Update: 4/18/17: In light of digit’s move to start charging $2.99/month for their services, you may want to check out my post What Are Some Other Ways to Save besides digit?

A few months ago, I wrote about an app called Acorns that helps automate your savings and lets you take baby steps into investing. Acorns costs $1.00 a month to provide this service for you, but there’s a new app on the market that’s undercutting them: digit.

I love their slogan – automate your savings, intelligently.

I totally get that there are times in life when you’re stretching your budget to the last penny and have no idea how you’re going to manage to start any sort of savings. You may have been puttering around personal finance blogs for a while and you know you need an emergency savings account, but can’t see any feasible way to get it started.

That’s ok. Because computers and algorithms are smarter than we are (and they’re going to take over the world soon and kill us all… but I digress) and digit will find the tiny loopholes in your budget for you.

So how does this work?

You begin by linking your bank account to digit. Their website is secured the same as any bank, you can trust me on this one because my future-robot-ruler paranoia always checks, so you don’t have to worry about your bank account info falling into the wrong hands.

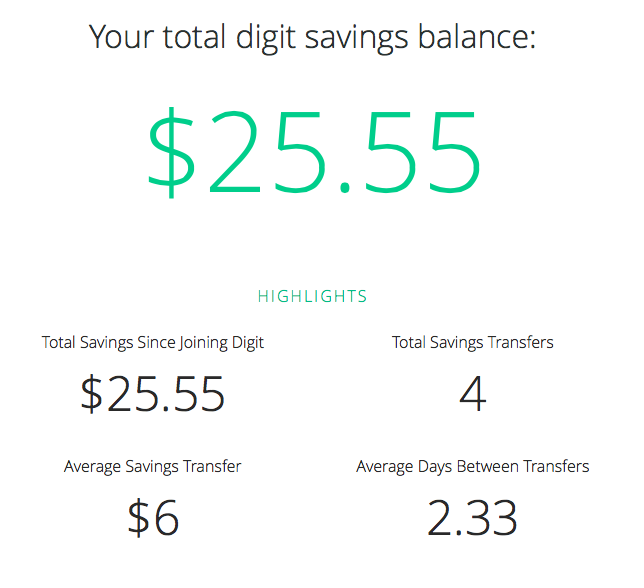

Once you’ve linked in your bank account, digit begins to analyze your spending patterns and it makes small withdrawals that it’s sure you’ll never miss. I actually wondered how well this would work since I typically get paid on Fridays and then promptly clean out my bank account by paying bills and transferring to savings, leaving a balance around $50.

In addition to that, I’ve still got my Acorns experiment running and so I regularly have tiny, rounded up withdrawals going into that account as well, with no understanding of exactly what day that withdrawal will occur.

Does having a small amount of money withdrawn automatically and set aside freak you out? Are you sure you’re about to get dinged with a bunch of overdraft fees? I get you.

So does digit – they are so confident in the way they figure out the patterns in your spending and how much money you won’t miss, they pay any overdraft fees you receive because of them.

In my opinion, this is what makes them genius for someone struggling to get an emergency fund started. Seems to me like you can’t lose.

So how do they do this without charging anything? Well digit is a straight up savings vehicle – NOT an investment account, like Acorns. Whatever you put in sits there waiting for you and can be withdrawn at any time, but it’s not earning any interest, that’s how digit makes their money.

Are there any cons? Well, there’s the no interest thing. Additionally, what I consider a con, many may consider a plus – digit texts you reminders of your balance and your spending and you can request information from digit.

They usually text daily – I found the texts irritating, but it was easy to turn them off. For someone just learning how to track their finances though, they’re a great idea!

Is it sitting in an FDIC insured account? Is it my own account or is it their account? The zero interest thing throws me off….who owns the money until I remove it?

Joe Saul-Sehy recently posted…David Bach Helps Us With The “Money Talk”

This is my issue with Digit Joe, they have ownership of the assets and benefit from the ownership while the client earns 0% on their money. I feel like you can set up your own auto draft every month and achieve the same results and also keep the interest.

Shannon @ Financially Blonde recently posted…Life is Unpredictable

This is why I like your comments, Joe. They always give me more to explore. I’m not sure and I’ll definitely look into it – especially since they’ve already got some of my own money.

Very cool to get your perspective on Digit. Thanks for taking the time to share!

@Joe we hold customer funds in a custodial account which is FDIC-insured on a “pass through” basis to the individual users. This means that each individual users’a balance is protected by FDIC insurance, up to the limits established by the FDIC. It’s the same way Lending Club holds/insures customer funds before they’re invested in Notes.

@Shannon appreciate the feedback. We hear you and have an income product in the works!

lol I JUST commented on Budgets Are Sexy where he was singing the praises of the same app…

Looks great — I echo the concerns about the account security though. Probably not allowed in Canada for the reasons listed by other commenters above =(

Bridget recently posted…My Pay As You Go Wedding

Yeah, I’m not 100% sure it’s the best choice for people who are already financially savvy, but I think it will help folks who are just starting out, especially millennials who have an easier time navigating an app that figuring out different bank websites.

I would tend to agree. This can help get people started with a savings program if they aren’t already there. It helps to start where you are.

Toni @ Debt Free Divas recently posted…The 5 Worst Financial Tips I’ve Followed (So Far)

Ya Bridget, it’s not for Canadian Banks yet. I’ve never really been a fan of these automated savings tricks. But, I was intrigued when it said it new how to save better than I could myself! I’d be up for that challenge! But I’m Canadian.

Emily @ Simple Cheap Mom recently posted…Financially Savvy Saturdays #77