Profile

I am thirty one years old and I am the Stage Manager/Lighting Director for Clifford the Big, Red Dog! I make $700 a week and receive a $30/day per diem.

Saving & Spending

This month, while totally average, just felt like such a let down after all the big wins of February. Why can’t we get tax refunds every month? ;o)

The month started with a few big expenses. I bought tickets to see Absinthe in Las Vegas on the last day of the month. I bought mine, my roommate’s and my best friend’s tickets, so that was nearly $400 on my card. We also filled up the company van at a place that rejected my corporate AmEx, so another $90 went on my card that day too.

This reminded me of why I’m happy to be on top of my expenses. My roommate paid me back for the theater ticket almost immediately, but my best friend still owes me and the company messed up my reimbursement so I still haven’t been repaid for the gas. However, I still paid off my credit card with no issues at the end of that week.

On the flip side, it also means that I’ve been a little behind on some of my savings goals. Ideally, it means they’ll get a $200 bump early on in April.

I’m also trying to let go of the HIT ALL THE MONEY GOALS mentality for April, since I usually stockpile money the last full month of work to get me through the summer.

But in other exciting news – I have my next two gigs lined up. I’m stage managing The Marriage of Figaro for OnSite Opera in NYC through May and June. This is really exciting to me because working on an opera was on my stage management bucket list.

I had sort of figured I wouldn’t find anything after it ended that would allow me to make it home for my best friend’s wedding, but I actually wound up interviewing with two places that do a high school arts camp type thing. I wound up taking the job stage managing in Virginia for July and part of August, even though the pay is way below my usual minimum working wage because I don’t actually have any musicals in my resume and Roanoke seems like a perfectly fine place to spend a month. It also fit pretty perfectly into the time frame I needed to fill.

So I don’t need to stockpile as fervently as usual, although I’m not sure at what point I’ll get paid for the opera. There’s a good chance it will all be at the end, so I need some stockpiling to get me through May and June and then replenish the coffers in July.

My other best friend and I are tentatively planning a trip for the first week of July before I head off to Virginia, which would cross another item off this year’s list of goals.

Some of the free entertainment for the month – a giant olive in the Olive Capital of America, Carhenge and Little Bighorn Battlefield, which is not actually free, but there was no one in the booth to take our money.

My food budget was way out of whack compared to usual and my entertainment budget was a little high too (Absinthe better be worth it). The majority of the people on our show have also been sick this month, including me, so medicine got it’s own budget line in March too.

Also, one of my largest money suckers this month was setting aside all the money to pay my car insurance payment in June. So I’m set to make that payment for 2016, but it definitely impacted my ability to save for other goals. I’ll be happy I did it in June though.

My spending breakdown this month:

- Gym – $10.70

- Food – $718.50

- Entertainment – $161.34

- Healthcare – $190

- Gifts – $20.40

- Clothes – $16.20

- Medicine – $23.08

- Miscellaneous – $122.15 (this includes the company gas I’m waiting for the refund on)

Total Spending in March – $1,262.37

Hustling

My income this month was made up of Clifford paychecks, brokeGIRLrich, and UserTesting.

- Stage Managing – $3,044.08

- brokeGIRLrich – $638.62

- UserTesting – $10

Income This Month: $3,692.70

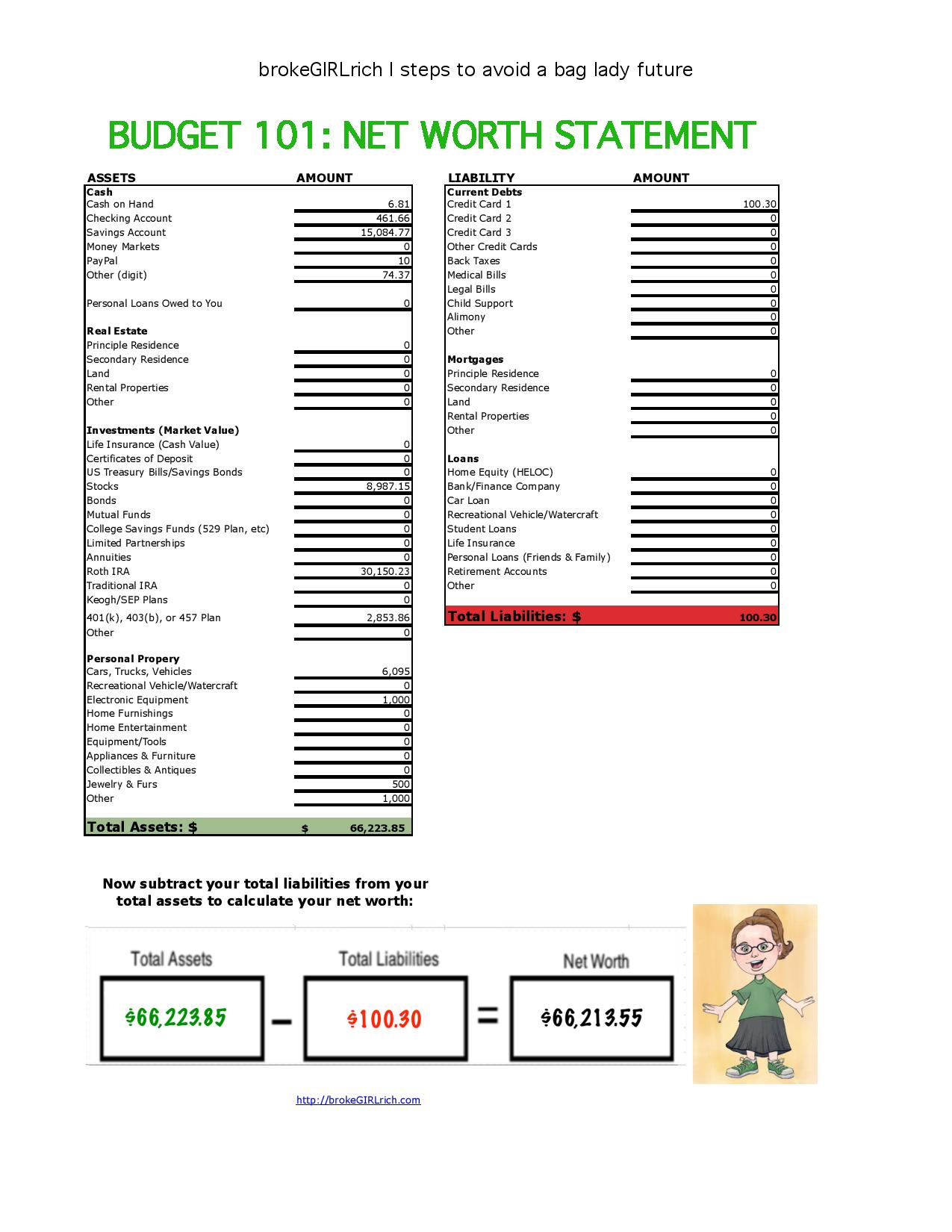

Wonder why you should prioritize investing? My net worth went up nearly 2 grand more than I made this month and that’s completely without taking expenses into account.

Most Popular Post of the Month: 114 Side Hustles: Ways to Make More Money

My Favorite Post to Write This Month: My Money Story

Elsewhere on the Web: Items with a Lifetime Guarantee U.S. News & World Report

How to Cultivate a Mindset of Frugality U.S. News & World Report

Entirely Unrelated to Personal Finance (or is it?)

The Tieks are doing a little better. They got worn on a second outing that turned into a lot more of an adventure than I’d initially planned.

On one of our infamous roadside attraction stops, we went to the Pirate Tower in Laguna Beach. I thought it would be a quick stroll down the sand to snap a shot of the tower, but we wound up climbing jetties and scaling some rocks to get over to the tower. Surprisingly, the Tieks did ok with this.

Then there was an impromptu jaunt to Downtown Disney for two hours of walking. By this time, there was quite a bit of pain. We hit up Olive Garden and I definitely sat with my shoes kicked off under the table. Then everyone wanted to go shopping, so I wound up throwing down $17 at Payless for a pair of plaid slippers that I then wore around like a sad slippered hobo.

So… the amount of time before I want to hack my own feet off while wearing them has expanded. They are still not the magical foot pillows I thought I was buying.

Goals

- Contribute $1,000 to my Emergency Savings Account– Nailed it.

- Max out my Roth IRA– Done. DONE. Does a little dance, done, done, done.

- Contribute $3,000 to my Down Payment Fund– $2,650 to go. Maybe I’ll get there… eventually…

- Contribute $2,000 to my New Car Fund– Just over half way there with $1,050 added this year. I’m kind of hoping to finish up this goal by the end of April, but I also know I should probably wait till the end of the summer. I think I’m going to compromise and put any hustled funds in.

- Have a $1,000 Best Friend’s Wedding Fund– Done. $100 of it is already spent on the dress, but there’s $900 sitting there, ready to be used when necessary.

- Buy $1,000 of stock– Nothing on this front yet.

- Develop 2 new resume skills– Nothing here yet.

- Track all the time I spent on my computer outside of work for 1 week and then go without a computer for a week and see how I use that time– I will not be attempting this goal until I find myself in one of those weird periods of unemployment/massive underemployment again. I’m sure there’ll be one at some point this year.

- Go on a vacation with a friend– things are looking good for a July vacation with the best friend.

- Look for a big show to stage manage– I’m stage managing an opera in June! And then a musical (granted, the latter is full of high schoolers)! But still, I’m excited to stretch my stage managing muscles in new directions.

- Run a 5k– I used to think that hitting $3,000 in my down payment fund was the goal least likely to happen, but now I’m not sure. It’s definitely a toss up between these two.

Love the photos. Ah the West Coast. Some of the coast lines can be a lot different then ours back East. Overall still looks like a good month. Work line up until the end of summer sounds good to me. 🙂

Brian @ debt discipline recently posted…Sharing our Personal Journey out of Debt

To me too! And yeah, time in the West Coast, especially when we’re there in the winter, is definitely a solid job perk.

Glad you have some cool jobs lined up! I swear running a 5k is not as bad as it sounds. It won’t take long to train. Have you thought about a couch to 5k program?

Tonya@Budget and the Beach recently posted…When You Find Yourself Surprised at What You Want Out of Life

I did one last summer actually and used that program! It was really terrific. And when I actually force myself to sign up for a run, now that I know my summer schedule better, I think I’ll probably use it again.

I think everyone got sick in March. I got sick too and it sucks when you have to spend extra money on medicine and healthcare, but that’s part of life I guess. Congrats on the gigs you have lined up. Sounds fun!

Catherine Alford recently posted…5 Ways My Life is Changing Drastically This Spring

Stage managing an opera sounds really interesting. Frugal opera tip…if you want to see shows from the Met and either aren’t local or can’t afford the ticket prices, Fathom Events shows some of their operas on movie screens across the country for a lot less. Sure there’s nothing like live theatre, but this is a close second…they even do behind-the-scenes and interviews during the intermission.

Gary @ Super Saving Tips recently posted…How Much Does 1% Cost You?

That’s true! And if you are local and can’t afford a ticket, the Met screens operas outdoor in it’s courtyard for free once a week in the summer.

I knew some folks in theatre back in the day, and my day feels like forever ago, and I always wondered how a career as a stage manager would look so I love your updates. Can’t wait to hear about the opera and musical experiences, whatever you choose to share about those!

What’s your plan with the Tieks? Do they have a while longer before you decide what to do with them?

Revanche recently posted…TGIF: A toast!

Oh, I’m going to break those suckers in. I’m making progress, but it’s slow. It definitely does get better each time I wear them though. So maybe in another month or two, they’ll be fully functional – but they’re definitely not the amazing, comfortable, cloud-on-your-feet that they’re advertised as, at least not right out of the box.

Great news on your income and the fact that you have another two gigs lined up! Hope you are feeling better now by the way!

Hayley @ Disease Called Debt recently posted…Financially Savvy Saturdays #136

Thanks. I’ve moved on to what one of my cast members calls the “phlegm stage” – where you’re mostly healthy but just still sniffly and coughing. So… an improvement at least.

Congrats on getting some jobs lined up for the summer! Spending a month in Virginia sounds wonderful!

You could definitely run a 5K! You should sign up for one in the fall. That way, you’re committed but still have all summer to train. I usually find that having a strict deadline helps me meet my goals.

Michelle recently posted…Budgeting 101: Reevaluating Your Budget

I’m leaning towards doing it again at the end of August now. I just have to find one in New Jersey.

Yay for coming to Virginia this summer! That’s where I am! 🙂 You’re doing so great with all of your goals in my opinion!

Erin @ Stay At Home Yogi recently posted…Social Media Blast! | StumbleUpon Week!

Thanks! I actually live in Virginia for 3 years a lifetime ago and the city I’m headed to is only 45 minutes away from where I used to live, so I might have a chance to catch up with some old friends. I’m pretty excited.

Love the update, seems you are doing quite well! It must be a good feeling to have the next gigs lined up already (and to see your investments pay off, wow!).

Mrs. CTC recently posted…So how is the debt doing? (We’re baring the numbers!)

Definitely (on both counts)!

You’re just chugging along! I have to say, it all sounds pretty glamorous as a reader — opera, musical, road trip! But, I’m sure that it’s all tons and tons of work (I read your day in the life of a cruise ship employee and I was exhausted just reading it). It seems like you’ve really mastered the art of managing irregular paychecks! Not everyone has such foresight or discipline, that’s for sure.

Miss Thrifty recently posted…Financially Savvy Saturdays #136

We’ll see – I actually threw a pretty big (but fun) wrench into the works right after writing this post. So I’m pretty sure my April financial update will not only be unimpressive but also might dip into some savings… but I’m excited.

I know last summer was fun, but I’m also happy for you that this one will be a bit more profitable! Drove by the battlefield once, but same deal… No one was there.

Femme Frugality recently posted…Don’t Let Comparison Steal Your Joy