Let’s kick off the New Year with one final look back at the old one. In 2015 I became a lot more of a lurker than I ever used to be online, but I still tried to read a good number of other bloggers posts and some of them were truly excellent. A few even influenced me to look at my own habits and reevaluate them and others were inspirational because of how much that blogger had achieved.

So without further ado, the blog posts that made my top 10 list for 2015 (in no particular order):

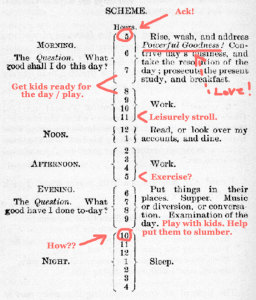

What I Learned Working Like Benjamin Franklin for a Week at Budgets are Sexy

So I think it’s pretty universally agreed that Benjamin Franklin was kind of a bada$$. Turns out that he essentially left an instruction booklet on how he structured his days to achieve everything he achieved. J. Money was kind enough to try to live like Ben for a week so the rest of us didn’t have to only to find – maybe the rest of us should be. I haven’t developed the self discipline yet to start every day at 5 AM, but it’s safe to say the earlier I rise, the more stuff gets done. And taking time out of your day to contemplate “Powerful Goodness” is never a bad idea either.

Don’t Let Your Self-Worth Impact Your Net Worth at Financially Blonde

Shannon’s post struck a chord with me because I know when my self-esteem is lagging a bit, my bank account it likely to take a hit as well. It was kind of nice to know I’m not alone, but mostly I loved the second half of her post – how she overcame it. Sometimes “fake it till you make it” really does work and stuff like telling yourself something you like about your body even when you don’t think you like anything eventually leads to your brain starting to see yourself that way. So many goals start with baby steps like “today my eyes look pretty” or “today I can save $1.50” and before you know it you’ve got smoking confidence and a smoking bank account.

10 Instances When Being Lazy Saves You Money at Fun on a Budget Blog

As one of the laziest people around, I love to hear how my sloth-like ways can save me money and I found a lot of this list on the money. I don’t think I’ve personally owned holiday decorations since college and I couldn’t care less. The simplicity of leftovers does save me time and money. Having no interest in bothering with organizing a trip does often lead to staycations where I spend considerably less than going to Budapest or even just the beach. If you ever want your lazy ways vindicated, look no further.

What Did You Get? at Debt Discipline

This was my favorite holiday post this year. Brian turned that popular holiday question “what did you get?” on it’s head and started a #whatdidyougive movement. If we’re going to get kind of bogged down in consumerism, we might as well emphasize the altruistic side of gift giving. And as I get older, I know I’m generally a lot more proud of finding the perfect gift for someone or just the right memory to box up somehow than of whatever I got. I also love posts that remind us to do little good deeds for others and Brian’s Starbucks gift card was a really smart way to pass on a little holiday cheer to a bunch of stressed out holiday shoppers.

Digit: The Easiest Way to Save Money? Ever? At Budgets are Sexy

I feel like I need to point out the post that made saving $961.67 so easy I didn’t even know it was happening. I’ve raved about digit over here repeatedly, but first learned about it over at Budgets are Sexy. In case you aren’t aware – digit is an app that you connect to your savings account. It analyzes your spending patterns and then withdraws small amounts into a savings account for you. You can withdraw that money back out of the savings account at any time and if it somehow analyzed wrong and causes an overdraft, digit will pay the fee. I totally doubted this would happen because my spending and checking account balances vary widely but I’ve never thought “where did my money go?” and I always get excited when my digit balance hits $100. I transfer it out and put it right into one of my long-term goals savings accounts or my retirement fund. Seriously digit is awesome, if you haven’t jumped on the bandwagon, make it one of your New Year’s resolutions.

Where Did 16 Years of Paychecks Go? At Professional Girl on the Go

I really enjoyed this little case study because I felt I could relate to it. I’m also about 16 years into the working world with a variety of jobs over the years. It is kind of crazy to realize how much cash has already flowed through my hands by now but even more crazy to realize I have no idea where most of it went. A sobering realization that I don’t want to say about the next 16 years.

Why Is No One Talking About Medium-Term Financial Goals? By Stefanie O’Connell

What can I say? Stefanie often hits the nail on the head, especially when it comes to things we should be talking about but aren’t. Or maybe she and I are on similar financial paths. I know right around this time I realized I was completely out of debt, had a solid emergency savings account and my retirement plans were set up and being fully contributed to…. and that I had no idea what to do next. I kind of wanted to save up for a new car in a few years and a down payment on a house, but how do you do that? Emergency savings go into the highest interest, easy to access savings account you can find. Retirement savings go into IRAs, 401ks, stocks and bonds. But no one really did seem to be talking about these medium-term goals, until she did.

My $458 Lesson in How to Adult Properly at Half Banked

I could not stop laughing while I read this. Sorry, Des, I don’t think you were trying to be funny. It’s just that I always felt like a moderately on top of it person, but when I got my first car, I didn’t know that oil changes were a thing or that you had to register your car each year. I figured I had registered it and now I’d let the government know if that changed, right? Most of the time, you just register for things once. Anyway, another instance of where it felt nice to not be the only one who doesn’t know what’s happening with cars but is still managing to adult thanks to a solid savings account.

Learn How to Become a Millionaire With These 7 Secrets at Club Thrifty

I really like lists of actionable advice. Do numbers 1-10 and you will get X. And I check off each step as I progress towards X and then X happens. The odd things about working towards becoming a millionaire is that it does seem like there is essentially a like. Do numbers 1-10 and then you will get 1,000,000. To be fair, numbers 1-10 are largely gigantic mental overhauls, which take a while to complete, but I love that Greg has essentially broken down the steps to financial success here in an actionable list. One that I’m certainly working on and you should too.

What Is the Tiny House Movement – Plans, Resources, Pros & Cons at Money Crashers

Because I will live in one someday. Really, I will. And this is an incredible resource. It’s got links to companies that prefabricate them or provide plans. It had a lot on land – which is what I’ve currently been hung up on trying to figure out (a lot of tiny homes can’t actually be built in a lot of places). I’ve definitely bookmarked this site for the future.

Thanks for including my post with the other great ones! Happy New year Mel!

Brian @DebtDiscipline recently posted…Merry New Year

Love the round up- thanks for including mine. HAPPY NEW YEAR!!!

There is some great information out there. Thanks for sharing. A bit surprised about the tiny house, though. I can’t wait to see you walk that part of your journey 🙂

Amanda @ The Fundamental Home recently posted…Goals for 2016- The Year of Diligence

Hahahaha oh my gosh it was SO intended to be funny, I’m glad that came through! If you can’t laugh at losing almost $500 for something you should have known to do, what can you laugh at, right?

Thank you so much for including my post on the list, Mel – I really appreciate it! And cars are like my biggest adulting pain point, so I’m glad I’m not alone on that. Remembering to book an appointment to put on my winter tires before it snows for the first time? Taking warning lights seriously? Uh… I’m working on it.

Hope you’ve had an awesome new year so far – looking forward to a great year and reading more from you in 2016!

Des @ Half Banked recently posted…My Personal Finance Goal for 2016? Not Anonymity.

It’s true – cars are really one of those things that should be included in adulting classes.

I am right there with you on being lazy! My motto is that I’m “too lazy for complicated.” 🙂 That goes for Christmas decorations (they are really just clutter, and I HATE clutter), and planning any kind of outing (walking around the mall is fine with me), and cooking (if I weren’t gluten free we’d be eating a LOT of cereal, lol). ALL of these posts look like great reads — thanks for putting them all in one place! And thanks for linking up at Frugal Friday! 🙂

Ann recently posted…January is NO SPEND Month & Frugal Fridays #9

Oh my gosh, I could eat cereal all day every day if I wouldn’t gain like 800 pounds.

All great posts! I laughed reading How a To Adult Properly too (sorry)

Tre recently posted…I Am The New Year

Thank you SO much for including my post in your 2015 round up!! I love when I write something personal to help me and that it helps other people. There is no greater gift in life. Cheers to a wildly successful 2016 for you Mel!!!

Shannon @ Financially Blonde recently posted…2016 Goals – Happy Hour Style

Pingback: How to Plan for a NO SPEND MONTH & Frugal Fridays #10 ~ Annie and Everything

Pingback: Frugal Friday {Week #10} - Aspired Living