I love reading about Financial Independence but a lot of times it seems so far off and totally impossible to me.

I’ve learned from nearly five years of reading personal finance blogs and writing this one that almost anything is achievable, but even knowing that, and seeing evidence of it in my own life, financial independence can still just seem like some crazy, impossible dream.

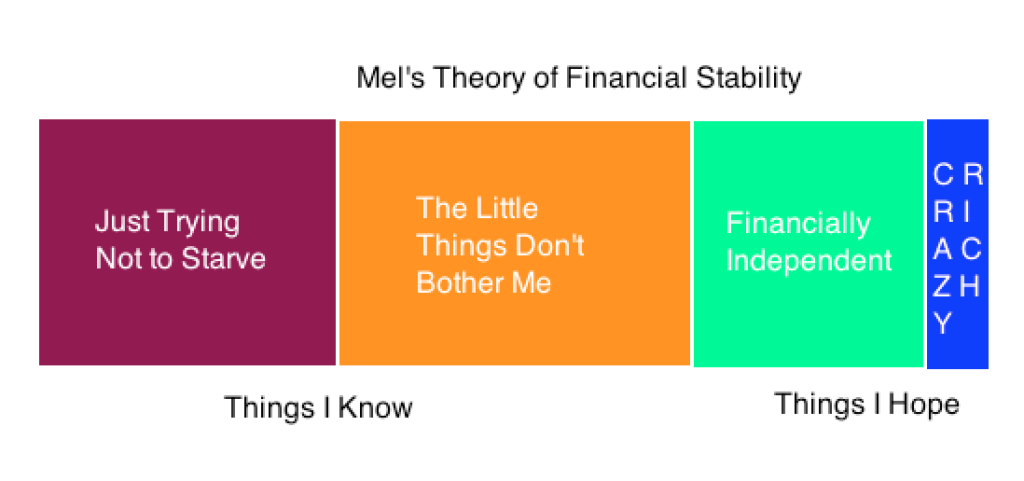

If financial independence seems like a joke to you, let me make you feel a little better – I’ve developed this highly scientific theory of financial stability.

And by highly scientific I mean I pretty much made it up.

But here is what I postulate:

Between just trying not to starve and financially independent is another fairly awesome financial state of being I like to call “the little things don’t bother me.”

According to my theory, financial states of being are split into four categories:

The Maroon Category is when you’re just starting out on your personal finance journey. You may be an 18 year old with no financial background or you may be a 35 year old up to your eyeballs in debt.

The Maroon Category is not a place you want to stay. This is where money = stress. Money = stress is the defining nature of this category. When you have to clip coupons or else you won’t have enough money to eat this week. When you have no emergency savings. When retirement savings seem like a joke.

Lots of people spend some time in Just Trying Not to Starve (aka the Maroon Category). For the most part, it just sucks. The silver lining you’ll find as you progress though, is that it teaches you a lot of survival skills.

From the Maroon Category, many look longingly at the Mint Category (aka Financially Independent) and wonder how the heck they could ever get there. I know, I’m often one of them.

Now, I don’t know much about Financial Independence or the Blue Category (aka Crazy Rich), but I suspect that at least the financial side of life is much easier in them.

What I want to encourage everyone with is that I’ve found there is an Orange Category (aka The Little Things Don’t Bother Me) and it’s a really great place to be.

Like… compared to the Maroon Category, it’s really great.

You have officially made it to the Orange Category when money ≠ stress. Money is just another aspect of life you have to control.

The move from the Maroon Category to the Orange Category is also not cut and dried. It happens like a gradient.

- You finally get $1,000 into your emergency savings. A little of that trying not to starve to death pressure falls off.

- You manage to get a month ahead on all your bills, so there’s a little wiggle room if you have a rough month.

- You notice you can save $100 on your car insurance if you pay for the whole year up front, so you spend this year saving up so that next year you can start doing that.

And the stress lets up bit by bit.

Then one day you’ll find you’re fully Orange Category and it’s kind of glorious because money rarely equals stress anymore.

There are still some things that could knock you off balance, but for the most part you’ve got good financial habits (like, coupons cause you want to and you have easy systems set up to use them, not because you have to).

Exciting Orange Category experiences I’ve had lately:

- I often get stupid sinus infections that get a little out of hand because I wait too long to go to the doctors. This time, I felt the beginning of one and went right away. It cost $250 even though I have insurance. I was fairly irritated at how our health care system is a complete sham but it didn’t actually cause me any financial stress.

- I need to run a ton of errands but didn’t have a car so I just rented one for the day.

- I needed a bunch of things for work and just bought them and floated the money until they finally reimbursed me.

- A pair of work pants ripped and I just went to the store and got a new pair the next day.

Seriously though, I remember times in life when $30 for new pants would’ve effed up my finances for the whole month.

So the Mint Category of Financial Independence seems wildly out of reach to you still, let me encourage you that you may only be two or three years out from the Orange Category kicking in if you start making little changes now.

I like your theory, as well as your graphic visualization. People don’t live in the “just trying not to starve” category for years and then suddenly find themselves FI. There’s definitely something in the middle there and it certainly has a gradient. I’m glad to hear you’ve had some good orange category occurrences lately (and I’m especially glad to hear that work finally reimbursed you!).

Gary @ Super Saving Tips recently posted…The Strange Case of Taxing Your Social Security Benefits

Nice concept, I started out in the orange and never was stressed about money and I suppose I’m in the blue now although most studies show that even fat FI people consider “crazy rich” to be about twice what they have whether they have one million or ten million! Definitely I interract with people in every category, including an elderly guy who was saying he might have to stop taking a lifesaving drug due to the cost since he also had to eat. He was in his eighties and still working full time. He really has cause to think our med system is crazy.

Steveark recently posted…What My Parents Taught Me About Money

Having spent a long, painful time in the Maroon Category trying not to starve or become homeless, I can second that Orange = Happiness. For too long, I let a lot of myths about working in the theater keep me from doing anything sane around money. I will say this: Orange can become like a warm bath, and if you’re not alert, you can cross over into Boiling Frog. The new tax law will probably cost me, but I will be fine–for now. I need to tighten my ship, take a good look at every spending category, and figure out how to stay on a sustainable path despite this crap. I’ve been living on autopilot for a while. If I ever want to get to the Mint category I’m going to need to wake up a little!