Personal finance and fitness actually have a lot in common. No one really wants to do any of the work involved, but we all want the results. And I’m exactly the same. For those who don’t know, the Whole 30 is a 30 day clean eating challenge.

Here are the rules (taken from the Whole 30 website):

- Do not consume any kind of sugar – real or artificial. That includes maple syrup, honey, agave, coconut sugar, Splenda stevia –

- Do not consume alcohol in any form, including cooking.

- Do not eat grains, including quinoa.

- Do not eat legumes (beans, chickpeas, peanuts, soy).

- Do not eat dairy (with the exception of clarified butter or ghee).

- Do not consume carrageenan, MSG or sulfites.

- Do not try to re-create baked good, junk foods or treats with “approved” ingredients.

- You are not allowed to step on a scale or take any body measurements for the duration of the program.

Beyond that, there’s also a pile of recommended rules that really maximize your results.

A few of my friends have really hopped onboard the Whole 30 bus, and my Instagram is constantly full of pictures of their meals that looked incredibly delicious but were still shockingly #whole30. So I picked up the book It Starts With Food and definitely found a lot of the information really interesting – especially about the psychological hold food has on us.

Personally, I’d just come off 6 months of eating all sorts of fast food crap. Even better, I knew I eat even worse when I’m at my parents house since I just sit around binge eating and watching TV shows. I also have a family history of diabetes.

May seemed like as good a time as any to experiment with this sucker and here are a few things I found that reminded me of personal finance.

The Whole 30 Timeline was amazing and so are personal finance blogs.

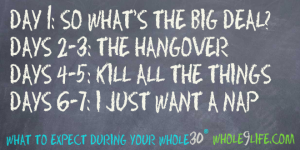

I was super unsure of what I was about to embark on, but thousands of other people have already done it before me and while everyone’s result is specific to them, there are still a lot of things that happen on this crazy health journey that seem to happen to most people at most times. It’s actually so common that the Whole 30 creators compiled a timeline and wrote a post about it.

When I was paying off student loans, I really got into reading other personal finance blogs because while I decided to go whole hog and work crazy jobs on cruise ships and with circuses to pay them off, a lot of the things I was going through were exactly the same as someone on the other side of America on a 10 year repayment plan with an office job somewhere. So much of the human experience is shared.

When I hit a road bump with how I felt doing the Whole 30, the timeline gave me a realistic gage that how I felt was normal and it would pass. It’s way easier to buckle down knowing most people were having crazy, vivid food dreams that made them desperately want a Quick Check sub on days 12-14 and that for almost everyone they passed by day 15. The same is true when you hit debt repayment fatigue and see that everyone goes through phases like that but can still come out the other side still going strong!

90% of the battle is in your head.

One of the most amazing things for me was learning that most of how I felt about food was all in my head and how infrequently I’m actually hungry when I eat. I eat because I’m bored or because it’s there. I can’t tell you how many times I ran errands during May, passed a Starbucks and suddenly needed a coffee. Since I couldn’t actually have it, that was also the first time I realized that if I just didn’t go get it, the need passed pretty quickly. And I wasn’t actually thirsty or even really tired and looking for a caffeinated pick me up.

It’s honestly almost exactly the same with my finances. It’s so rare that I need to buy something. All the little money hemorrhages that happen all month are just temporary wants that pass when they’re ignored.

Most of the other 10% is preparation.

If you don’t do some prep work for the Whole 30, you will fail. The weeks I was the happiest and best fed usually included a few hours of prep work over the weekend so I could just thaw something for dinner after a long day or so that my lunches were just ready to be grabbed from the refrigerator.

Building wealth often starts with frugal living tips. Making more is awesome, but figuring out how to do that often seems to come a few steps later in the process. Frugality is all about the prep work too – hitting up sales for stuff you know you use all the time, bulk buying, coupons, learning new skills like sewing. These are ways to prep to save money and while they’re not always fun to do, preparation reaps some awesome rewards.

Stick to the main rules and work up to the recommended ones.

I made it through the entire Whole 30 with one tiny, accidental slip up according to the main rules. According to the recommended rules, well, I could’ve done better. But since the goal was to feel healthier, sleep better, have more energy and lose a little weight – and all of those were achieved – I’m calling it a successful Whole 30. I’m happy to admit, it was those strict main rules that got me there and while following them was a pain, it was worth it.

I’m also happy to admit I probably would’ve achieved those goals quicker if I’d followed the recommended path too. For instance, fruit juice is very technically complaint, if there’s no added sugar, because you can eat fruit. It’s also encouraged as a sweetener in things. However, part of the recommended rules is that you avoid too much sugar because you’re trying to slay your “Sugar Dragon.” My Sugar Dragon is still alive and kicking because I ate a ton of fruit and drank a compliant Naked fruit juice/smoothie for breakfast every morning on my way to work. Larabars were also a pretty regular snack and not just an emergency option.

Doing both of those things helped me figure out how to eat on the go while I commute into NYC and work crazy long hours (whoever wrote the Whole 30 sure didn’t work in theater). Another recommended rule is just to eat 3 good sized meals and to stop snacking. That didn’t happen either.

When it comes to personal finance, I have several rules that I think of as “main” rules and then a massive pile of recommended ones that I work on as my tolerance for personal finance has grown. Spend less than you earn is a main rule for me. Save at least 20% of your income is another one and so is having a well stocked emergency fund. Cutting out Starbucks isn’t (except during Whole 30s. Ugh).

Haters gonna hate. Everywhere.

I can’t tell you how many people tried to make me have a drink with them during May. I had a show closing night party, a birthday party and baby baptism and a weekend camping trip to weather during this time and I never realized how much people are sort of offended if you don’t drink with them. It’s crazy. Or how many people will try to force you to eat cake, when you don’t even want it! It was really rare to run into a friend who was just supportive (although there were a few).

It’s the same with getting your finances in order, some friends just don’t get it and that can be really frustrating.

On the flip side, there’s also hate from some of the people who are several steps past you. The Whole 30 message boards are nuts. They are like a psycho army of haters who just attack any mistake you make. Sometimes you can get the same vibe in the personal finance world – “oh, you’re only saving 20%? We live off one paycheck and invest the other one.” “Oh, you’re planning to retire at 65? I’ve got it down to 41, but we might be able to hit 39 if we can just figure out how to stop eating.”

You have to find your balance and plow your own path with both things.

These are just a few of the lessons I kept learning over and over again throughout May. On the 31st day, I learned another important lessons. If you’ve reset your stomach so it’s not used to unnatural foods anymore do not binge on Chick-fil-a and Dunkin Donuts. Only bad things will happen. And if you’ve done something awesome like a No Spend week or month, don’t binge on Louis Vuittons and a trip to Prague or your credit card will feel like my stomach did.

Interesting. I have never heard of the Whole 30. Totally agree on the commonality between finance and fitness. It’s such a mindset thing. Ouch. Binging on the bad stuff after being good for awhile doesn’t sound pretty, 🙁

Brian @ debt discipline recently posted…Getting Out Of Debt

No. But it was delicious. And also a pretty interesting lesson to learn about how desensitized I’d become to pretty much poisoning my body.

That’s a really interesting connection between Whole30 and personal finance. I also find a link between my health habits and financial habits, and also employ some of the same strategies to my health as I do with my finances. “Do I *need* a cup of coffee right now? Let me wait an hour and if I’m still dragging then I’ll go get one.” And 9 times out of 10 I don’t go for that coffee, or donut, or french fries.

Jax recently posted…Careers, Dream Jobs and Financial Independence

Hmm. That’s pretty smart. Ive never used that trick with my eating habits.

Sounds interesting. I’ve thought about doing some 30 day thing along these lines, but I’d probably honestly do it around February or March simply because there are just so many more temptations in the summer and then later around the holidays. Thanks for sharing.

Money Beagle recently posted…Preparing for Retirement in Your Early 20s

I completely agree that maintaining a healthy lifestyle and healthy finances requires similar types of efforts. Even though 90% of it is in your head, it can still be tough to do. Do you feel like doing the Whole 30 for just a month will make a difference in how you eat long term, or was it just meant to be a one-time thing? Last year I was eating much healthier (cutting down added salt and sugar, lowering carbs and fats) and I was doing well, but now I’ve ended up back where I started. Whereas my finances are still doing alright, my healthy lifestyle could use some work.

Gary @ Super Saving Tips recently posted…The Middle Ages Part 1: Money Tips for Your 30’s

I’m not sure. Overall, I’d say I’ve take a step in a healthier direction because of it but I haven’t gone whole hog. I definitely preferred how I felt during it, but I’m going on vacation at the end of the month and want to be able to eat and drink whatever, so I haven’t tried to stick with it, since those foods were making me so sick the first week off of it. I may go back to it in July though – or an overall Paleo diet since it’s a lot less rigid but still has a lot of health benefits.

There was a relationship where we switched to something similar. We both ate less and felt more alert and more full. But it was work. I would be preparing something while she putz with something else in the kitchen.

Kudos to you for trying it.

ZJ Thorne recently posted…Net Worth Week 9 – Small Setbacks Edition

I agree also. Most of what we struggle with in finances and food is mental. Good for you for realizing steps you needed to be successful at both. The Whole 30 sounds pretty challenging! Congrats on completing the challenge also. I am sure that was a bit tough with your schedule and life happening with all the parties and things that were going on.

Becky@Frametofreedom recently posted…6 Reasons You Should Alter Your Budget… Or Get Rid of It.

Yeah, but I’m really not sure there’s any perfect time to wait to do it. In the book, it kept emphasizing that the best time was right now.

Oh man, I need to do another Whole30. I’ve done 3, and I learn something new every time. I find it really helps curb my Starbucks spending, and my going out spending in general. I’d rather save the money and spend it on some nice steaks or salmon for the grill. Weirdly, that’s never just as easy when I’m not on a Whole30, when fast food just looks soooo goood.

And yeah… After the first one, my husband took me out to celebrate with Oreo Cheesecake. The night that followed was … unpleasant.

Pia @ Mama Hustle recently posted…Why We MUST Talk About Money

Ugh, I bet! And I can totally see that – I’ve grabbed take out several times since finishing, even though during the Whole 30, I just sucked it up and went home and made dinner every night. Nothing has changed about my schedule other than the Whole 30 just being over.

After going through the list of “no-go” foods, I wondered what was left?! Haha.

So many parallels between health and finance. I wonder if people are more likely to suck at both, or be good at one and not the other? (I’m definitely better at financial discipline than health discipline…)

Miss Thrifty recently posted…Guest Post on Canadian Budget Binder

I love that you pointed out how much of it is in your head. I think we forget how much our thoughts and feelings influence what we do more so than actual need. Sometimes, a change is mindset is the key to accomplishing real, long-term change. Being aware of how your mindset is setting you up for success, or failure, can make all of the difference!

Cathy @MonetizeMyMins recently posted…Financially Savvy Saturday

It’s true! Until your mindset starts to change, all gains are temporary.

That’s a big list of things that you can’t eat! Funny how you first think that you will feel deprived, until you see other people do it and get ahead because of it. Just like personal finance indeed 🙂

I can’t get over the fact that people have the urge sabotage your plans. It’s the same for dieting and paying off debt, even the most friendly and loving people seem to do it at times. It must have something to do with people feeling worse about themselves when they see others succeed.

Anyway: well done!

Mrs. CTC recently posted…Experiment: Can Anyone Become A Morning Person?

Thanks, it is kind of crazy – especially since it’s such well meaning-seeming sabotage. I guess they feel like if that’s how they’re happy and having fun, it must be the same for you too.

Wow, the whole 30 sounds so tough but I can imagine that timeline was a huge help. Half the battle is knowing that you’re going to get over the hurdle. Food definitely has a psychological hold over me. I tend to want to eat junk food and drink wine when I’ve had a bad day or am feeling particularly stressed. After I’ve consumed the junk, I don’t feel any better (worse in fact!). Glad you managed to stay the whole course and give the whole 30 a go. I would love to do this too, but I just need to get in the right frame of mind to really go for it.

Hayley @ Disease Called Debt recently posted…Can You Get a Mortgage After a Debt Management Plan?

Definitely! Being in the right frame of mind is always the key to success – as tempting as it is to try to push anyone forward, you won’t succeed till you want to!