – to see how the Manifesto is going. As I pretty much wrote it… and then largely forgot about it for years.

I sort of laughed about this a bit.

So I am kind of spoiled (obviously, I’m pretty up front about that in the blog) and my parents paid for my undergraduate and a large part of my first Master’s degree. They saved up a bunch of money and I didn’t use all of it. I got a lot of scholarships and overall came in way under what they expected.

So going into my last year of grad school in 2007, they bought me a car.

When I wrote this in 2014, Mona the Matrix was 7 years old and I was thinking I should be prepared to buy a new car soon and I should make sure I keep on top of this head start they gave me by being ready to buy my next car without going into debt. So I started saving a bit here and there.

And as of writing this, Mona the Matrix is still going strong, despite feeling like I’m driving a go kart with very questionable A/C in the summer and coming up on 200,000 miles. I have just under $14,000 saved for my next car.

This is, sadly, not enough for a new new car. BUT Mona is still trucking along, and this has clearly not been a high priority savings goal. Her trade in value is just a little over $3K too.

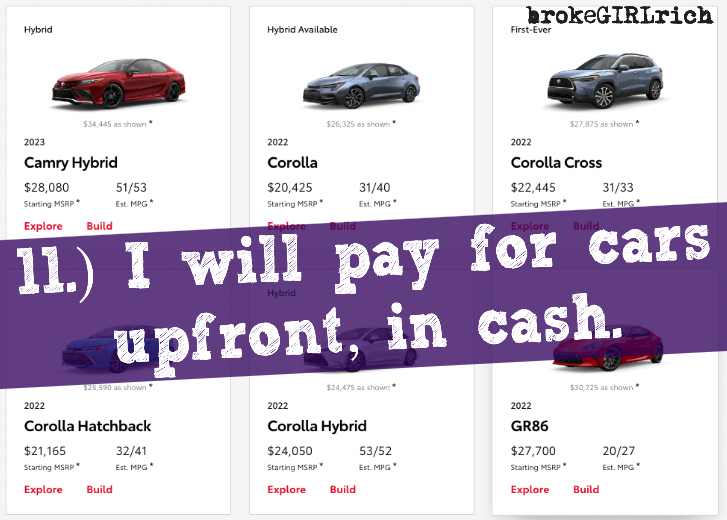

I’m pretty sure I’m a Toyota girl for life considering the absolute rockstar of a car Mona has been. And once in a while, I check out the Toyota website to get a ballpark on what I’m trying to save up. Current next car contenders are the Corolla Cross, which is about $25k brand new, Corolla Hatchback, about $24k new, or a sturdy old Corolla at $23k.

I did borrow a C-HR when Mona blew a gasket a year ago and I needed a rental car while she was repaired and this wound up being a great choice since it was high on my list at the time and I absolutely hated driving it. I felt like I was in a tank and had thought it was likely a car I would’ve liked.

So crazily enough, I could probably easily buy a used model that’s just a few years old with cash but I’m not that far away from being able to buy any of those in cash, so if I prioritized that savings account, I could possibly get to that number.

And I don’t think I’ll be buying a new car at any point in the next 4 years, while I’m in school.

Thus, I’ve never tested whether or not #11 on the Manifesto is what I’ll actually do, it is still the goal and it is well on track to succeed in minimially painful ways since I’ve had such a long runway on the goal.

And yay for Toyota’s. Mona really has been an excellent vehicle. She had zero issues in the first 100,000 miles and I just regularly got her oil and tires changed when needed. I paid a little extra to have her do a full checkup at Toyota for the 100,000 check up but it went well.

Last November, she blew a gasket and it cost about $700 between fixing it and renting a car for two days while they did. Until that point, over 14 years I’d spent about a total of $1,500 on small repairs. Just before moving to London, her brakes went a little wonky and I had to get them fixed because sometimes my dad and brother use my car and I didn’t want them to die. That being said, I still have no complaints about the overall maintenance needed for this car over the last 15 years.

I have a suspicion Toyota stopped making Matrixes because they were just too awesome. Which is a shame. I would buy them for the rest of my life if they hadn’t stopped making them.

If you’re interested in seeing how the other goals on my Money Manifesto are going, you can read those posts here:

- ) I will pay off all my debt.

- ) I will tithe 10%

- ) I will save at least 15%

- ) I will build up a $10,000 emergency fund.

- ) I will max out my IRA every year.

- ) I will put effort into learning how the stock market works better.

- ) Then I’ll invest in it.

- ) I’ll put effort into learning how REITS work.

- ) And then I’ll invest in it.

- ) I will own a home and it will not be a McMansion.

Pingback: 11.) I will pay for cars upfront, in cash. | Indianapolis Local News

Pingback: 12.) I will write a book. About a little man named Jorge who lives in a jar in an antique shop. He has a mustache. | Indianapolis Local News

Pingback: 13.) I will keep on learning thrifty and frugal ways to live and then actually use them. - VIRGINIA BEACH VA News