Profile

I am thirty five years old and I am a Visiting Instructor of Theatre Arts/Production Management at a state university, where I make $26,418.51 for the semester.

How post apocalyptic the world has become…

Spending & Saving

What even was this month? I mean…

I’m one of those people who sometimes laughs at inappropriate times and when I am overwhelmed.

I have been laughing a lot this month. Probably still very inappropriate. Though at least now I mostly laugh while sitting home alone in my apartment. Not. Crazy. At. All.

You’d think quarantine would have me better at saving money, yet… it does not seem to be the case. Amazon and Etsy still work and even more so, I feel like I’m supporting little cash strapped businesses when I’m buying from Etsy right now.

My candle obsession has become an act of altruism. Finally. Is that delusional? Maybe. And yes, candles have their own budget line again this month.

You know what’s gotten weird though – food. I live around the corner from a grocery store that is between my apartment and my job. I don’t really stock up (because I also have a bad take out habit), I just buy what I want most days.

But since the grocery store is A. the place I look most forward to going each week and B. probably the most germ infested and dangerous place I go, my relationship with it has changed considerably.

I haven’t been in a week and a half.

I have carefully organized and eaten the foods I bought, way better than I usually do. I haven’t thrown out any leftovers. They get eaten. Or creatively stretched in ways that my grandmothers who lived through the Depression would be darn proud of.

And when I run out of stuff, I just do without till grocery day. I don’t run out and buy it like I usually would.

I bought the wrong proportions of a lot of stuff (I ran out of iced coffee very early last week and I am so excited to buy more later this week).

I learned I do not own a mixing bowl. Which I will fix on this next trip to the store, but I have been impressed with how much I can mix in a large pitcher.

I haven’t shopped and eaten like this since I was a super broke grad student. It reminds me of how I forced myself to learn to like mushrooms when I was living in England because I felt meat was too expensive to eat regularly.

It’s fascinating to me because expense is not the problem now. It’s just stretching stuff longer so I need less because maybe there will be less and it feels like it helps others if I don’t waste A. by needing less groceries and B. by going to the dangerous, gloriously people filled grocery store less often.

I am super excited to buy more coffee, prosciutto, and salmon in a few days though. And probably a bakery cake. I know it’s a bad idea cause I live alone and I will eat too much of it too quick… but I’m probably going to do it anyway.

The things we’ve always just taken for granted, #amiright?

Time has also become weird. I know this sounds ridiculous but it took me a little over a week working at home to realize I’ve been on the verge of a nervous breakdown because every class I teach, on average, is taking me three times longer to do everything.

Prepping the lesson takes as long as it ever did. Then I record my lecture over it (almost as long as class time). Then I have to get it uploaded (there is always an issue, how is there always an issue?? I was a theatre technician for how many years?!?). Then I hang out on Zoom during class time to answer any of my students questions. Then I have to go back through and read and comment on their discussion questions and check the activities I assigned them in place of work we usually just do in class.

And then there’s accounting for the student tech errors and issues, which I’ve wound up spending a lot of time trying to trouble shoot with them, but each kid has a different type of computer, questionable internet connections, harddrives that are to full to download something. I am not an IT person.

And then there are the midterms, which now have to either be printed out or turned into a pdf so I can just write on them on my iPad. The level of how big a project things that used to be kind of easy have become is just nuts.

And more poor students are all freaking out because every professor is also having issues – so all these problems they are having in my class is just amplified by however many classes they are taking and I can totally see they are super frustrated and some are just ready to give up.

So. It’s been a good week back from spring break.

Remember when the world wasn’t a dumpster fire? Ok, enough ranting about the dumpster fire. I am aware so many others have it so much worse.

Before/on the verge of the dumpster fire, I went to Brazil for a week to visit a good friend from my last job. That was fairly awesome. I had missed him a lot and Rio is really cool.

On the cusp of the Coronavirus dumpster fire.

I got a manicure for the first time ever before going so I wouldn’t bite my nails on the plane. I should’ve done this years ago. Three weeks in and still no nail biting. It is the nicest my nails have ever been.

I did my taxes. I was livid that after paying for QuickBooks all year to calculate my quarterly taxes for me, they were still very wrong. Overall, I wound up owing about $800. I used a new company called TrupointTax app for do my taxes (they reached out to me actually, so I would review them) and I was really pleased with how super easy it was and the cost.

Finishing the taxes for the year also closed the book on some of the last inheritance stuff from my mom. For the last year, my brother and I held back a large chunk of money in a savings account to deal with any last minute tax surprises. I’ve counted my half of it all year as part of my savings accounts, but now I redistributed some of it to achieve some of my investing and specific savings goals, which is reflected in my goal checklist at the end of the post.

I don’t know if it was the plague or what but my miscellaneous line is higher than usual and I can’t actually remember everything in it. I know it included some sewing supplies to fix some clothes and my seat cushions. But other than that…?? I am usually better at the tracking.

I also finally cancelled a few things that I was being charged for that I don’t really use. #pfbloggerfail I cancelled the gym subscription, the Quickbooks subscription, and I dealt with changing my health insurance to the school’s since I finally qualified for it.

And despite the stock market also largely being a dumpster fire this month, it’s the first time since December that my finances feel sort of back on track. I made more than I spent! Woooo.

My expenses this month:

- Taxes – $1936

- Rent – $1298

- Food – $353.32

- Brazil – $310.93

- Clothes – $168.37

- Candles – $144.25

- Entertainment – $90.09

- Miscellaneous – $77.51

- Gas – $64.92

- Car – $62.34

- Stage Managing – $50.68

- Utilities – $50.47

- Apartment – $44.71

- Health Insurance – $44.46

- Gifts – $43.97

- brokeGIRLrich – $30

- Toiletries – $25.58

- Manicure – $25.00

- NJ Transit – $18.50

- Postage – $17.10

- Gym – $10.66

Total Spending in March: $4,866.86

Hustling

My income this month was from teaching, brokeGIRLrich, some eBay sales, tax refunds, a dividend check, a voice over payment, and repayment of the loan from last month.

- Teaching – $3701.85

- Loan Repayment – $1502.35

- Tax Refunds – $1232.18

- brokeGIRLrich – $337.10

- Voice Overs – $40.00

- Dividends – $35.20

- eBay – $11.22

Income This Month: $6,859.90

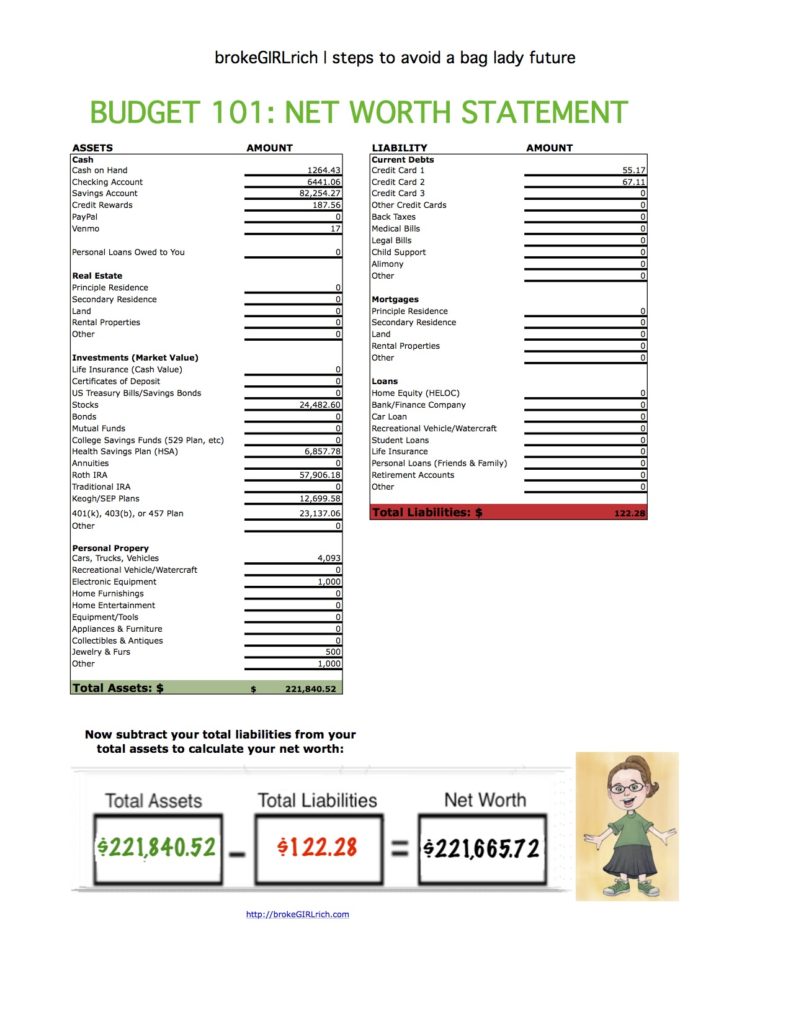

Net Worth: March 2020

Most Popular Post of the Month: Doin’It By the Decade: The Wealthy Barber Review

My Favorite Post to Write This Month: Coronavirus and the Responsibility of Financial Stability

Goals

- Do two things to build up my stage management skills. Teaching and an ETC course in Troubleshooting (btw, all those ETC online courses are free right now).

- Spend more time with family and friends. This got unexpectedly more difficult, but my FaceTiming game is stronger than it’s ever been – so in some ways, I am really succeeding here.

- Max out my Roth IRA. Done.

- Max out my HSA. Probably as done as it can be, since I can’t contribute to it while I’m on the university healthcare.

- Set aside $1,000 for my new car account.Done.

- Invest $2,000. Done.

- Read more – not counting textbooks I have to read. Currently rereading The Stand.

- Learn to make macaroons. Will this be the year? I mean, the odds of it being the year have certainly increased.

yep… this is something we all start thing about, things are getting out of hand… don’t know how long it would go :/

Can I suggest that you get macaron ingredients and hoard them for the full lock down? Then you have a lock down project already there. Seriously, make the frickin macarons already!

Also, if you haven’t got masks, hand sanitiser and gloves already, get some. If you haven’t got flour, sugar, oats, the basics, get it now. Get some cheap meat in your freezer. Things are going to get worse, not better. Don’t be unprepared. Don’t assume goods will be on the shelves.