If you’re swimming in a sea of financial confusion, the first step you have to do is evaluate where exactly you are. You need to know if you’re actually just a little too far out to sea, the shoreline is right there beyond the horizon, or if you’ve fallen off a boat in the middle of the ocean and you’re just totally screwed.

It’s easy to feel too overwhelmed to do anything really, but Mint is a great tool that makes it super easy to get a clear snapshot of your financial picture. And they have lots of helpful tools to help you move forward too.

You can shoot through all the steps listed below in one go, but I’ve also broken them into smaller sections, so if you are feeling like this is just too much to bother with at once, set of goal of completely one of these steps a day or a week until you’ve got your account fully set up.

NOTE: To use Mint, you need to connect it to a lot of secure accounts, like your credit cards and your bank accounts. Mint is an https and wwws site, which means it is secure. Always be sure to use websites that have that s in their address when entering personal information.

Day 1 – Set Up an Account & Add Some Assets

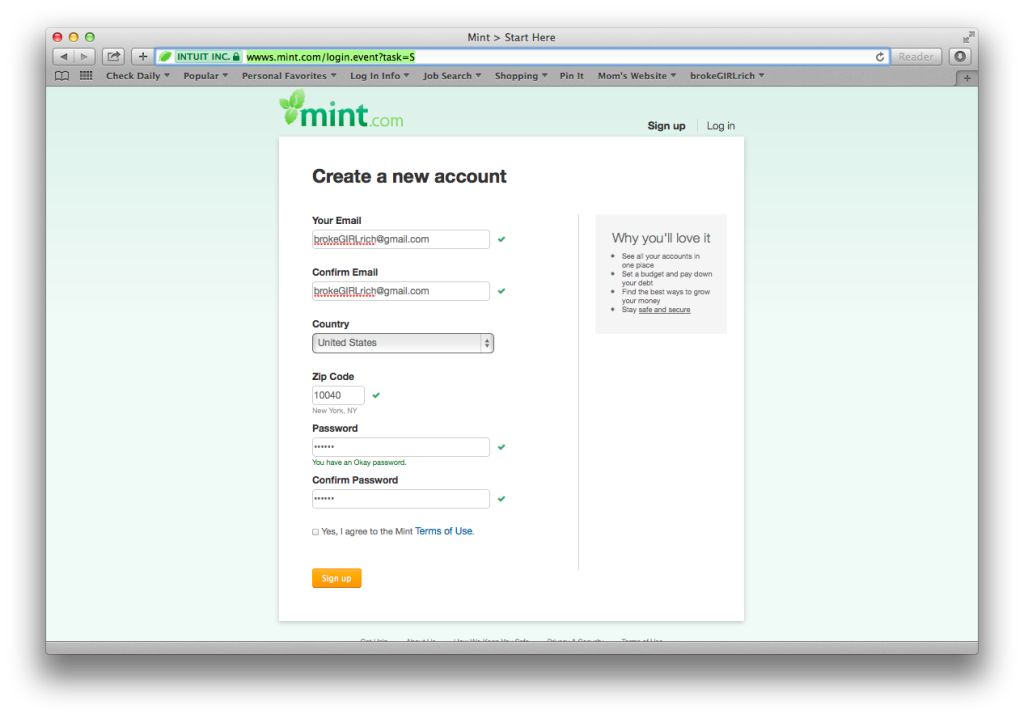

Log onto www.Mint.com and select Sign Up from the upper right hand corner. In the create a new account screen enter your email address, area code and select a password. It’s easier than signing up with Twitter!

Start with Your Banks

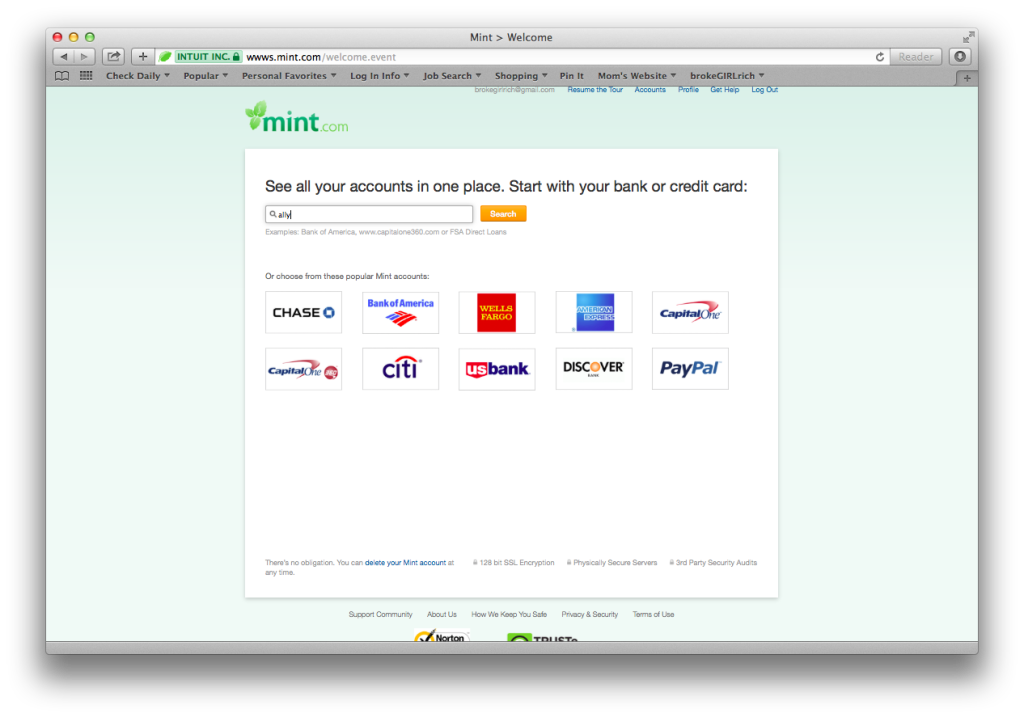

Make a list of every bank account you have – checking or savings – and your log in information for each one. The next screen that pops up is going to ask you to link them.

You need to already have an electronic sign in set up with your bank and pretty much every bank does have that option (maybe a few tiny credit unions don’t). If you’ve never set it up before, go to your bank’s website and try to log in. You may need to call the bank to help you set up a log in. This can be time consuming and irritating, I get that. If that’s the case, tackle setting up one a day until you have a electronic log in for all your checking and savings accounts.

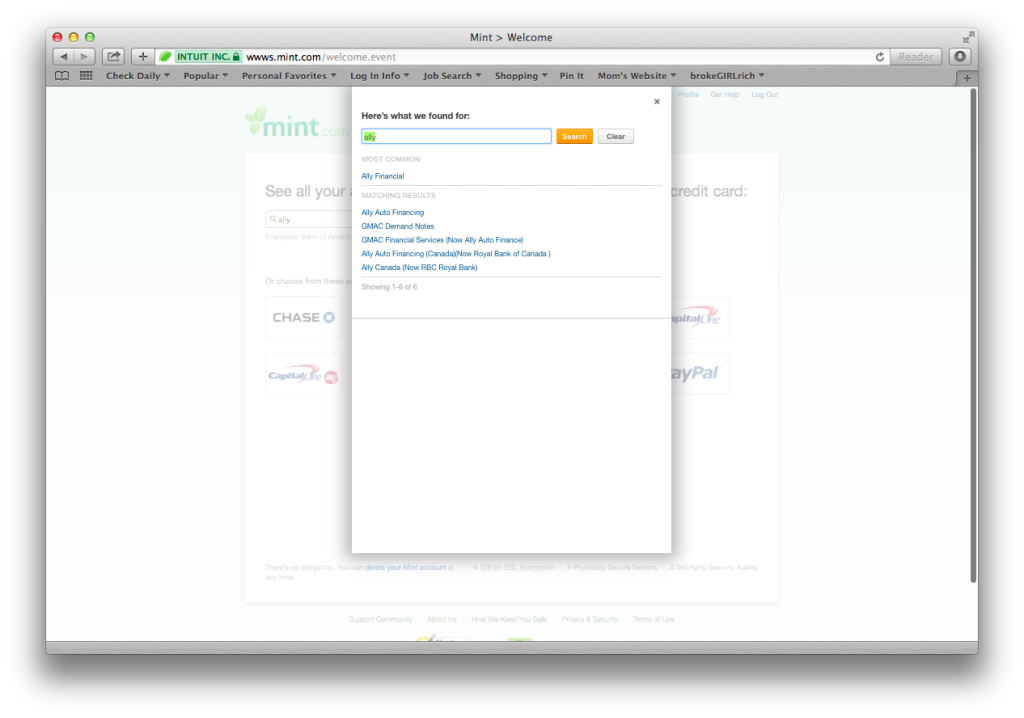

Type in your financial institution. For example, mine are CapitalOne, Ally and TD Bank. Once I typed Ally into the search bar, it popped up a second box with the different types of Ally accounts (for example, Ally Financial, Ally Auto Financing, Ally Canada). I guessed that Ally Financial was the one I needed, so I clicked on that.

Enter the user name and password you use to connect to that account. Mint will do the rest. While it’s syncing up to that account, it will ask you if you have another account to link. If you do, just repeat the process for each checking and savings account you have.

If you’re married and you wanted to add your spouses accounts too, Mint will let you do that. Keep in mind that you can’t actually make any transactions or changes to your accounts through Mint, it just tracks you balances and what you’ve been purchasing.

Day 2 – Add Your Investment Accounts

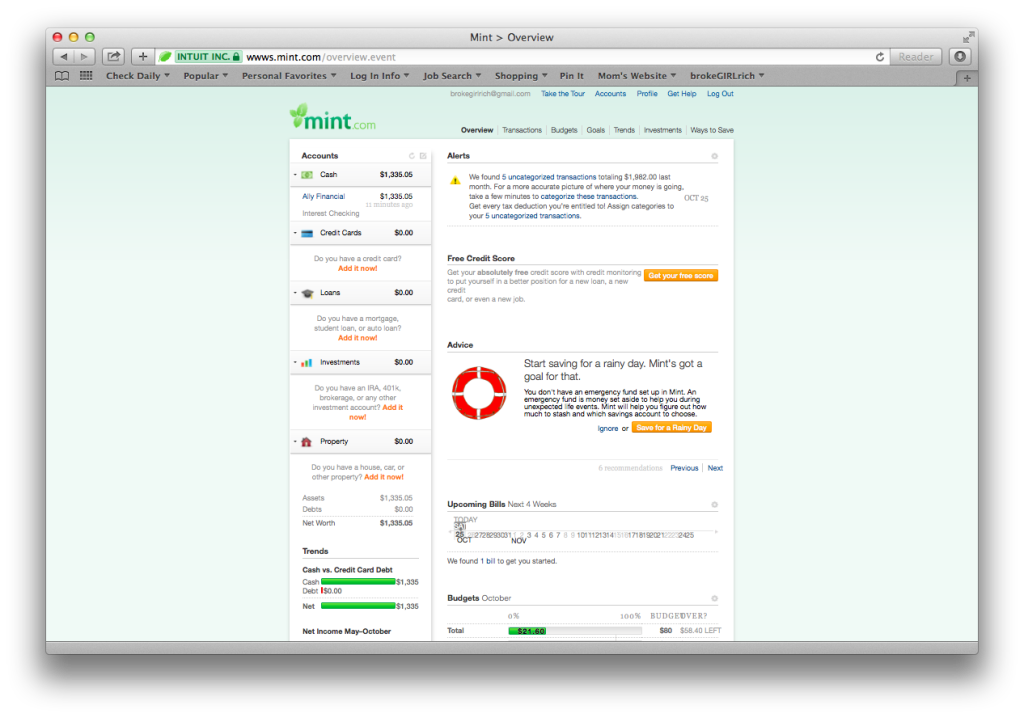

So you’ve made it through adding all your checking and savings accounts and when you log in, Mint is telling you, you’ve got a nice little balance in the green. Yay! Go you!

…this may be a total lie.

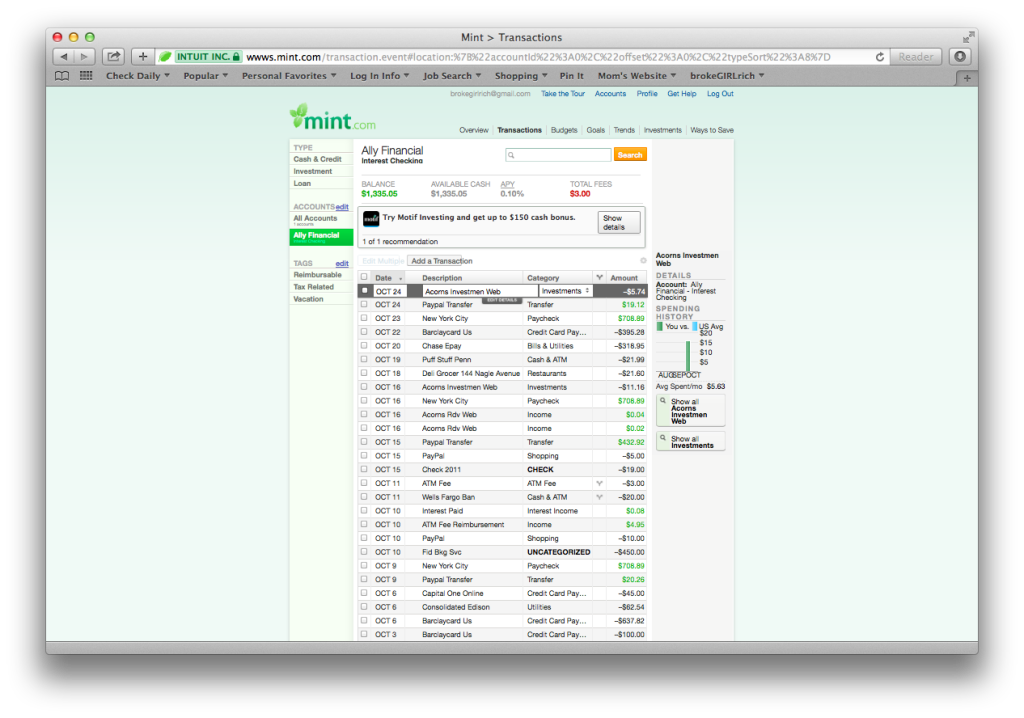

But let’s keep going. When you log in now, the screen will look like this:

To continue adding accounts, click on either a bank account you added in the left side bar under accounts or on Transactions on the bar along the top. Over where it says accounts, click on edit and a familiar box will pop up.

Click on add an account and today we’re going to tackle and of your investment accounts. Again, you’re going to want to make a list of every IRA, 401(k), 403(b), and any other sort of investment account you have and make sure you’ve got your electronic log in information. If you don’t have that set up, take some time today to find out how to set up those accounts online. You may need to call ING Direct to find out how you log into your 401(k) or reset a password on a forgotten ShareBuilder account so you can track the $63.23 in stock you have on their.

Do it. I honestly think this might be the most frustrating step of them all if you haven’t been tracking your money before and don’t already know how to log onto each company’s website to access your balances.

Investment companies also do things sometimes like require you to answer your safety questions to verify it’s you requesting this link up (which I think is a good thing) and ShareBuilder has this completely obnoxious thing where you have to log into their website to find a code that they list under you information there to link up to Mint.

So yes, it’s a pain.

Do it anyway.

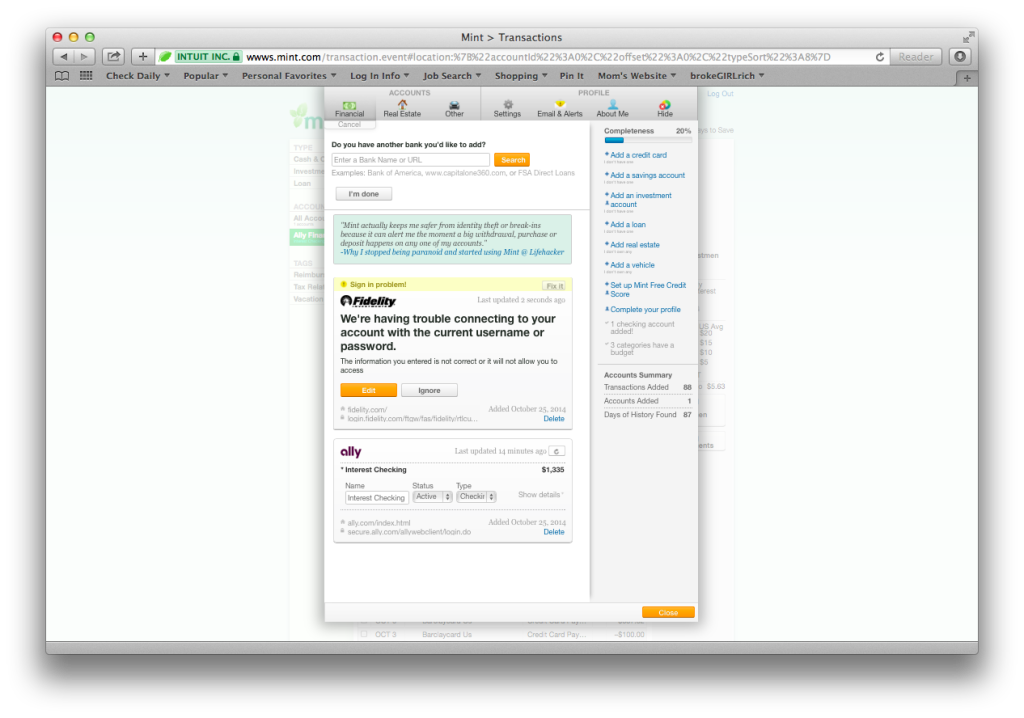

If Mint has trouble signing into your account, you’ll get a little pop up like this. Click the fix it button and it will let you Edit the information you used to log in and try again.

If you have more than one account with a company – for example my IRA and a former employers 401(k) are both with Fidelity, I enter the log in information once and Mint pulls out all the associated accounts and lists them.

Congrats, once you’ve made it through these steps, your net worth should be solidly green and you’re through what I think is the most difficult day of hunting down info and getting your accounts synced.

Day 3 – Add Your Credit Cards

Log in again and get back into the screen that lets you add accounts by doing the same thing as yesterday.

Today you want to list all your credit card and make sure you have that log in information handy too.

Type your credit card into the same place we entered your banks and savings accounts and select it from the menu. You should add every credit card you have, including store cards.

Again, you may have to take some time setting up an online account with each credit card company, although I’d guess for most of us, that’s how we pay the bill these days, so I think adding all of them should be much simpler than hunting down old 401(k)s and figuring out how to access your IRA.

Besides, you’re probably a pro at this by day 3 anyway, right?

Once you’ve got all your credit cards added, you can close the screen for adding accounts and check out how your net worth is doing now. Still in the green? Don’t worry, it’s not end of the world if it’s not, but at least your starting to get an accurate picture of where you are financially!

Day 4 – Add Your Other Debt

Does Sallie Mae have her claws deep in you? Do you have medical bills or any other debts?

Today we’re going to get back into the screen that lets you add accounts. Along the right side you’ll see you can add a loan. Type in your lending agency (or agencies) and sync them in too. Again you’ll need your log in information for those accounts.

This is when you should also add any car loans and your mortgage, as well as any other debts that are through lending agencies.

Day 5 – The Odds & Ends

Today we’re going to add in the last few things that can effect your net worth. For instance, when you added your mortgage yesterday, it may have really dragged down your net worth.

Go back into the screen to add accounts. On the right hand side you’ll see an add real estate option. Mint works with Zillow to keep pretty accurate tabs on the current price of your home. This will give you an idea of what it would likely sell for right now. So while you may feel like your mortgage is humongous, owning a home is an asset that balances that out.

You can also opt to override Zillow if you have a more accurate estimate of what your home would sell for right now and enter that number instead.

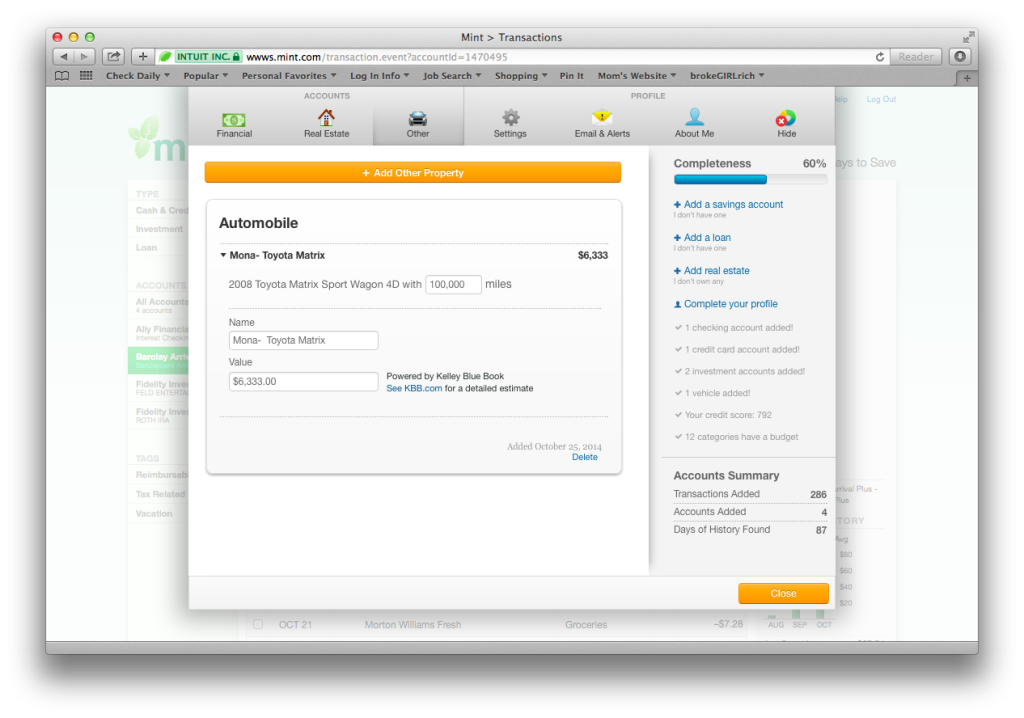

Your vehicle is also an asset to add. Granted, cars is tricky assets because they depreciate quickly, but the fact is that you could probably get several hundred to several thousand dollars for that vehicle sitting out on your curb – and hopefully it’s worth at least as much, if not more, than any car loan you’re paying for it.

Mint has teamed up with Kelley Blue Book to provide that number.

Under Other you can also add any other assets you have. Maybe you have an impressive guitar collection that you know, in a pinch, you could absolutely sell off for $10,000. You can list that there. Keep in mind that you don’t want to necessarily overvalue these items and you really may not want to add them at all. I you do, I recommend you add them at the price you think you’d get if you listed them on Craigslist today and absolutely needed them to sell – it’s probably a considerably lower number than they are actually worth.

Personally, I keep a $1,000 trumpet and about $500 in jewelry listed in my net worth, because I have a lot of confidence that I could sell off those things within a week for at least that much if I ever had to.

The worst of the week challenge is over here! You don’t have to call another financial institution anytime soon AND you can now see your full financial picture.

Click around the site and check out your income vs spent graphs. Have you ever seen your net worth before? Now it’s listed in the sidebar on the side.

Of course, as a human being, your real worth is NOT a number. You are special, you’re the only one, you’re the only one like you. There isn’t another in the whole wide world who can do the things you do. However, for the purpose of fixing your financial problem, this is a number you need to know… even if it’s a big, red, debt-ridden number.

Day 6 – Set Up a Budget

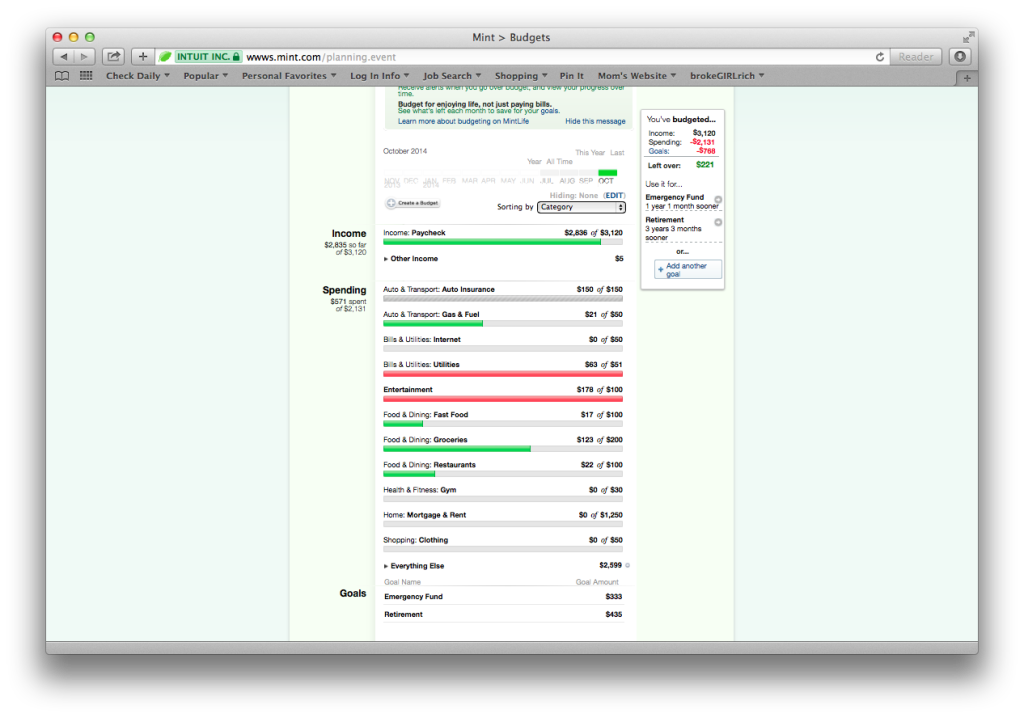

As you scroll down your account, you’ll see a section labeled budgets.

Click it.

Mint has crawled through your accounts and figured out how much you make each month. You can see this in the income line.

Under spending, Mint starts you out with some generic suggestions about how to set up your budget, but lets take a minute to personalize it and make it actually useful.

Over the income line is the little button that says Create a Budget. Click it.

Select a drop down category like Rent & Mortgage, enter the amount you pay each month and add it to the budget. Do this for each of your utilities and any recurring payments like student or car loans.

One nice thing is that Mint scans your previous credit card payments so that when you try to add something like Utilities, it suggests the average amount you’ve been paying.

You can also click on those Spending lines that Mint suggested for you and delete them, if they’re not something you think should get it’s own budget line.

Mint has also added a cool feature that lets you budget for your once a year bills – for instance, I pay $1,200 in car insurance once a year in May and I enter it that way in my Mint budget, but Mint automatically breaks it down into what I have to save each month to make that payment.

Once you’ve got your set expenses and an estimated budget for things like food and entertainment, check out the Goals section right underneath.

This is one of the things that makes Mint incredible. You’ve just spent all week futzing around this site, setting up your bank accounts and getting to know your money better. It was probably a pain at times, but here is where it gets worth it.

I bet you want to retire one day, right?

Click on Goals and Mint will help you set up savings amounts to Pay Off Credit Card Debt, Save for Retirement, Save for an Emergency, Take a Trip – it’s got a really nice list of things to pick from.

If you’re in debt I really, really recommend making your first goals Pay Off Credit Card Debt, Pay Off Loans and Save for an Emergency. Forget the rest (for now) and let Mint help you sort out some numbers for those goals to work into your monthly budget.

You set a number you’re aiming for, assign one of your accounts to it and select a goal date to accomplish it! You can mess around with the goal date to increase or decrease your contributions, but it gives you a clear moment in time in which you’ll achieve your financial goal!

Finally, you’ll want to keep an eye on your credit card transaction and double check how Mint has categorized them. They’ve got this super easy to navigate drop down menu, so if something pops up as Uncategorized, make sure to categorize it – this keeps your budget report accurate.

Who’s out to sea now? Not you.

Day 7 – Ways to Save

You may be a little burnt out on this personal finance kick by now, but I’m hoping you’re actually excited to see where things lie, to understand where your money is going every month and start making a plan to get where you want to be!

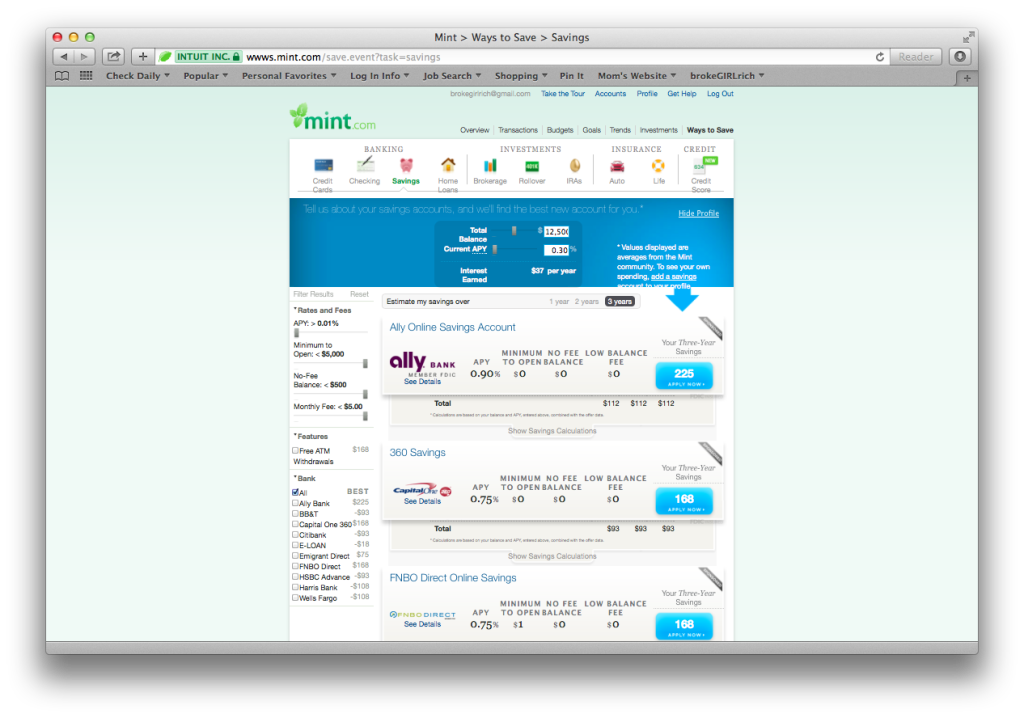

Today we’ll check out a fun Mint feature called Ways to Save. A friend of mine recently said she felt like she was being screwed over her IRA and the company that set it up for her. Maybe she is – not everyone is looking out for your best interest (except me, here, duh – I’m trying to empower you and who else if going to look out for you as well as yourself?). Under Ways to Save, Mint examines the different savings accounts, credit cards and brokerages you use and lets you know if there are better options out there.

Now that you’re a pro at navigating financial institution websites and calling them up, you might want to consider switching over some of your accounts. Spending an hour or so today chatting on the phone with some of these companies and rolling over your savings accounts or your retirement accounts could save you a lot of money in the long run.

Finally, I recommend you add your credit score to your Mint account. In the right hand corner of the Ways to Save section, Mint lets you access it for free! Your credit score effects a lot regarding the interest rates you pay on credit cards and loans even to your ability to get a job (lots of employers check them). Even if it’s low right now, knowledge is power and with everything you’ve done this week, you’re already on track to improving it.

Mint a little too high tech for you? I wrote a series about budgeting a year ago that will let you conquer your finances with a pen and pencil too. Check it out:

- Budget 101: Net Worth

- Budget 101: Monthly Budgets

- Budget 101: Yearly Budgets

- Budget 101: Debt Control

- Budget 101: Financial Goals

- Budget 101: Needs vs Wants

- Budget 101: How to Stay Inspired

- Budget 101: Mind Over Money

- Budget 101: 9 Sources to Learn More About Budgeting

- Common Budget Bandits

Mint is fantastic! Although it doesn’t recognize my local bank so that throws all my numbers off. Grr, Mint. Maybe I can send them a ‘new bank’ request or something.

Will.i.am @firstqfinance recently posted…Don’t Lie to Yourself: Outsourcing > Insourcing

Maybe. I would definitely shoot them a note through their website.

Wow Mel lot’s of detail information here. Nicely done! I need to revisit my Mint account, it is a great tool. I just keep going back to excel spreadsheets. 🙂

Brian @ Debt Discipline recently posted…20 Years

That’s the path I use, too. I’m anal so I have all the same info down, but Mount could save me a lot of work!

femmefrugality recently posted…How did it end? The soccer drama.

*Mint. Grrr autocorrect

femmefrugality recently posted…How did it end? The soccer drama.

Great post Mel! Mint is an awesome system, but only as awesome as the user. It’s one thing to go through the hassle of inputting all of this info, but if you are not going to do anything about it what’s the point. I had a client say “Mint told me I spent too much money on restaurants.” And I asked if she stopped eating out as much and she said no. Once you get everything in one place, you should really look to create actionable steps from the info it is giving you.

Shannon @ Financially Blonde recently posted…Music Mondays – Running on Empty

I love the way to you it up over days to make it less intimidating. I love Mint! I use it, as well as Goodbudet (for a manual budget). Mint makes everything easier and I love the tools too. Especially the goals tool.

Kalen Bruce @ MoneyMiniBlog recently posted…3.2 Tax-Free Ways to Invest for College

The goals tools are awesome. I love how when you’re doing better than expected and paying ahead, it shows you how much closer you’ve moved up your goal. At the rate I’m going right now, I’ve knocked 2 years off my retirement time.

Wow, great comprehensive info! I used to use Mint, but it’s been a while – this makes me want to update my info! I had no idea it had that real estate feature too. Very cool!

Melissa @ Sunburnt Saver recently posted…Saturday Weekly Update

This is such a very helpful one! I downloaded Mint before but I uninstalled it because I had some problem on it but after reading this one, I think I would try to use it again.

Kate @ Money Propeller recently posted…Whatâs Saved on Your Work Computer Right Now?

Wow! You did an amazing job of breaking that down! About 5 years ago when I was fresh out of college, I used Mint religiously. The good part was that I thought it was really cool to look at the breakdown. The not-so-good part was that it didn’t change any of my poor spending habits. I would just look at my or chart and say, “huh. I really do like my shopping don’t I? Good thing I didn’t go to Costco this month.” Nowadays I’m loyaly to my DIY budget spreadsheet, but maybe I should give mint another try with my more mature and correct perspective on money 🙂

Brittany @ Fun on a Budget Blog recently posted…Weekend Survival Guide for the Girl on a Budget

LOL. I can see that – to be honest, I don’t change my spending a whole lot based on how my budget shows up there. However, I do reign things in when the Net Worth panel starts looking funky. That freaks me out and it kept me really motivated when paying off debt.

<3 Mint.com! 🙂 I check it every weekday to make sure I'm on top of things!

Ms. Mintly recently posted…In Which I Gripe About the Elusive “Normal Month”

I started using Mint this summer. I love the fact that I can not only see the US accounts but also add my Canadian ones also! The currency exchange is the only downer as it considers the CAD accounts as USD dollar values but I still really like what Mint offers.

Kassandra recently posted…The Truth About My Marriage

That’s awesome! I didn’t know they would link up to Canadian accounts.

Pingback: Year In Review - Sunburnt Saver